Get the free pdffiller

Show details

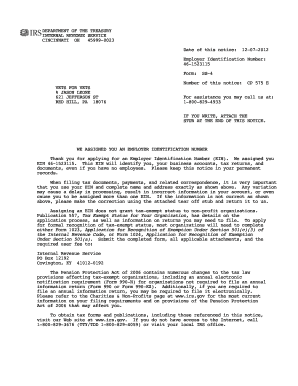

This document provides information about IRS Form 147C, its purpose, how to obtain it, and related IRS forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 147c printable

Edit your fax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 147c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what is a 147c letter online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pdffiller form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out form 147c pdf?

01

Start by downloading the form 147c from the official website of the Internal Revenue Service (IRS).

02

Open the downloaded form using a PDF reader or software that allows you to fill out PDF forms.

03

Provide your business name and employer identification number (EIN) in the designated fields. If you don't have an EIN, leave the field blank.

04

Indicate the type of entity for which you are requesting the form 147c. This could be a partnership, corporation, sole proprietorship, etc.

05

Enter your name, title, and phone number in the appropriate sections of the form.

06

If the business has authorized representatives, provide their names and phone numbers as well.

07

Review the completed form to ensure all the information is accurate and legible.

08

Save the filled-out form as a PDF file for your records or print a hard copy if needed.

Who needs form 147c pdf?

01

Individuals or businesses who have applied for an EIN from the IRS may need form 147c as it confirms the assigned EIN and provides official proof of the business's name and identification number.

02

Entities that require verification of their EIN for various legal, tax, or financial purposes may also need to submit form 147c.

03

Additionally, organizations that need to update or verify their authorized representatives may utilize this form as well.

Fill

form

: Try Risk Free

People Also Ask about

How to read 147C?

How to read the 147c: Your EIN. Name of the company. Name of the responsible party if the entity is an LLC. If this is a corporation, this line is usually omitted. Business address. Your EIN again. The date on which the 147c was issued. Your EIN one more time.

How do I get a 147C letter from the IRS?

How to request a 147C letter Call +1-800-829-4933. Select your preferred language (press 1 for English). Press 1 for EIN "Employer Identification Numbers." You can press three if you have an EIN but cannot remember it. If you lost your notice of CP 575, tell the agent you will need an EIN verification letter.

How do I get Form 147?

Call 1-800-829-4933 and ask for a Form 147c, also known as an EIN Verification letter, to be issued to you. This number reaches the IRS Business & Specialty Tax department, which is open between 7 a.m. and 7 p.m. your local time. Locate your original EIN letter.

Can I get a 147C letter online?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) two ways: by mail.

How can I obtain a copy of my EIN letter?

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone. Request a 147c letter when you speak with an agent on the phone.

How do I get a 147c form from the IRS?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdffiller form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the pdffiller form. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my pdffiller form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your pdffiller form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete pdffiller form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your pdffiller form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is form 147c pdf?

Form 147C is an official document issued by the IRS that provides a confirmation of an Employer Identification Number (EIN) for a business.

Who is required to file form 147c pdf?

Form 147C is not typically filed; rather, it is requested by entities who need proof of their EIN, such as businesses, tax-exempt organizations, or estates.

How to fill out form 147c pdf?

Form 147C does not require filling out by the user. Instead, it is completed by the IRS or can be generated via the IRS website by providing necessary business information.

What is the purpose of form 147c pdf?

The purpose of Form 147C is to provide confirmation of an EIN for businesses or organizations that need to validate their tax identification information.

What information must be reported on form 147c pdf?

Form 147C includes information such as the business name, EIN, and possibly the type of entity, but it is primarily a confirmation document rather than a reporting form.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.