Get the free EXPENSES RELATED TO CREATIVE ARTS INCOME - prudentialvanguard

Show details

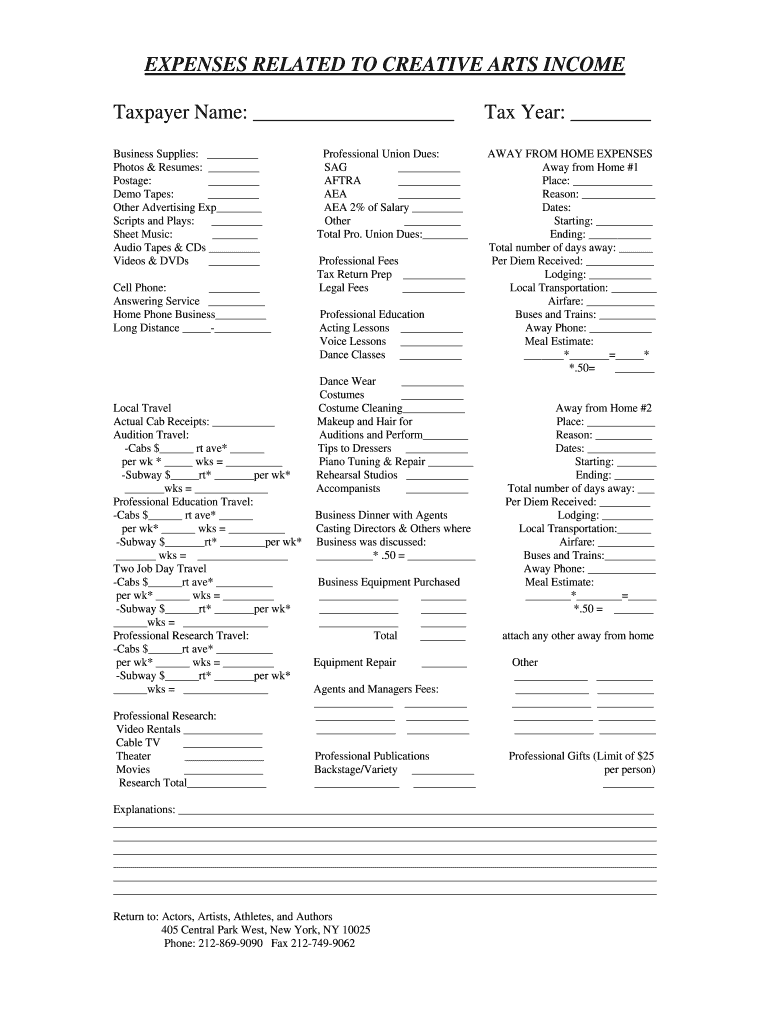

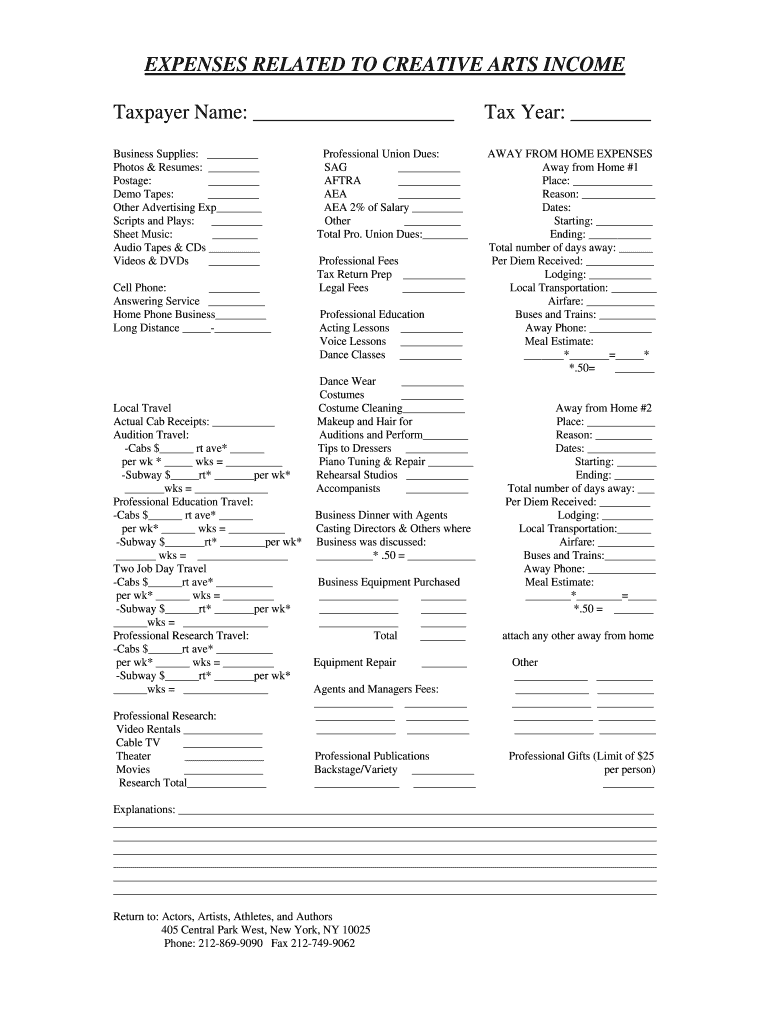

EXPENSES RELATED TO CREATIVE ARTS INCOME Taxpayer Name: Tax Year: Business Supplies: Photos & Resumes: Postage: Demo Tapes: Other Advertising Exp Scripts and Plays: Sheet Music: Audio Tapes & CDs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expenses related to creative

Edit your expenses related to creative form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expenses related to creative form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit expenses related to creative online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit expenses related to creative. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expenses related to creative

How to fill out expenses related to creative:

01

Start by gathering all of your receipts and invoices related to creative expenses. This can include things like art supplies, graphic design software, advertising costs, or even fees for attending creative workshops.

02

Create a spreadsheet or use accounting software to track these expenses. Make sure to include the date, description of the expense, and the amount spent. This will not only help you keep organized but also make it easier to calculate your total creative expenses at the end of a specified period.

03

Categorize your creative expenses. This step is crucial for proper financial management. Assign specific categories to your expenses, such as art supplies, software subscriptions, printing costs, or marketing expenses. This will enable you to analyze your spending patterns and make informed decisions about your creative endeavors.

04

If you are self-employed or a freelancer, consider consulting with an accountant or tax professional to ensure you are categorizing and deducting your creative expenses correctly. They can provide valuable guidance on what can be claimed as a legitimate business expense and help you maximize your tax deductions.

Who needs expenses related to creative:

01

Artists: Whether you are a painter, sculptor, or photographer, artists often have various expenses related to their creative process. These could include art supplies, studio rent, marketing material, or travel costs for art shows.

02

Designers: Graphic designers, web designers, or fashion designers may incur expenses for design software, equipment, materials, or even fabric samples. It is vital for them to accurately track these expenses to understand their business costs.

03

Content creators: Bloggers, writers, videographers, and podcasters often have expenses related to creating content. This may include expenses for professional cameras, audio equipment, editing software, web hosting, and even props or costumes.

04

Entrepreneurs: Business owners who value creativity in their work, such as marketing agencies, event planners, or product designers, may require creative expenses as part of their business operations. This could include designing marketing materials, creating brand identities, or hiring creative professionals.

Overall, anyone who engages in creative activities as part of their profession or business should keep track of their expenses related to it. It ensures accurate financial reporting, tax deductions, and gives a clear understanding of the costs involved in their creative endeavors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send expenses related to creative for eSignature?

When your expenses related to creative is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit expenses related to creative online?

With pdfFiller, the editing process is straightforward. Open your expenses related to creative in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete expenses related to creative on an Android device?

Use the pdfFiller Android app to finish your expenses related to creative and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is expenses related to creative?

Expenses related to creative involve costs incurred for activities such as designing, creating content, and production.

Who is required to file expenses related to creative?

Anyone who incurs expenses related to creative activities as part of their business or work may be required to file these expenses.

How to fill out expenses related to creative?

Expenses related to creative can be filled out by keeping track of all costs incurred for creative activities and reporting them accurately on the appropriate forms or accounting software.

What is the purpose of expenses related to creative?

The purpose of reporting expenses related to creative is to accurately track and deduct these costs from taxable income, reducing tax liability.

What information must be reported on expenses related to creative?

Information such as the date, description of the expense, amount spent, and purpose of the expense must be reported on expenses related to creative.

Fill out your expenses related to creative online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expenses Related To Creative is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.