PH BIR 2550Q 2002 free printable template

Show details

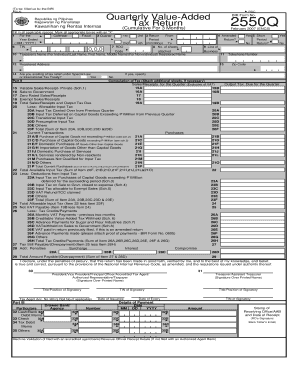

To be filled up by the BIR DLN PSIC Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas BIR Form No. Quarterly Value-Added Tax Return 2550Q April 2002 ENCS Fill in all applicable spaces. 2550Q - Quarterly Value-Added Tax Return Guidelines and Instructions Other Franchise Real Estate Renting Business Activity Sale of Real Property Lease of Real Property Sale/Lease of Intangible Property 10. 35 Check 35A 35B 35C 36 Tax Debit 36A 36B 35D 36C Memo. 37 Others 37A 37B 37D...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PH BIR 2550Q

Edit your PH BIR 2550Q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH BIR 2550Q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PH BIR 2550Q online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PH BIR 2550Q. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 2550Q Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH BIR 2550Q

How to fill out PH BIR 2550Q

01

Obtain a copy of the PH BIR Form 2550Q, which is available from the BIR website or at BIR offices.

02

Fill out the taxpayer's Identification Number (TIN) and other personal information in the designated fields.

03

Indicate the tax period for which you are filing the return in the appropriate section.

04

Calculate the total revenue for the period and input the amount in the revenue section.

05

Identify any exempt sales and enter the corresponding amounts.

06

Compute the value-added tax (VAT) due based on the taxable revenue and applicable rates.

07

Deduct any available input VAT and report the net VAT payable.

08

Complete the section on penalties or surcharges if applicable.

09

Review all entries for accuracy and completeness before submitting the form.

10

Sign and date the form, then submit it to the BIR on or before the due date.

Who needs PH BIR 2550Q?

01

Businesses and individuals who are engaged in the sale of goods and services subject to VAT in the Philippines.

02

Taxpayers who are required to report their quarterly value-added tax (VAT) liabilities to the Bureau of Internal Revenue (BIR).

Fill

form

: Try Risk Free

People Also Ask about

What is the return period for 2550Q?

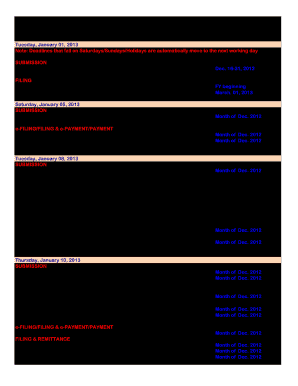

The returns must be filed not later than the 25th day following the close of the quarter. The returns must be filed with any Authorized Agent Bank (AAB) within the jurisdiction of the Revenue District Office where the taxpayer is required to register.

What is the purpose of form 2550Q?

What is this form? BIR Form 2550Q, also known as Quarterly Value-Added Tax Return is a form of sales tax imposed on sales or exchange of goods and services in the Philippines. Serving as a form of indirect tax, VAT is passed on to the buyer which consumes the product/service.

How to fill up 2550Q form?

The Return – BIR Form 2550Q Log in to the Company's eFPS account or through eBIR Forms (latest version is v7. From the drop down selection, select Form – BIR Form 2550Q (Quarterly Value-Added Tax Return). Fill-out the fields in the form.

Who needs to file 2550Q?

The 2550q form For experienced VAT-registered businessmen, filing VAT Returns may be monthly or quarterly. Those who opt for the quarterly filing, the 2550q form is used. The Quarterly Value-Added Tax Return is a sales tax imposed in exchange for goods and services in the country.

Who should file 2550Q?

With the revised rules, beginning April 2023, all taxpayers who are required to file VAT return shall file the BIR Form No. 2550Q on a quarterly basis.

What is BIR 2550Q?

BIR Form 2550Q, also known as Quarterly Value-Added Tax Return is a form of sales tax imposed on sales or exchange of goods and services in the Philippines. Serving as a form of indirect tax, VAT is passed on to the buyer which consumes the product/service.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PH BIR 2550Q online?

Completing and signing PH BIR 2550Q online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the PH BIR 2550Q form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PH BIR 2550Q and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit PH BIR 2550Q on an Android device?

You can edit, sign, and distribute PH BIR 2550Q on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is PH BIR 2550Q?

PH BIR 2550Q is a quarterly value-added tax (VAT) return form used by businesses in the Philippines to report their VAT liabilities and payments to the Bureau of Internal Revenue (BIR).

Who is required to file PH BIR 2550Q?

Individuals and entities that are registered for value-added tax (VAT) in the Philippines are required to file PH BIR 2550Q.

How to fill out PH BIR 2550Q?

To fill out PH BIR 2550Q, one must provide accurate information regarding sales, purchases, VAT payable, and other relevant figures in the designated sections of the form, ensuring all calculations are correct.

What is the purpose of PH BIR 2550Q?

The purpose of PH BIR 2550Q is to facilitate the reporting and payment of VAT by registered businesses on a quarterly basis, ensuring compliance with tax laws.

What information must be reported on PH BIR 2550Q?

Information that must be reported on PH BIR 2550Q includes gross sales or receipts, purchases subject to VAT, VAT payable, and any payments made during the quarter, among other details.

Fill out your PH BIR 2550Q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH BIR 2550q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.