India Form 60 2006-2026 free printable template

Show details

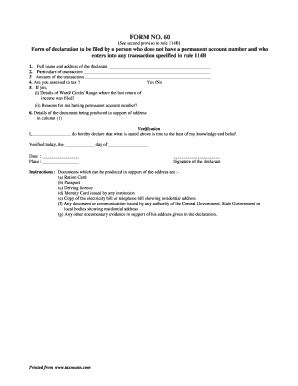

FORM NO. 60 See second proviso to rule 114B Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114B Full name and address of the declarant. Particulars of transacton. Amount of the transaction. Are you assessed to tax. If yes i Details of Ward/Circle/Range where the last return of income was filed ii Reasons for not having permanent account number 6. Details of the document being pdoduced in support of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 60 pdf

Edit your form 60 post office pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 60 india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 60 format online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 60 for bh registration. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 60 rto

How to fill out India Form 60

01

Download the Form 60 from the official income tax website or obtain a physical copy.

02

Begin filling out your name in the designated field as it appears in your official documents.

03

Provide your father's name if applicable, or other alternate names as necessary.

04

Specify your address, ensuring it is clear and complete with city and postal code.

05

Indicate the reason for submitting Form 60, such as for opening a bank account or purchasing an asset.

06

Enter details of any identification documents you have, such as Aadhaar number or PAN if available.

07

Sign the form at the designated space to verify the information provided is accurate.

08

Submit the completed form to the relevant financial institution or authority.

Who needs India Form 60?

01

Individuals who do not possess a Permanent Account Number (PAN) and need to provide their identity for financial transactions.

02

Those applying for bank accounts, purchasing property, or making large transactions where PAN details are typically required.

Fill

form 60 india sample

: Try Risk Free

People Also Ask about form 60 format download

Where can I download Form 60?

You can also download Form 60 from the income tax portal.

What is a Form 60 declaration?

Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account number and who enters into any transaction specified in rule 114B. Hence, any persons who does not have PAN while entering into certain transactions must file Form 60.

What is Form 60 PDF?

Form for declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent. account number and who enters into any transaction specified in rule 114B. 1 First Name. Middle. Name.

What is form of form 60?

Form 60 is an important document that is submitted when an individual does not have a permanent account number and enters into certain transactions specified in Rule 114B of the Income-tax Rules, 1962.

What is fixed deposit with Form 60?

Form 60 is needed for making a fixed deposit of amount exceeding Rs. 50,000 with any banks. Form 60 is must for depositing in any post office savings bank of amount Rs. 50,000 or more.

How do I fill out a No 60 form?

How to fill Form 60? Full name and address of declarant. Date of birth of the declarant and name of the Father (in case of individual) Full address of the declarant with the mobile number. Details of the transaction including the amount.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 60 sample filled pdf from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like post office form 60, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find form 60 post office pdf?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rto form 60 sample filled and other forms. Find the template you need and change it using powerful tools.

How do I edit from 60 rto form pdf in Chrome?

Install the pdfFiller Google Chrome Extension to edit form 60 working certificate in word format and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is India Form 60?

India Form 60 is a declaration form used by individuals who do not have a Permanent Account Number (PAN) to provide their information for various financial transactions.

Who is required to file India Form 60?

Individuals who do not possess a PAN and need to conduct certain financial transactions, such as opening a bank account or purchasing high-value items, are required to file India Form 60.

How to fill out India Form 60?

To fill out India Form 60, the individual must provide their name, address, date of birth, and details of the transaction for which the form is being submitted. The form must be signed and submitted to the relevant authority.

What is the purpose of India Form 60?

The purpose of India Form 60 is to collect information from individuals who do not have a PAN, ensuring compliance with tax regulations during significant financial transactions.

What information must be reported on India Form 60?

Information that must be reported on India Form 60 includes the individual's name, address, date of birth, the purpose of the transaction, and other identification details as required by the authority.

Fill out your India Form 60 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 60 Rto Pdf Download is not the form you're looking for?Search for another form here.

Keywords relevant to form 60 from employer

Related to form 60 pdf download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.