Get the free sample homeowners insurance policy pdf - ehomeamerica

Show details

(06 97). QUIT CK REFERENCE'SEE AL FORM. HOMEOWNERS SPEC AL FORM. MARYLAND SPEC ILL FIVE S I Wins. ADJUSTED BUI LYING COST ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample homeowners insurance policy

Edit your sample homeowners insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample homeowners insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample homeowners insurance policy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample homeowners insurance policy. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample homeowners insurance policy

How to fill out sample homeowners insurance policy:

01

Begin by filling out your personal information, such as your name, address, and contact details.

02

Provide details about the property being insured, including the address, type of dwelling (e.g., house, condo), and the year it was built.

03

Specify the coverage limits and deductibles you prefer for different parts of your policy, such as dwelling coverage, personal property coverage, and liability coverage.

04

Indicate any additional coverages or endorsements you want to include, such as flood insurance or scheduled personal property coverage.

05

Provide information about any security systems or safety features installed in your home, as this may impact your premium.

06

Disclose any previous claims you have made on homeowners insurance and provide details if necessary.

07

Review the policy application thoroughly, ensuring all the information provided is accurate and complete.

08

Sign the application, acknowledging that all the information provided is true to the best of your knowledge.

Who needs sample homeowners insurance policy:

01

Homeowners or property owners who want to protect their investment.

02

Individuals who own a house, condo, or other types of residential properties.

03

Renters who want to protect their personal belongings and liability within the rented property.

Fill

form

: Try Risk Free

People Also Ask about

What are 5 things that may not or usually not covered by homeowners insurance?

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered.

What things are not covered by homeowners insurance?

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

How does where you live affect your home insurance premium?

What Is The Average Home Insurance Cost In Ontario? The average home insurance cost in Ontario is approximately $1250 per year. This averages out to just over $104 per month. However, depending on your home value and location, you can expect to pay anywhere from $700 to $2000 or more annually.

What do typical homeowners insurance policies cover?

Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others. Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

What does homeowners insurance cover examples?

A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft or vandalism, or damage caused by a weather event such as lightning, wind, or hail.

What are the three most common homeowner policy coverage areas?

Key Takeaways Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others. Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

How much is home insurance?

ing to Ratehub, the average cost of home insurance in Canada is around $960 annually. However, this may be more expensive depending on which province or territory you live in, or it could even be slightly cheaper.

What different coverages are offered by a homeowners insurance?

Types of Coverage Comprehensive. As the most inclusive home insurance policy, comprehensive covers both the building and its contents for all risks, except for those specifically excluded. Basic or Named Perils. Broad. No Frills. Personal Liability.

What is an HO 3 homeowners insurance policy?

An HO-3 insurance policy is a form of home insurance that protects policyholders against property damage, legal liabilities and other expenses associated with unexpected disasters befalling your home.

What are the 3 main coverages that a homeowner's insurance policy provides?

Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others. Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

How to figure out homeowners insurance policy?

You can calculate the approximate cost of homeowners insurance by dividing the value of your home by $1,000 and then multiplying the result by $3.50. For example, a home valued at $400,000 would have a home insurance policy that costs roughly $1,400.

What are the three main components of an insurance policy?

Insurance Policy Components Three components of any type of insurance are crucial: premium, policy limit, and deductible.

What is homeowners policy coverage examples?

The home insurance policy covers various kinds of damage. For example, damaged electric lines/wires, water pipelines, or structure damage. It also provides coverage for broken windows/doors/floors/walls. Not only the house but also covers for the loss and damage to the contents of the house.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sample homeowners insurance policy in Chrome?

sample homeowners insurance policy can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my sample homeowners insurance policy in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your sample homeowners insurance policy and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit sample homeowners insurance policy straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing sample homeowners insurance policy right away.

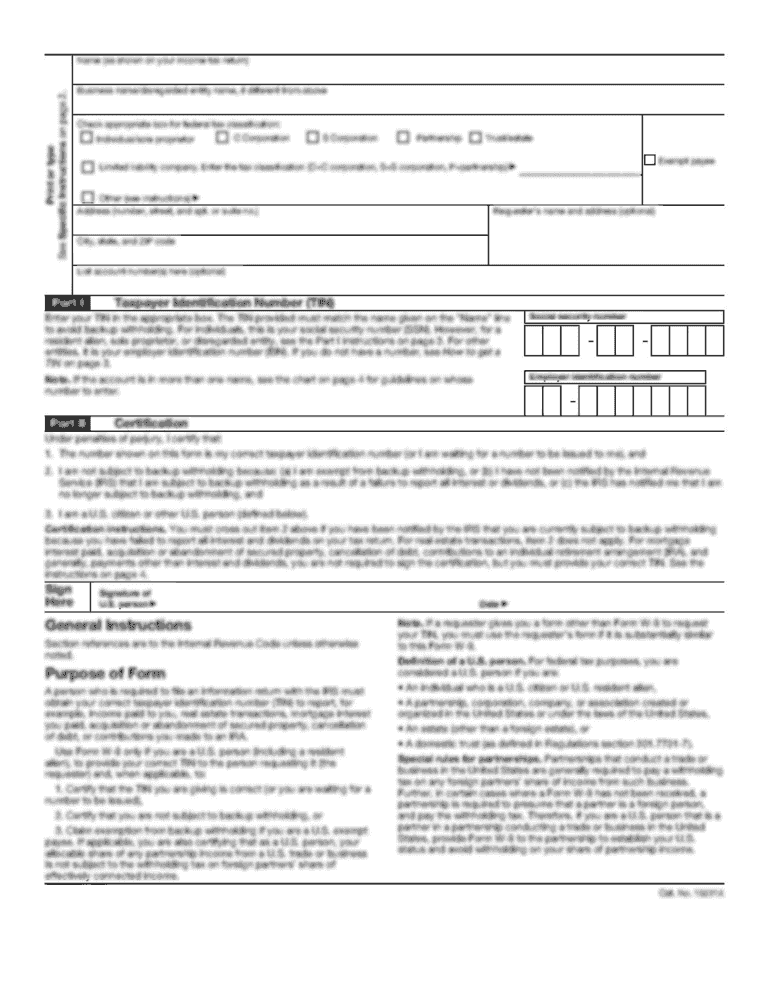

What is sample homeowners insurance policy?

A sample homeowners insurance policy is a document that outlines the coverage options, limits, and terms that a homeowner can expect from an insurance provider. It typically includes coverage for the home, personal property, liability, and additional living expenses.

Who is required to file sample homeowners insurance policy?

Homeowners who own a property and wish to protect their investment from risks such as fire, theft, or natural disasters are generally required to file a homeowners insurance policy. Additionally, lenders may require proof of insurance before financing a home.

How to fill out sample homeowners insurance policy?

To fill out a sample homeowners insurance policy, the homeowner should provide personal information such as their name, address, and contact details, as well as details about the property, including its value, age, construction type, and any special features or risks.

What is the purpose of sample homeowners insurance policy?

The purpose of a sample homeowners insurance policy is to protect homeowners from financial loss in the event of damage to their property, liability for injuries on their property, and loss of personal belongings due to covered events. It provides peace of mind and financial security.

What information must be reported on sample homeowners insurance policy?

Information that must be reported on a sample homeowners insurance policy typically includes the homeowner's personal details, property address, property value, coverage limits, deductibles, and a list of any additional endorsements or coverage options selected.

Fill out your sample homeowners insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Homeowners Insurance Policy is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.