India LIC Housing Finance N.R.I. Undertaking Letter 2006 free printable template

Show details

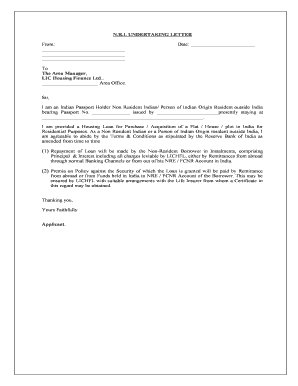

N.R.I. UNDERTAKING LETTER From: Date: To The Area Manager, LIC Housing Finance Ltd., Area Office. Sir, I am an Indian Passport Holder Non-Resident Indian/ Person of Indian Origin Resident outside

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India LIC Housing Finance NRI Undertaking

Edit your India LIC Housing Finance NRI Undertaking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India LIC Housing Finance NRI Undertaking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India LIC Housing Finance NRI Undertaking online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit India LIC Housing Finance NRI Undertaking. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India LIC Housing Finance N.R.I. Undertaking Letter Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India LIC Housing Finance NRI Undertaking

How to fill out India LIC Housing Finance N.R.I. Undertaking Letter

01

Begin by writing the title 'N.R.I. Undertaking Letter' at the top of the document.

02

Include your name and address at the beginning of the letter.

03

State your status as a Non-Resident Indian (N.R.I.) clearly.

04

Mention the purpose of the letter, specifying that it is for LIC Housing Finance.

05

Provide necessary details such as your LIC account number or reference number, if applicable.

06

Clearly outline your commitments and responsibilities related to the undertaking.

07

Sign and date the letter at the bottom.

08

Ensure that the letter is printed on a blank sheet of paper.

Who needs India LIC Housing Finance N.R.I. Undertaking Letter?

01

N.R.I.s who are availing housing finance or loans from LIC Housing Finance.

02

Individuals who need to submit a formal commitment regarding repayment or terms to LIC Housing Finance.

03

Non-resident Indians who are purchasing property in India and require financial assistance from LIC Housing Finance.

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out an undertaking letter?

Tips for Writing Undertaking Letter Include the precise terms of the agreement and any other pertinent details. Avoid using informal greetings to ensure that the letter is written in a formal tone. The subject should be clear and concise. Avoid using technical jargon that can make the terms less clear.

What is the letter of undertaking in Word?

1. It is hereby confirmed that we have fully complied with all the provisions of all Labour and Industrial Laws as applicable to the workers engaged by us for the above work and we have also paid them wages not less than the minimum wages under the relevant laws. 2. We shall indemnify M/s.

What is a letter of undertaking?

What is a letter of undertaking? A Letter of Undertaking (LOU) is a bank guarantee given by one bank to another bank on behalf of the customer for repayment of the loan. Mostly, the LOU is used when the person imports anything from a person, in another country.

What is a letter of undertaking for a mortgage loan?

Undertaking 2 stipulates that, if the buyer is obtaining a new mortgage, all conditions of the buyer's new mortgage will be fulfilled including disbursement of mortgage funds and registration, prior to registration of the Transfer.

What does undertaking mean format?

Answer: An undertaking letter is a formal document that provides assurance from one party to another to fulfill an obligation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get India LIC Housing Finance NRI Undertaking?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the India LIC Housing Finance NRI Undertaking in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in India LIC Housing Finance NRI Undertaking?

With pdfFiller, it's easy to make changes. Open your India LIC Housing Finance NRI Undertaking in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit India LIC Housing Finance NRI Undertaking on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign India LIC Housing Finance NRI Undertaking right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is India LIC Housing Finance N.R.I. Undertaking Letter?

The India LIC Housing Finance N.R.I. Undertaking Letter is a document required for Non-Resident Indians (NRIs) applying for housing finance. It serves as a formal declaration that outlines the borrower's understanding and compliance with the terms of the loan.

Who is required to file India LIC Housing Finance N.R.I. Undertaking Letter?

Non-Resident Indians (NRIs) who are applying for housing finance through LIC Housing Finance are required to file the N.R.I. Undertaking Letter.

How to fill out India LIC Housing Finance N.R.I. Undertaking Letter?

To fill out the India LIC Housing Finance N.R.I. Undertaking Letter, the applicant needs to provide personal details such as name, address, nationality, passport number, and specific loan details, ensuring all information is accurate and complete.

What is the purpose of India LIC Housing Finance N.R.I. Undertaking Letter?

The purpose of the India LIC Housing Finance N.R.I. Undertaking Letter is to confirm the borrower's residency status, affirm their intent to comply with loan conditions, and provide LIC Housing Finance with necessary disclosures about their financial situation.

What information must be reported on India LIC Housing Finance N.R.I. Undertaking Letter?

The N.R.I. Undertaking Letter must report information including the applicant's full name, residential address in India and abroad, income details, purpose of the loan, loan amount requested, and any other relevant financial disclosures.

Fill out your India LIC Housing Finance NRI Undertaking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India LIC Housing Finance NRI Undertaking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.