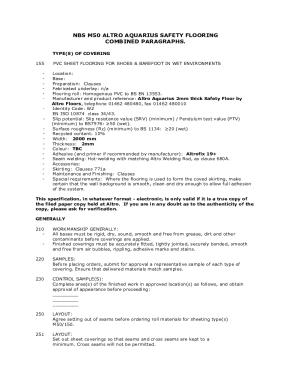

GH PML ProSeed Loan Application Form free printable template

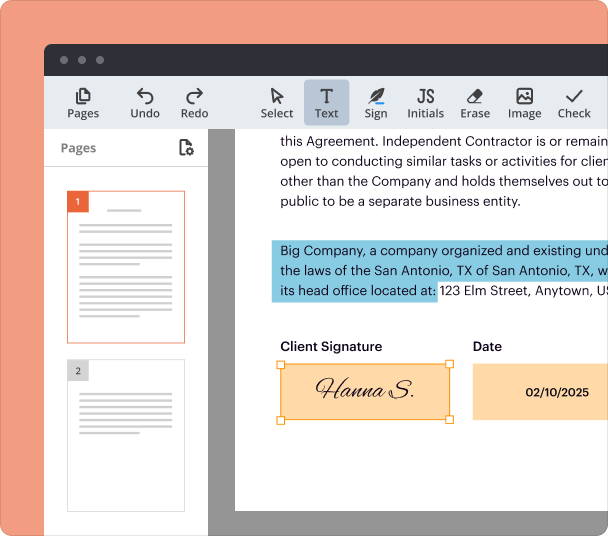

Fill out, sign, and share forms from a single PDF platform

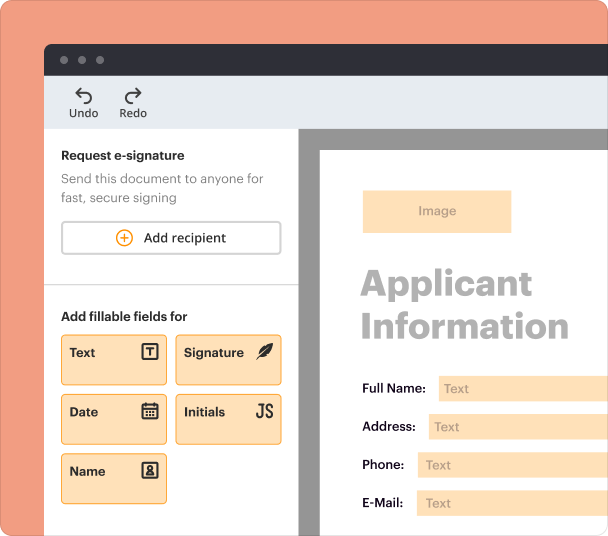

Edit and sign in one place

Create professional forms

Simplify data collection

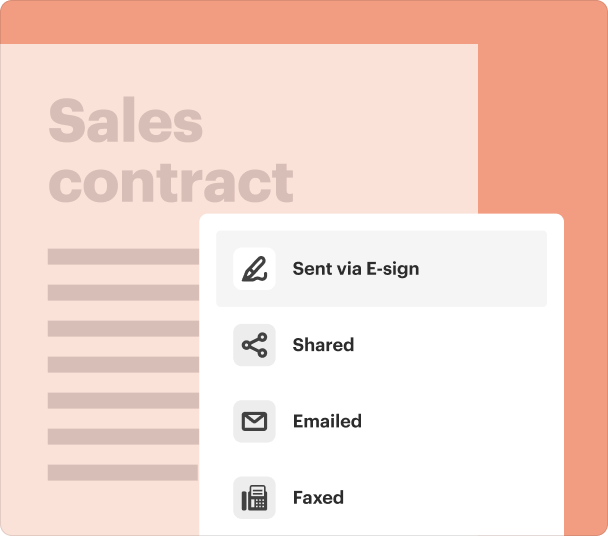

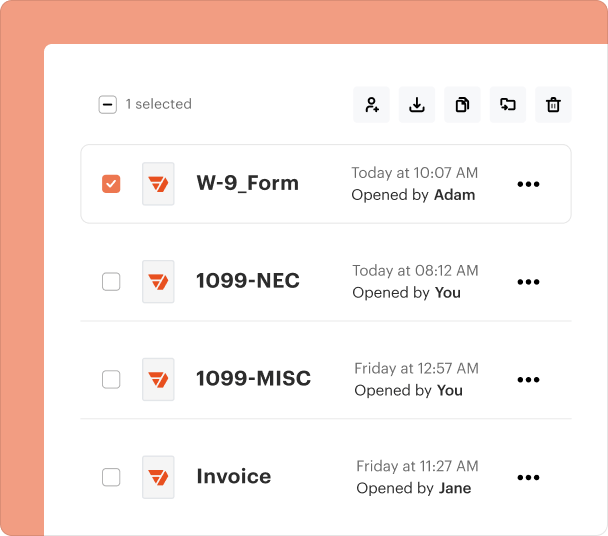

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

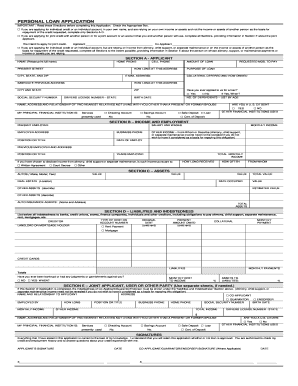

How to Complete the GH PML Proseed Loan Form

TL;DR: How to fill out a GH PML Proseed loan form

To complete the GH PML Proseed loan form, gather necessary documents such as identification and income proof, and accurately provide details about yourself, your loan request, and your financial history. Use pdfFiller to fill, sign, and submit the form seamlessly online.

What is the purpose of the Proseed loan form?

The Proseed loan form aims to collect essential information from applicants seeking financing through microfinance institutions. This form is crucial for banks to evaluate the applicant's eligibility based on their financial situation, creditworthiness, and the reason for borrowing.

-

The form ensures that all necessary information is obtained to make informed lending decisions.

-

Filling out the form accurately minimizes the risk of delays or rejections in the loan approval process.

-

Use pdfFiller for an easy online filling experience, which helps prevent errors through its validation features.

What does the spousal consent form entail?

If you are applying for a joint loan, a spousal consent form may be required. This form confirms the agreement of your spouse to the loan application, ensuring transparency and consent in financial commitments.

-

Both applicants must declare any joint financial obligations they have.

-

This includes full name, address, and other identifying information.

-

Signing this form means both parties agree to the loan terms and acknowledge their shared financial responsibility.

What details are needed for the loan request?

Section 2 of the Proseed loan form focuses on the specifics of your loan request, providing banks with critical information to assess your financial needs.

-

Important details such as your name, requested loan amount, and duration of the loan must be clearly stated.

-

You should fully comprehend your pledges and responsibilities regarding repayments and collateral if applicable.

-

Review RTP (Responsible Third Party) and LTP (Legal Third Party) to know who is accountable.

Why is a personal loan guarantor necessary?

Including a guarantor adds an extra layer of security for lenders, as it ensures another responsible party is willing to take on the liability if you default on the loan.

-

They offer additional assurance that the loan will be repaid, which can enhance your chances of approval.

-

The guarantor must provide their title, contact details, and identification numbers.

-

Both you and your guarantor should fully understand the implications and liabilities attached to this role.

What employment and income details should be provided?

Section 4 emphasizes the need for transparency regarding your employment status and income, which are vital factors in determining loan eligibility.

-

Include details about your employer, position, tenure, and relevant experience.

-

Be prepared to document your monthly salary, allowances, and any additional income sources.

-

A clear financial picture enhances the likelihood of loan approval, with the income declared serving as a critical component.

How should borrowing history be documented?

Accurate representation of your previous borrowing history is crucial in evaluating your creditworthiness and reliability as a borrower.

-

List any past loans, outstanding balances, and repayment history to give a comprehensive view of your loan behavior.

-

A positive credit history can lead to better loan terms, while a negative one may limit options.

-

Ensure to manage any previous obligations efficiently, as this reflects responsibility in financial dealings.

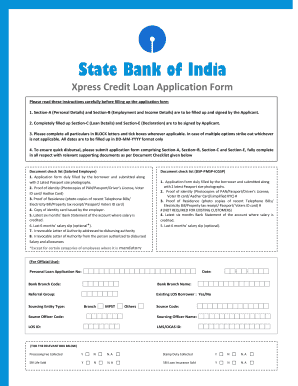

What documentation and identification are required?

Providing the necessary identification and supplementary documents is essential for verifying your identity and supporting your application.

-

Common identification forms include a passport, voter’s ID, or driver’s license.

-

Proper documentation upholds integrity during the application process and is necessary for approval.

-

pdfFiller offers features to easily upload, edit, and submit your documents efficiently.

What common mistakes should be avoided?

Awareness of frequent mistakes can save applicants a lot of time and trouble when filling out the Proseed loan form.

-

These include incorrect personal details and missing required fields which may result in application rejections.

-

Always review all entries for accuracy before submission to enhance your chances of a smooth approval process.

-

The platform’s features help users identify potential issues it detects around incomplete fields.

Frequently Asked Questions about loan application form

What is a Proseed loan?

Proseed loans are financial products offered by microfinance institutions aimed at supporting individuals or businesses in need of funds. They often focus on providing accessible credit with less stringent requirements compared to traditional loans.

How long does the application process take?

The loan application process duration varies depending on the institution and completeness of your submission. Typically, it can take anywhere from a few days to several weeks.

What happens if my loan application is denied?

If your application is denied, you’ll receive a notification explaining the reasons. You can often rectify these reasons and reapply, ensuring all information is accurate and complete.

Are there fees associated with the loan application?

Many microfinance institutions may charge application fees or processing fees. It's essential to review the terms of your loan to understand all associated costs.

Can I modify my loan request after submission?

Most institutions allow for modifications, but this varies by lender. Contact your loan officer promptly to discuss any changes you need to make.

pdfFiller scores top ratings on review platforms