AU NSW Form 835 2011-2025 free printable template

Show details

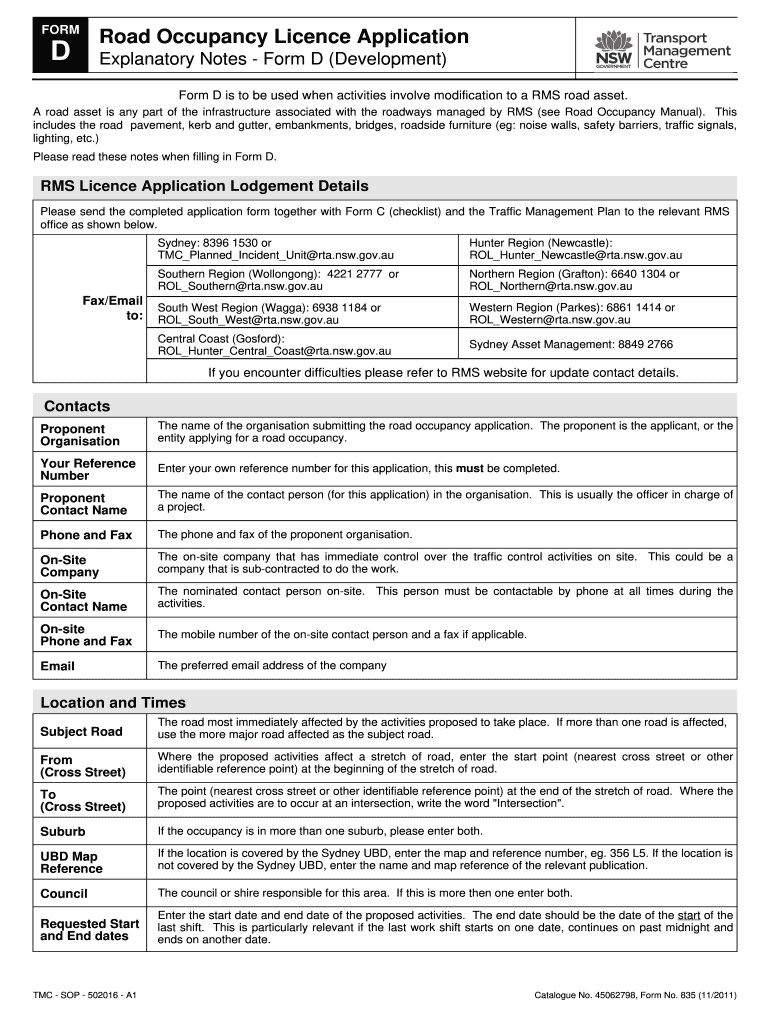

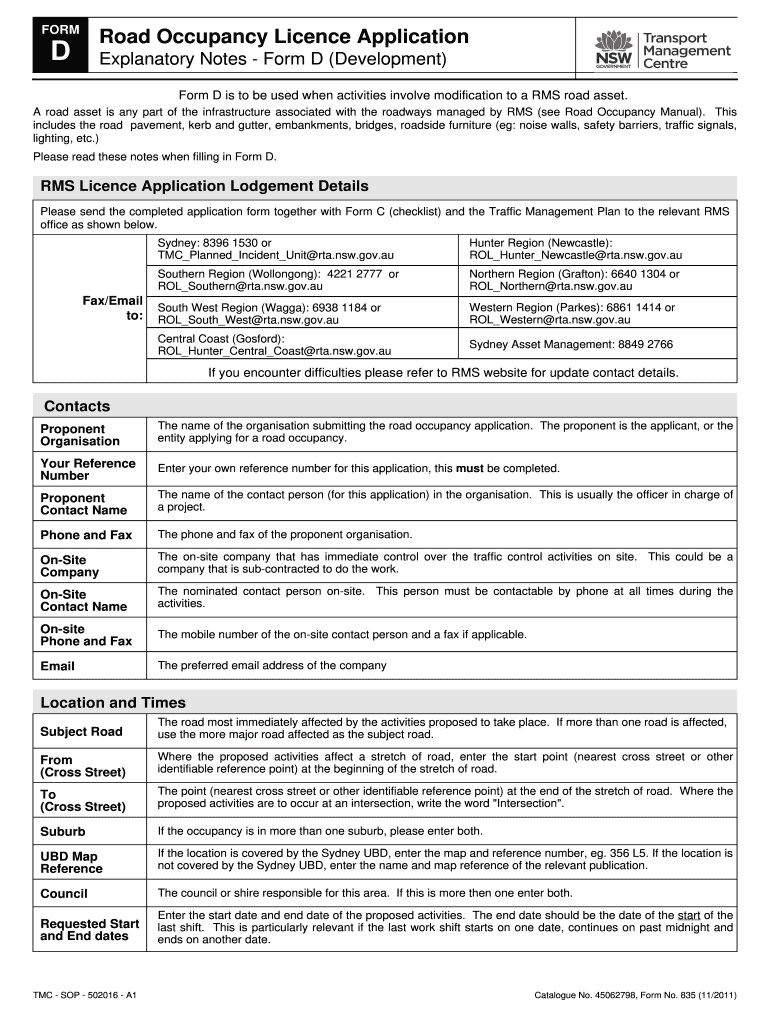

FORM Road Occupancy License Application D Explanatory Notes Form D (Development) Form D is to be used when activities involve modification to an RMS road asset. A road asset is any part of the infrastructure

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form road occupancy licence application

Edit your AU NSW Form 835 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NSW Form 835 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU NSW Form 835 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU NSW Form 835. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

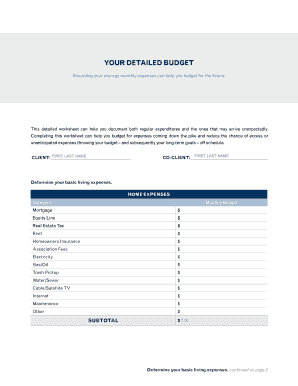

How to fill out AU NSW Form 835

How to fill out AU NSW Form 835

01

Download the AU NSW Form 835 from the official website or obtain a physical copy.

02

Read the instructions provided on the form carefully.

03

Fill out your personal details, including name, address, and contact information.

04

Provide specific information related to the purpose of the form, as required.

05

Double-check all entered information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form as instructed, either by mail or in person.

Who needs AU NSW Form 835?

01

Individuals seeking to apply for a specific permit or license in New South Wales, Australia.

02

Businesses that need to submit regulatory information to the state.

03

Anyone required to provide personal or organizational information for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form D used for?

Form D is a short notice detailing basic information about the company for investors in the new issuance. Such information may include the size and date of the offering, along with the names and addresses of a company's executive officers.

Why is a Form D filed?

Form D, also known as the Notice of Sale of Securities, is required by the SEC for companies selling securities in a Regulation (Reg) D exemption or with Section 4(6) exemption provisions. Form D details basic information or essential facts about the company for investors.

What happens if you don't file a Form D?

Failure to File Form D Under Rule 507 of Regulation D, the SEC can take action against the issuer that fails to file a Form D, having the issuer enjoined from future use of Regulation D. In some instances, if the violation of Regulation D is willful, it could also constitute a felony.

What is the meaning of Form D?

Form D is a brief notice that includes basic information about the company and the offering, such as the names and addresses of the company's executive officers, the size of the offering and the date of first sale.

Who has to file a Form D?

Regulation D is a series of rules that govern commonly used regulatory exemptions that companies can use to sell securities. Regulation D requires that companies file a notice of their offering with the SEC using Form D.

What triggers a Form D filing?

A company must file this notice within 15 days after the first sale of securities in the offering. For this purpose, the date of first sale is the date on which the first investor is irrevocably contractually committed to invest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AU NSW Form 835 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign AU NSW Form 835 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit AU NSW Form 835 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign AU NSW Form 835 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete AU NSW Form 835 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your AU NSW Form 835 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is AU NSW Form 835?

AU NSW Form 835 is a tax form used in New South Wales, Australia, for reporting payroll tax liabilities.

Who is required to file AU NSW Form 835?

Employers in New South Wales who have a payroll exceeding the threshold amount set by the state are required to file AU NSW Form 835.

How to fill out AU NSW Form 835?

To fill out AU NSW Form 835, employers need to provide details such as their business name, address, payroll amount, and calculate the payroll tax owed based on the provided guidelines.

What is the purpose of AU NSW Form 835?

The purpose of AU NSW Form 835 is to facilitate the reporting and payment of payroll tax owed by employers in New South Wales.

What information must be reported on AU NSW Form 835?

The information that must be reported on AU NSW Form 835 includes the employer’s details, total payroll amount, and the calculated payroll tax liabilities.

Fill out your AU NSW Form 835 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NSW Form 835 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.