Get the free autofill document

Get, Create, Make and Sign autofill document form

Editing autofill document form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out autofill document form

Video instructions and help with filling out and completing autofill document

Instructions and Help about autofill document form

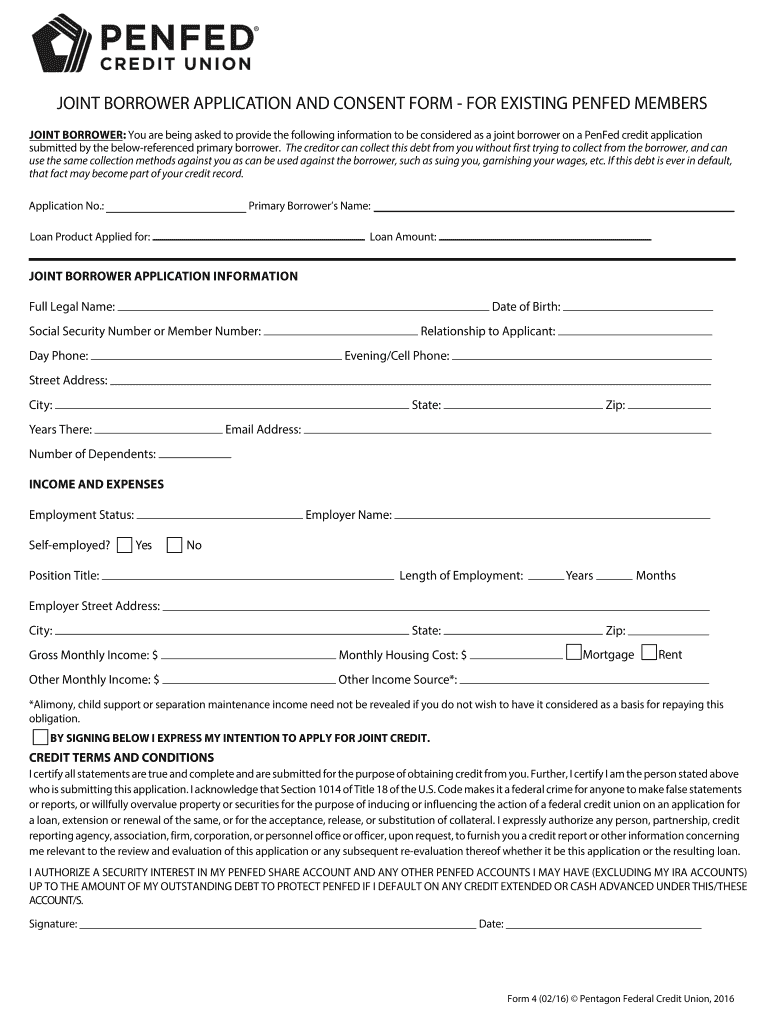

What if I told you you can buy any car you want including this Tesla Model X car for 150000 and only pay less than 2 in interest which is around a hundred and ninety dollars a month which is literally less money that I spent on coffee every single day well I dont really drink coffee and a hundred nine dollars worth of coffee every single day would be insane if youre doing that I recommend you stop and on top of that 9999 of my subscribers think that this Pentagon Federal Credit Union is the best credit unit in the history of credit unions but if you really want to find out how this Pentagon Federal Credit Union actually works from credit cards auto loans mortgages student loans like whatever it is were gonna find out Im gonna call customer service in this video and I see test them out and ask them all the hard questions including why they have so many bad reviews online Im talking about hundreds and hundreds and hundreds of bad reviews Im pretty sure no one has ever asked a customer service like why they have so many bad reviews and thats one of the reasons actually want to call them actually test them out to ask him all these hard questions that nobody elses accent now guys if you dont know me my name is hi Brice Im an accountant and Im a present personal finance for the past four years and on top of that most of you guys that are new to this channel probably dont know this but Im not biased when it comes to any company so I always ask me the same questions try to figure out every single detail and Im not biased okay because the only thing Im biased about is getting the best rate in the best return on my money and getting the best value so I recommend if you have any loyalty to any company its not giving you the best rate I recommend you lose that loyalty and go where the best rates are to get the best return on your money theres I do post videos every single day on this channel so make sure you subscribe when you do subscribe hit that notification bell so whenever I upload a video about credit cards credit union or whatever they didnt teach you in school that wasnt so important you actually be the first one to actually get notified and watch the video because I hear a lot of people say me tell me what are gonna upload what time is I upload every single day but the time is a little mysterious so if you have notifications on you get notified whatever time during the day actually upload 8 am 10 am 12 pm like whatever time in that day that i uploaded youre gonna get notified and be the first one to actually watch the video so make sure you turn on notifications now guys as always I want you guys to comment down below and let me know in the comments what you think about the pentagon credit unit before I start the video because I want to know what you think first and then after the video interest reply to that comment and let me know what you think of it now that you know all this information and if you remember or let me know the comments down...

People Also Ask about

Do you have to be a member to get loan at PenFed?

What is the minimum credit score for PenFed?

Is it hard to get a loan with PenFed?

Is PenFed a hard or soft pull?

Does PenFed verify income for credit cards?

How long does it take PenFed to approve a personal loan?

How do you get approved for PenFed?

What credit score is needed for PenFed?

Does PenFed do a hard pull for credit cards?

What credit score do you need for PenFed loan?

Is it hard to get a loan from PenFed?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the autofill document form in Chrome?

Can I create an eSignature for the autofill document form in Gmail?

How can I edit autofill document form on a smartphone?

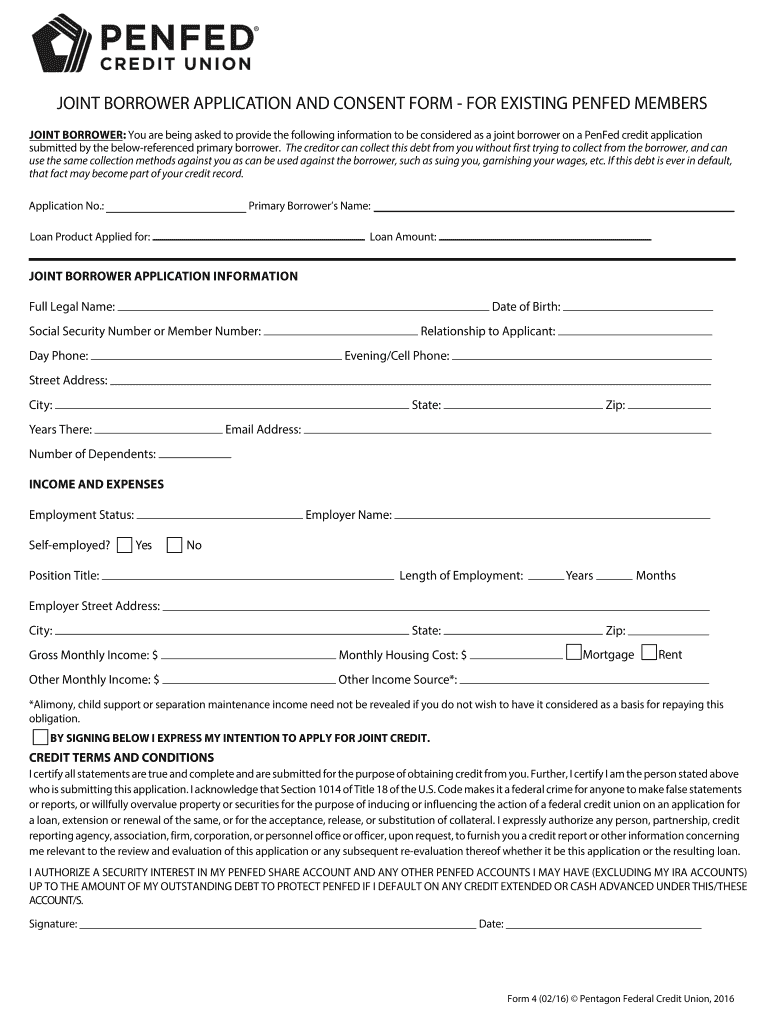

What is penfed joint borrower authorization?

Who is required to file penfed joint borrower authorization?

How to fill out penfed joint borrower authorization?

What is the purpose of penfed joint borrower authorization?

What information must be reported on penfed joint borrower authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.