NJ Public Records Filing for New Business Entity 2005 free printable template

Show details

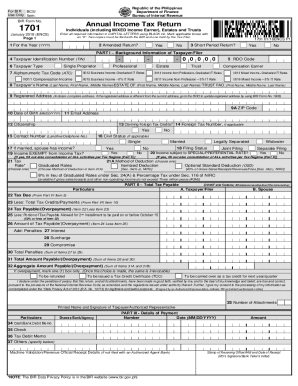

Mail to PO Box 308 Trenton NJ 08646 STATE OF NEW JERSEY DIVISION OF REVENUE FEE REQUIRED PUBLIC RECORDS FILING FOR NEW BUSINESS ENTITY Overnight to 33 West State St. 5th Floor Fill out all information below INCLUDING INFORMATION FOR ITEM 11 and sign in the space provided. Please note that once filed this form constitutes your original certificate of incorporation/formation/registration/authority and the information contained in the filed form is considered public. Refer to the instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ Public Records Filing for New Business

Edit your NJ Public Records Filing for New Business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ Public Records Filing for New Business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ Public Records Filing for New Business online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ Public Records Filing for New Business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ Public Records Filing for New Business Entity Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ Public Records Filing for New Business

How to fill out NJ Public Records Filing for New Business Entity

01

Visit the New Jersey Division of Revenue and Enterprise Services website.

02

Download the 'Public Records Filing for New Business Entity' form.

03

Fill in the name of the business entity as you want it to appear.

04

Provide the business address, including the city, state, and zip code.

05

Indicate the type of business entity (e.g., corporation, LLC, partnership).

06

Include the name and address of the registered agent for the business.

07

State the purpose of the business in a concise manner.

08

Specify the duration of the business entity, if applicable.

09

Sign and date the form as the organizer or authorized individual.

10

Submit the completed form along with the required filing fee to the appropriate office.

Who needs NJ Public Records Filing for New Business Entity?

01

Any individual or group planning to establish a new business entity in New Jersey.

02

Entrepreneurs looking to formalize their business structure, such as LLCs or corporations.

03

Businesses needing to comply with state regulations for legal recognition.

Fill

form

: Try Risk Free

People Also Ask about

How do I look up a company in New Jersey?

You can find information on any corporation or business entity in New Jersey or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

How do I find out if a business is active in NJ?

You can visit the NJ portal website and enter either the name of the company, entity ID number, or even the taxpayer identification number (Federal Employer ID Number) of the business. The website will then verify if the business is registered.

How do you check if a company is legally registered in NJ?

You may check the online registration inquiry to determine if the business is already registered. If you have not registered but are required to have this certificate, you will need to complete Form NJ-REG.

What is an entity number for a business in NJ?

Business Entity ID: This is the ten-digit ID assigned to all corporations, LLC's and limited partnerships. Enter all ten digits, including leading zeros. Do NOT enter spaces, dashes or slashes.

What is an entity ID in New Jersey?

An Entity ID is a 10-digit number used to identify your corporate business records. Your corporate records are public and kept separate from your tax records, which are confidential.

How do I find out if a company name is available in NJ?

Use our online Name Availability Look-Up Service to see if a business name is currently available for use. You may also browse names on file with the State of New Jersey to get a general sense of which names are available.

What is NJ entity ID?

An Entity ID is a 10-digit number used to identify your corporate business records. Your corporate records are public and kept separate from your tax records, which are confidential.

How do I check if a business is active in New Jersey?

Corporation & Business Entity Search You can find information on any corporation or business entity in New Jersey or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

How do you find a if a company is still active?

The Secretary of State where the company is incorporated You can find out whether the company is a corporation in good standing and has filed annual reports with the state through the secretary of state where the company is incorporated.

What is my NJ sales tax ID number?

If you have a Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service (IRS), your New Jersey tax ID number is your FEIN followed by a 3 digit suffix. If you do not have a suffix, enter three zeroes.

How do you check if a company is under liquidation?

The easiest way to find out about a company's liquidation status is through the relevant ASIC-operated websites. There are several ASIC sites through which trading partners can ascertain whether a company is in liquidation and include the Published Notices website.

What is NJ business entity status report?

The Corporate Status Report includes information about a corporation such as: date of formation, name of the registered agent, registered office the status (active, dissolved, and revoked) , and principal office address of the entity if any.

How do you check if a name is being used for a business?

Businesses in every state are subject to trademark infringement lawsuits, which can prove costly. That's why you should check your prospective business, product, and service names against the official trademark database, maintained by the United States Patent and Trademark Office.

How do I look up a company's name?

Every state has a secretary of state or other state agency that's responsible for business entity filings. In most states, the website of the state business filing agency includes an online entity name check tool.

Is NJ EIN and entity ID the same?

To complete the NJ-REG form, you will need: Your business Entity ID (If you're a corporation, LLC, LLP, or LP. An EIN is a 10-digit unique identifier used for your non-tax records) Your business EIN (this is a 9-digit unique identifier provided to you by the federal government for your business)

How do I find a business name in NJ?

Use our online Name Availability Look-Up Service to see if a business name is currently available for use. You may also browse names on file with the State of New Jersey to get a general sense of which names are available. You may browse names online free of charge. When checking a name, be exact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NJ Public Records Filing for New Business?

The editing procedure is simple with pdfFiller. Open your NJ Public Records Filing for New Business in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the NJ Public Records Filing for New Business form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NJ Public Records Filing for New Business and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit NJ Public Records Filing for New Business on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NJ Public Records Filing for New Business from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is NJ Public Records Filing for New Business Entity?

NJ Public Records Filing for New Business Entity is a form that must be submitted to the New Jersey Division of Revenue and Enterprise Services to officially register a new business entity in the state.

Who is required to file NJ Public Records Filing for New Business Entity?

Any new business entity, including corporations, limited liability companies (LLCs), and partnerships, is required to file the NJ Public Records Filing.

How to fill out NJ Public Records Filing for New Business Entity?

To fill out the NJ Public Records Filing, you typically need to provide the entity name, business address, registered agent information, and details about the business structure. It can be completed online or via paper forms.

What is the purpose of NJ Public Records Filing for New Business Entity?

The purpose of NJ Public Records Filing is to legally establish a business entity in New Jersey and ensure compliance with state regulations, as well as to provide public notice of the business existence.

What information must be reported on NJ Public Records Filing for New Business Entity?

The information that must be reported includes the business name, business address, registered agent’s name and address, type of business entity, and sometimes the names of the owners or officers.

Fill out your NJ Public Records Filing for New Business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ Public Records Filing For New Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.