Get the free michigan form 165

Show details

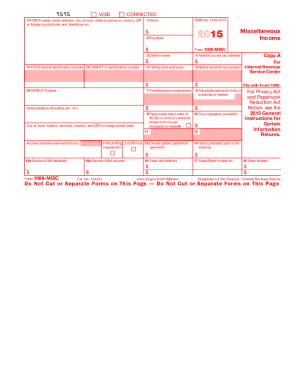

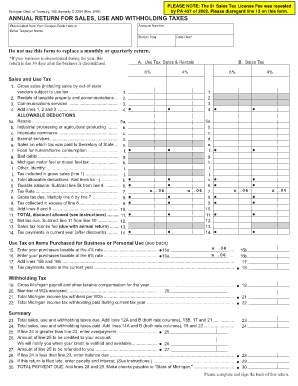

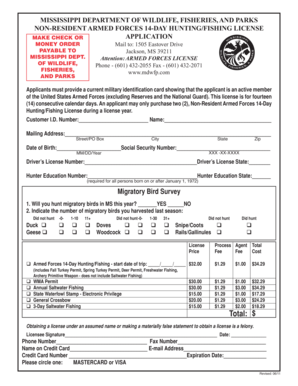

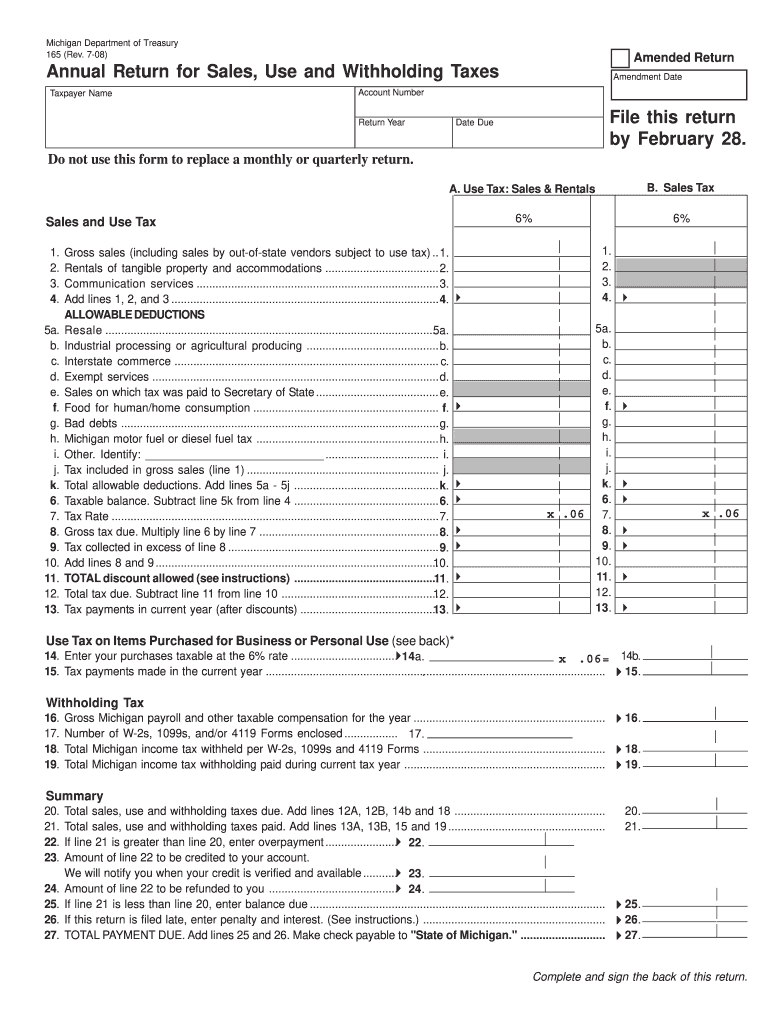

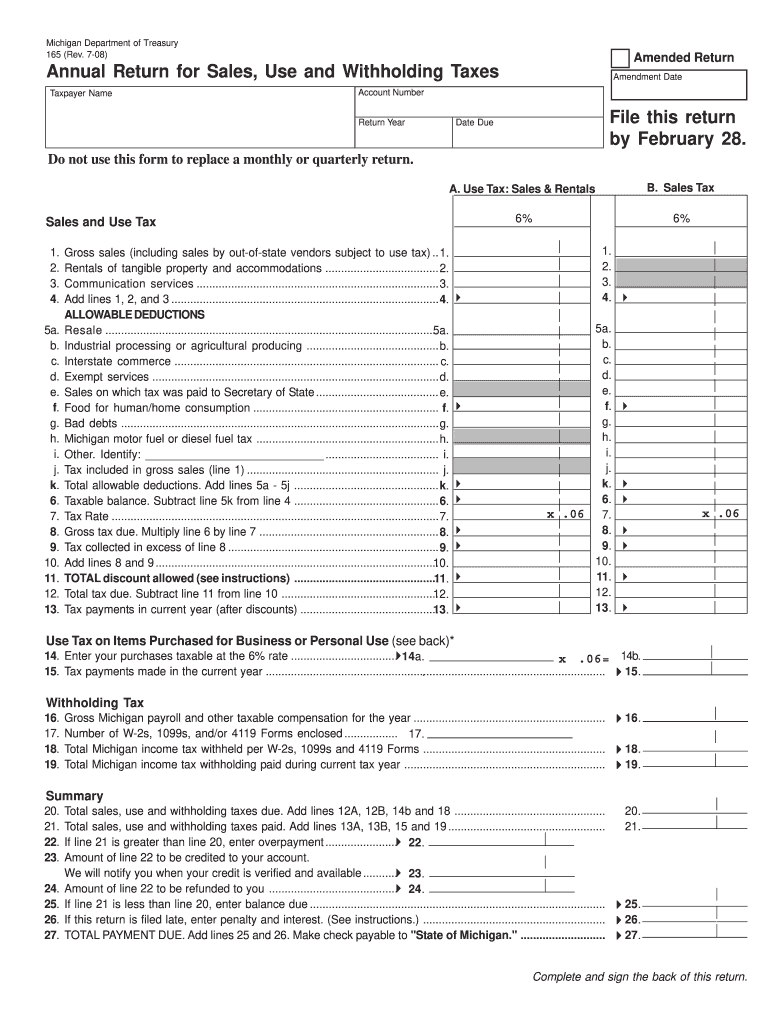

Reset Form Michigan Department of Treasury 165 Rev. 7-08 Amended Return Annual Return for Sales Use and Withholding Taxes Taxpayer Name Amendment Date Account Number Return Year File this return by February 28. Date Due Do not use this form to replace a monthly or quarterly return. A. Use Tax Sales Rentals B. Sales Tax Sales and Use Tax i 5a. i b. i c. i d. i e. i f. i g. i h. i i. i j. k. i 9. i 11. i 13. Gross sales including sales by out-of-st...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 165 form

Edit your form 165 michigan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mi form 165 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 165 online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan sales tax return 165 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

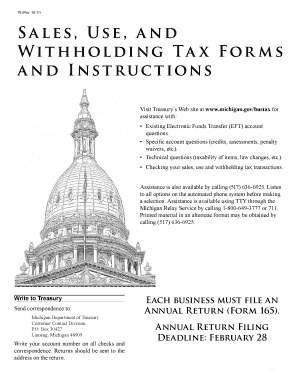

How to fill out michigan form 165 fillable

How to fill out Michigan form 165:

01

Gather all necessary information and documents such as your personal details, income information, deductions, and credits.

02

Label each section of the form properly to avoid any confusion.

03

Start with the top section, which will typically require your personal information such as name, address, and social security number.

04

Move on to the income section, where you'll need to report your wages, salaries, tips, and other sources of income. Follow the instructions carefully and fill in the appropriate boxes or lines.

05

Deductions and credits section comes next. Here, you will report any deductions you're eligible for, such as student loan interest, medical expenses, or charitable donations. Additionally, you can claim tax credits for things like education expenses or child care costs.

06

Review the form thoroughly once you have filled in all the necessary information. Make sure there are no errors or missing details.

07

Sign and date the form to certify its accuracy.

08

Submit the completed Michigan form 165, along with any supporting documents or schedules, to the appropriate tax office by the designated deadline.

Who needs Michigan form 165:

01

Michigan residents who need to file their state income tax return.

02

Individuals who have earned income in Michigan, regardless of their residency, may also need to file Michigan form 165.

03

Anyone who meets the requirements set by the Michigan Department of Treasury for filing this particular tax form. It is important to refer to the official guidelines or consult a tax professional to determine if you are required to file the form.

Fill

michigan dept of treasury form 165

: Try Risk Free

People Also Ask about michigan gov form 165

What is the Michigan exemption allowance?

For the 2022 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent.

What is excluded from sales tax in Michigan?

Michigan provides an exemption from sales or use tax on tangible personal property used in tilling, planting, caring for or harvesting things of the soil, in the breeding, raising or caring of livestock poultry or horticultural products for further growth.

Does Michigan have a state tax withholding form?

You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions.

What items are subject to sales tax in Michigan?

Generally, the sales tax applies to retail sales of tangible personal property to consumers in the State of Michigan. Examples of transactions which may be subject to sales tax are sale of: Books, pamphlets, duplicated materials. For example, course packets produced in a non-commercial manner are not taxable.

What is exempt from sales tax in Michigan?

Some goods are exempt from sales tax under Michigan law. Examples include prescription medications, groceries, newspapers, medical devices, and some agricultural and industrial machinery.

What is Michigan form 163?

163 (Rev. 07-19) Notice of Change or Discontinuance. Use this form only if you discontinued or made changes to your business. Complete all sections that apply.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my michigan form 165 pdf directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your michigan annual return for sales form 165 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the mi 165 form in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out mi 165 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your michigan department of treasury form 165. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is michigan form 165?

Michigan Form 165 is a tax form used for reporting corporate income to the Michigan Department of Treasury. It is specifically utilized by corporations to report their income for state tax purposes.

Who is required to file michigan form 165?

Corporations that conduct business in Michigan or have income sourced from Michigan are required to file Michigan Form 165. This includes both domestic and foreign corporations doing business within the state.

How to fill out michigan form 165?

To fill out Michigan Form 165, corporations must provide their business identification information, report total income, deduct any applicable exemptions or credits, calculate taxable income, and finally compute the tax liability. Supporting documentation may be required, and the form must be signed and dated.

What is the purpose of michigan form 165?

The purpose of Michigan Form 165 is to facilitate the accurate reporting of corporate income and ensure that corporations comply with state tax laws. It helps the Michigan Department of Treasury assess and collect taxes due from corporations operating within the state.

What information must be reported on michigan form 165?

Michigan Form 165 requires information such as the corporation's name and address, federal employer identification number (FEIN), total sales and revenue, deductions, credits claimed, taxable income, and the calculated tax amount owed. Additionally, any relevant schedules or supporting documents must be included.

Fill out your michigan form 165 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Form 165 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to form 165 state of michigan

Related to michigan dept tresury form 165

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.