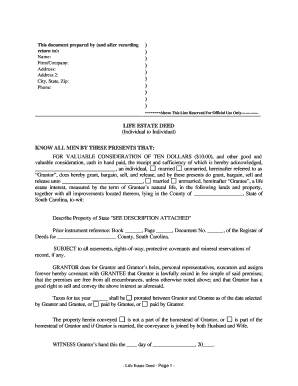

This form is a Warranty Deed where the granters are husband and wife and the grantees are husband and wife. The grantees have a life estate interest in the named property.

Get the free life estate deed example

Show details

This document serves as a legal instrument that conveys a life estate interest from a husband and wife (the Grantors) to another husband and wife (the Grantees) in certain property located in Alabama,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life estate deed example

Edit your life estate deed example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life estate deed example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life estate deed example online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life estate deed example. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life estate deed example

How to fill out life estate deed example:

01

Identify the parties involved: Start by determining the grantor, who is the current owner of the property, and the grantee, who will receive the life estate interest.

02

Gather necessary information: Obtain the legal description of the property, including the address and any other relevant details.

03

Draft the deed: Prepare the life estate deed using a template or consult an attorney to ensure it meets the legal requirements in your jurisdiction. Include the names and addresses of both the grantor and grantee, as well as a clear description of the life estate interest being conveyed.

04

Include any additional provisions: Depending on your specific circumstances, you may need to include additional provisions in the deed. For example, you could specify the duration of the life estate or any restrictions on the grantee's use of the property.

05

Sign and notarize the deed: Once the deed is complete, the grantor must sign it in the presence of a notary public. The notary will then acknowledge the grantor's signature by affixing their seal or stamp.

06

File the deed: Consult the local county recorder's office or other appropriate authority to determine the process and fees for recording the life estate deed. This step is necessary to establish the legal validity of the transfer.

Who needs life estate deed example:

01

Property owners in need of estate planning: Those who wish to retain the right to live in their property for the duration of their life while designating a specific individual or individuals as the future owners may require a life estate deed example.

02

Elderly individuals seeking to establish a living arrangement: Life estate deeds can be useful for elderly individuals who want to secure a home for their remaining years while ensuring that the property eventually passes to their chosen beneficiaries.

03

Blended families or second marriages: Life estate deeds can provide a solution for individuals who wish to provide for their current spouse while also ensuring their children from a previous relationship receive the property rights in the future.

Fill

form

: Try Risk Free

People Also Ask about

How do I sell my property in a life estate in California?

To sell property during the lifetime of the Life Tenant, all owners must agree and sign the Deed. Once the property is sold, the Life Tenant no longer has the right of sole control over the property. Transferring property into a California Life Estate is irrevocable.

What is a life estate deed in California?

A life estate vests the beneficial use of property in a person for their lifetime. The person who holds the life estate is the life tenant. The life tenant may have the right to occupy a residential property and/or the right to income from property that is rented or leased to others.

How does a life estate work in Florida?

A life estate is a right to live in the property until your death. When you pass away, the real property passes to your beneficiaries designated in the lady bird deed, called the remaindermen. The lady bird deed works similarly to a pay-on-death provision on a bank account.

How do you get around a life estate?

One way to get around the requirement for the remainderman's approval is to use a testamentary power of appointment. This is a clause in a will that allows the life tenant to change the person to whom the property will be bequeathed after death. Invoking a power of appointment won't make the life estate invalid.

What are the responsibilities of a life tenant in New York?

Before death, the life tenant is responsible for all costs (i.e., property taxes, insurance, maintenance, etc.). The life tenant also retains any tax benefits of homeownership while they are still alive. However, the life tenant's interest in the property ends at death.

What is a life estate deed in New York?

A life estate deed is a tool that can help with estate planning. With a life estate deed, people deed real estate to another party, but reserve a life estate, which means they have the legal right to occupy the property until death. Upon death, the property passes to the beneficiaries.

What are the disadvantages of a life estate?

Life estate cons The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

How long does a life estate last in California?

015 Life Estate. A life estate interest may be terminated by the life tenant during his lifetime. However, when a life estate is transferred to the owner of the remainder interest in a property, the life estate ceases to exist and is merged into the remainder interest.

Does California have a life estate deed?

If you decide that a life estate is appropriate, hire the attorney to draft a life estate deed for you and record it in the county where the property is located; or, The attorney could include a provision in your estate plan to create a life estate in the property upon your death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my life estate deed example in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your life estate deed example and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit life estate deed example straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing life estate deed example right away.

Can I edit life estate deed example on an Android device?

You can edit, sign, and distribute life estate deed example on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is life estate deed example?

A life estate deed example is a legal document that transfers ownership of a property to a beneficiary for the duration of the owner's life. Upon the owner's death, the property automatically transfers to the designated beneficiary without going through probate.

Who is required to file life estate deed example?

The property owner (grantor) who is creating the life estate is required to file the life estate deed. This ensures that the future interest of the beneficiary is legally recognized.

How to fill out life estate deed example?

To fill out a life estate deed example, include the names and addresses of the grantor and the beneficiary, a legal description of the property, the type of estate being created (life estate), and the effective date. Both parties must sign the document, and it may need to be notarized and filed with the local county recorder.

What is the purpose of life estate deed example?

The purpose of a life estate deed example is to allow an individual to transfer property to another while retaining the right to use and benefit from the property during their lifetime, thereby avoiding probate and ensuring a smooth transition of ownership upon death.

What information must be reported on life estate deed example?

The information that must be reported on a life estate deed example includes the names and addresses of the grantor and the beneficiary, a detailed legal description of the property, the specific terms of the life estate, signatures of the parties involved, notary acknowledgement, and any applicable dates.

Fill out your life estate deed example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Estate Deed Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.