Get the free General Excise Sublease Deduction Certificate - State Legal Forms

Show details

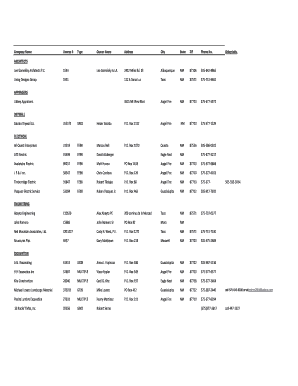

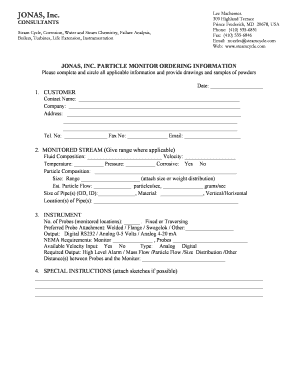

FORM G-71 (REV. 2001) STATE OF HAWAII ? DEPARTMENT OF TAXATION GENERAL EXCISE SUBLEASE DEDUCTION CERTIFICATE (Required for lessee’s files) PART I Information About the Lessor Name Address City State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your general excise sublease deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general excise sublease deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general excise sublease deduction online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit general excise sublease deduction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

How to fill out general excise sublease deduction

How to fill out general excise sublease deduction:

01

Gather necessary information: Start by collecting all the relevant documents and information related to the sublease agreement. This may include the lease agreement, sublease agreement, rental payment records, and any other documentation that supports your sublease deduction.

02

Determine eligibility: Before filling out the deduction form, ensure that you meet the eligibility criteria for claiming the general excise sublease deduction. Typically, this deduction is available for businesses that lease out their property and sublease a part of it to another party.

03

Complete the deduction form: Obtain the appropriate tax form from your state's tax department or revenue office. The form may be specific for general excise sublease deductions or may require you to enter the deduction amount in a general deductions section. Follow the instructions provided on the form and accurately fill out all the required fields.

04

Provide supporting documentation: Attach any necessary documents to substantiate your claim for the sublease deduction. This may include copies of the sublease agreement, rental payment receipts, or any other relevant paperwork that verifies your sublease arrangement.

05

Double-check for accuracy: Before submitting your deduction claim, review all the information you have entered on the form. Make sure that the details are accurate and properly reflect your sublease arrangement. Mistakes or inaccuracies may delay or jeopardize your deduction claim.

06

Submit the form: Once you are confident that everything is complete and accurate, submit the deduction form to the relevant tax authority. Follow the specified submission guidelines and deadlines. Keep copies of all the submitted documents for your records.

Who needs general excise sublease deduction?

01

Businesses that lease out their property: If you are a business owner who rents out a property and subleases a portion of it to another entity, you may be eligible for the general excise sublease deduction. This deduction is designed to provide a tax benefit to businesses that generate income through subleasing arrangements.

02

Individuals with sublease agreements: In some cases, individuals who sublease a property they have rented may also qualify for the general excise sublease deduction. However, the eligibility criteria and requirements may vary depending on the jurisdiction. It is important to consult with your state's tax department or a tax professional for specific guidance.

03

Businesses and individuals seeking tax savings: The general excise sublease deduction can potentially reduce the taxable income of qualifying entities or individuals. By properly filling out the deduction form and meeting the eligibility criteria, businesses and individuals can benefit from the tax savings provided by this deduction.

Remember to consult with a tax professional or the appropriate tax authority in your jurisdiction for personalized advice and guidance on filling out the general excise sublease deduction form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is general excise sublease deduction?

The general excise sublease deduction is a deduction allowed under the general excise tax law for businesses that sublease a portion of their space to another person or entity.

Who is required to file general excise sublease deduction?

Businesses that sublease a portion of their space to another person or entity are required to file the general excise sublease deduction.

How to fill out general excise sublease deduction?

To fill out the general excise sublease deduction, businesses need to provide information about the sublease activity, such as the duration of the sublease, the amount of rent received, and any qualifying expenses.

What is the purpose of general excise sublease deduction?

The purpose of the general excise sublease deduction is to provide businesses with a deduction for the income earned from subleasing a portion of their space.

What information must be reported on general excise sublease deduction?

On the general excise sublease deduction, businesses must report information such as the sublease duration, rent received, and qualifying expenses related to the sublease activity.

When is the deadline to file general excise sublease deduction in 2023?

The deadline to file the general excise sublease deduction in 2023 is typically April 20th, but it is recommended to check with the tax authority or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of general excise sublease deduction?

The penalty for the late filing of the general excise sublease deduction can vary depending on the jurisdiction. It is advisable to check with the tax authority or consult a tax professional for specific penalty information.

How can I send general excise sublease deduction to be eSigned by others?

general excise sublease deduction is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit general excise sublease deduction in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing general excise sublease deduction and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the general excise sublease deduction in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your general excise sublease deduction and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your general excise sublease deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.