Get the free TAX AUTHORITY COMPLAINT FORM - TxDMVGOV - txdmv

Show details

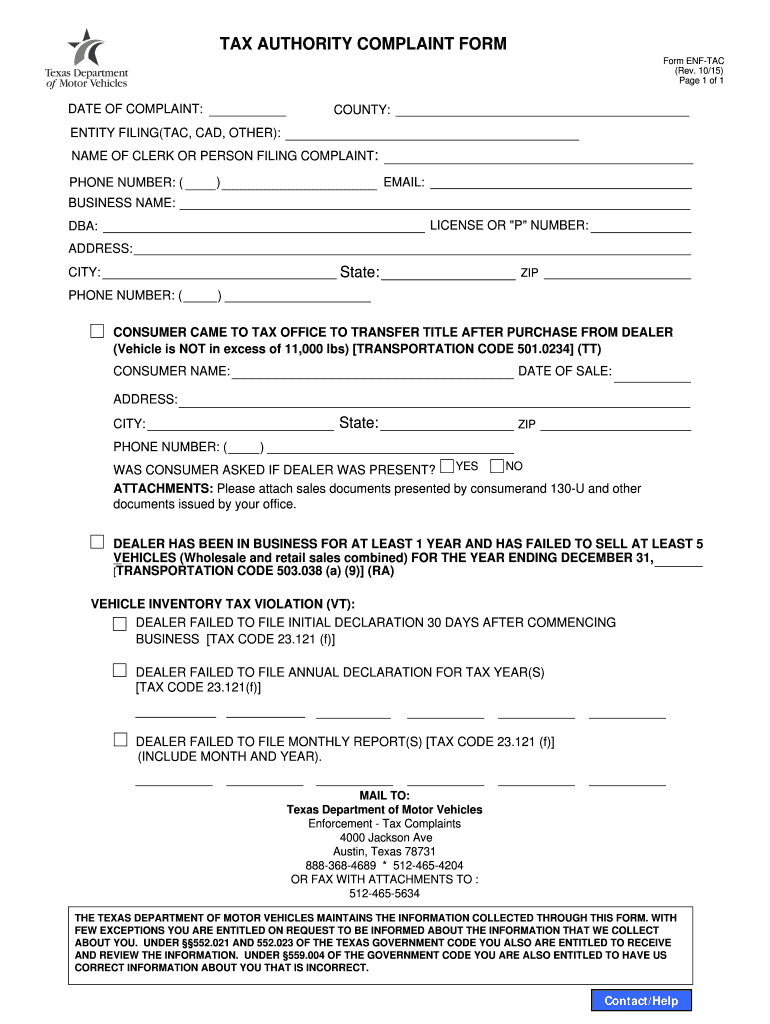

TAX AUTHORITY COMPLAINT FORM ENF-TAC (Rev. 10/15) Page 1 of 1 DATE OF COMPLAINT: COUNTY: ENTITY FILING(TAC, CAD, OTHER): NAME OF CLERK OR PERSON FILING COMPLAINT: PHONE NUMBER: () EMAIL: BUSINESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax authority complaint form

Edit your tax authority complaint form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax authority complaint form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax authority complaint form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax authority complaint form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax authority complaint form

How to fill out tax authority complaint form:

01

Obtain the complaint form: Begin by visiting the website of the tax authority or contacting them directly to request the complaint form. It may also be available at their office.

02

Provide personal information: Fill in your personal details such as your name, address, contact number, and any other required information. This will help the tax authority to properly identify and communicate with you regarding the complaint.

03

Specify the nature of the complaint: Clearly state the reason for your complaint. Provide all necessary details, including relevant dates, transactions, or incidents related to your complaint. Be specific and concise in explaining the issue you want to address.

04

Supporting documents: Attach any supporting documents that can strengthen your complaint. These may include correspondence, receipts, invoices, or any other relevant evidence that can verify your claim. Ensure that these documents are legible and properly labeled.

05

Seek legal advice if necessary: If the issue is complex or involves legal matters, it might be helpful to consult with a tax professional or attorney. They can ensure that your complaint is properly framed and provide guidance on the best course of action.

Who needs tax authority complaint form?

01

Individuals facing tax-related issues: Any individual who encounters problems with their taxes, such as incorrect tax assessments, delays in tax refunds, or unfair treatment by tax authorities, may need to file a tax authority complaint form.

02

Business owners and self-employed individuals: Those running businesses or engaged in self-employment may require the tax authority complaint form to address issues like incorrect tax calculations, disputes over deductions, or challenges with audit findings.

03

Organizations and corporations: If a company believes it has been subjected to unfair taxation practices, discrimination, or any other issue relating to its tax obligations, they may need to complete a tax authority complaint form to seek resolution.

Overall, anyone who believes they have been treated unfairly or encountered problems with the tax authority's actions should consider filing a complaint using the appropriate form. It provides a formal channel to address the issue and seek a resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax authority complaint form directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your tax authority complaint form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit tax authority complaint form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax authority complaint form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the tax authority complaint form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tax authority complaint form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your tax authority complaint form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Authority Complaint Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.