Get the free Motor Fuel Electronic Funds Transfer (EFT) Debit Application

Show details

Este formulario se utiliza para notificar al Tesoro que usted tiene la intención de pagar sus impuestos sobre combustibles mediante el método de débito EFT. El cumplimiento de este formulario es

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel electronic funds

Edit your motor fuel electronic funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel electronic funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor fuel electronic funds online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit motor fuel electronic funds. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor fuel electronic funds

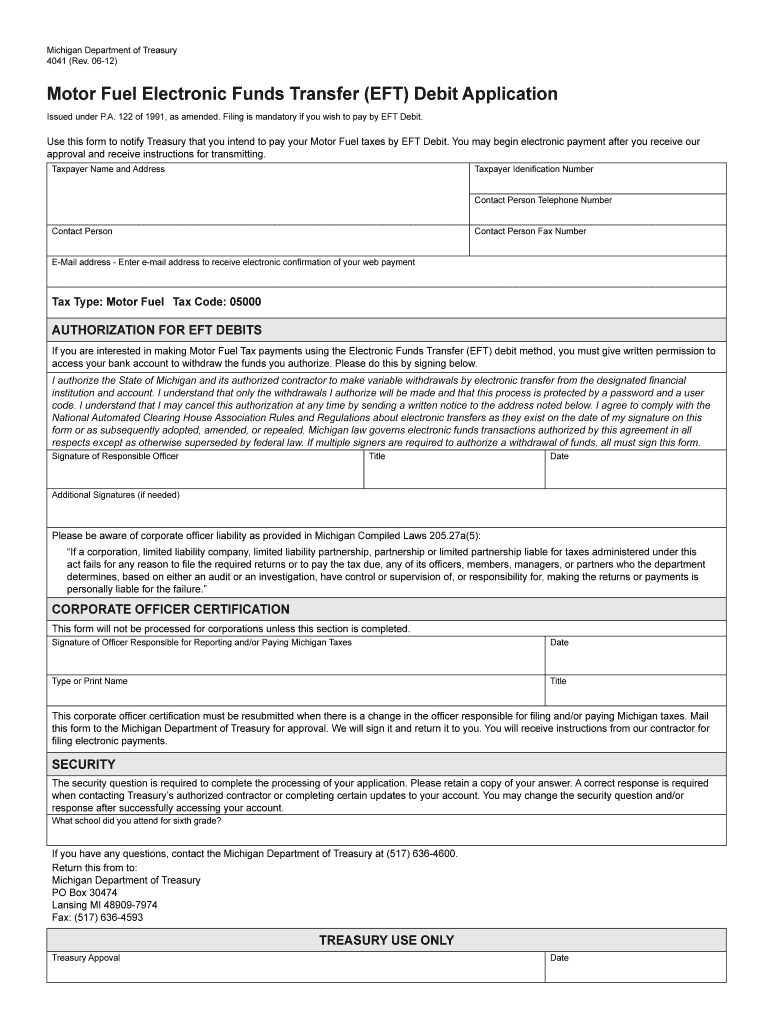

How to fill out Motor Fuel Electronic Funds Transfer (EFT) Debit Application

01

Obtain the Motor Fuel Electronic Funds Transfer (EFT) Debit Application form, which can usually be downloaded from the relevant authority’s website.

02

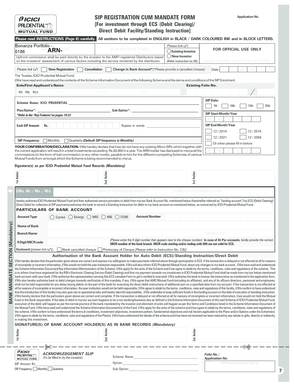

Fill out the applicant's information, including the legal name of the business, address, and contact information.

03

Provide the motor fuel license number issued by the state or federal agency.

04

Complete the banking information section, including the bank name, account number, and routing number.

05

Select the type of account (checking or savings) for the EFT transactions.

06

Sign and date the application to confirm the information is accurate.

07

Submit the completed application form to the appropriate agency by mail, fax, or email, as per their guidelines.

Who needs Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

01

Businesses that distribute or sell motor fuel and require a streamlined method for tax payments.

02

Companies that want to automate their motor fuel tax obligations through electronic fund transfers.

03

Individuals or entities seeking to establish a direct debit for motor fuel taxes with their state tax authority.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out an EFT?

What you need Electronic Funds Transfer Form. Providers must complete the authorized-signature (and date) field on the EFT form. Include the following documentation: Voided check. Bank letter that includes the bank name, provider name, bank account number, and routing number. Bank statement from the designated account.

What is an example of an EFT payment?

Because EFT is an umbrella term, it covers a broad range of payments, including telephone-based transfers, computer-based transfers (i.e., online), ATM transfers, Direct Debit, bank transfers, point-of-sale transfers, e-checks, and so on.

What is an EFT debit payment?

Electronic funds transfers (EFTs) are transactions that move funds electronically between different financial institutions, bank accounts, or individuals. EFTs are frequently referred to as electronic bank transfers, e-checks, or electronic payments.

What is electronic fund transfer in English?

What is an EFT payment? An electronic funds transfer (EFT), or direct deposit, is a digital money movement from one bank account to another. These transfers take place independently from bank employees. As a digital transaction, there is no need for paper documents.

What does EFT debit mean?

Other transaction types that are considered EFT include direct deposit, ATMs, virtual cards, e-Checks (used globally), peer-to-peer payments, and personal computer banking. As traditional paper processes become digitized, computerized systems like EFT transactions will continue to grow and evolve.

What is an example of an electronic funds transfer EFT?

The electronic fund transfer works through a series of secured computer networks connected to two or more bank accounts from a sender to a recipient. There are a variety of types of electronic fund transfers like credit cards, debit cards, online bill payment, direct debit and direct deposits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

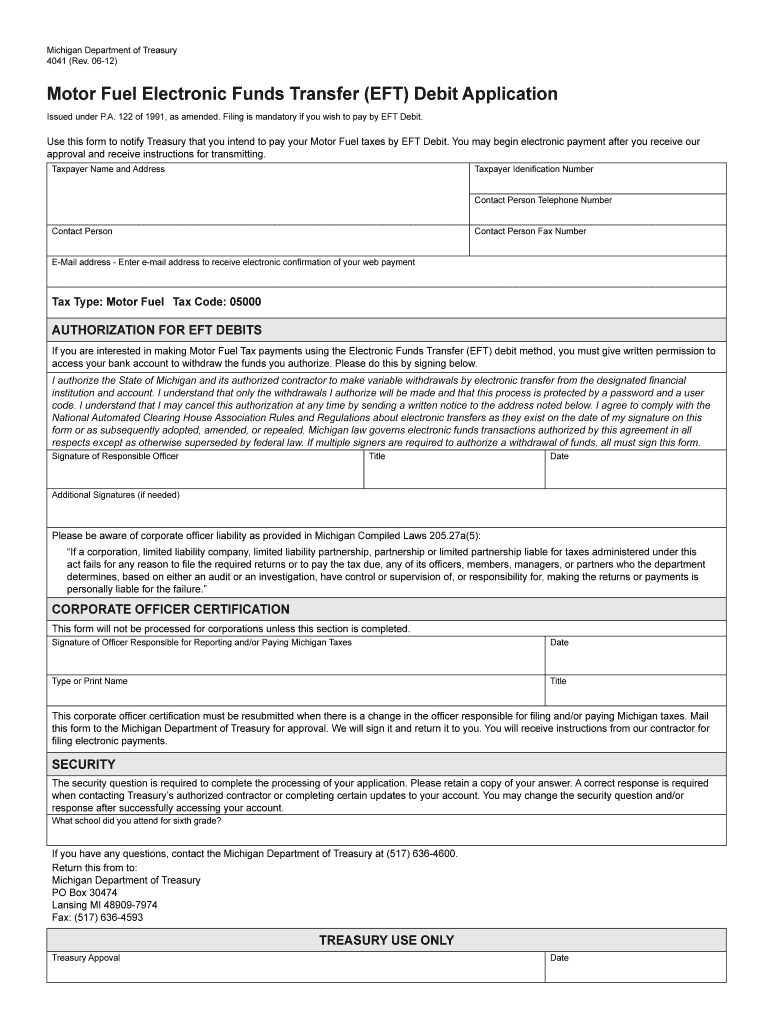

What is Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

The Motor Fuel Electronic Funds Transfer (EFT) Debit Application is a system that allows for the electronic transfer of funds related to motor fuel tax payments from distributors to tax authorities. This application facilitates efficient and secure transactions for fuel taxes.

Who is required to file Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

Distributors of motor fuel who are responsible for the payment of motor fuel taxes are required to file the Motor Fuel Electronic Funds Transfer (EFT) Debit Application. This typically includes wholesalers and retailers engaged in the distribution of motor fuel.

How to fill out Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

To fill out the Motor Fuel Electronic Funds Transfer (EFT) Debit Application, applicants must provide their business information, tax identification number, bank account details, and any relevant information pertaining to their fuel distribution activities. It's important to follow the specific forms and guidelines set by the tax authority.

What is the purpose of Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

The purpose of the Motor Fuel Electronic Funds Transfer (EFT) Debit Application is to streamline the payment process for motor fuel taxes, ensuring timely and accurate tax remittances while reducing the need for paper-based transactions.

What information must be reported on Motor Fuel Electronic Funds Transfer (EFT) Debit Application?

The information that must be reported on the Motor Fuel Electronic Funds Transfer (EFT) Debit Application includes the distributor's name, address, tax identification number, bank details, and a breakdown of fuel volumes sold, along with the corresponding taxes owed.

Fill out your motor fuel electronic funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Electronic Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.