Emerson Financial Gift Letter 2004-2025 free printable template

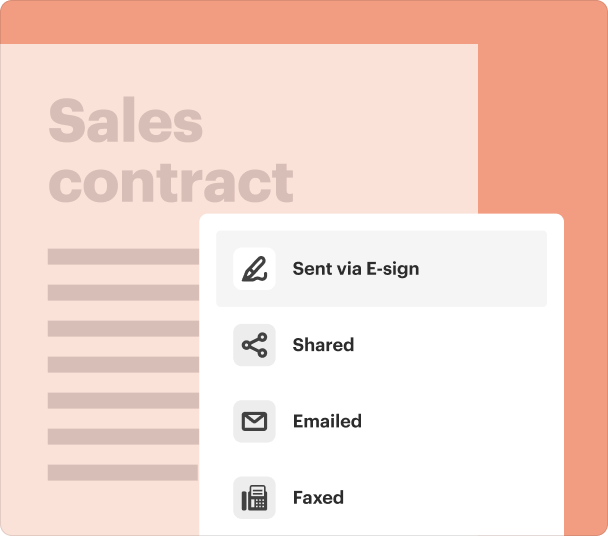

Fill out, sign, and share forms from a single PDF platform

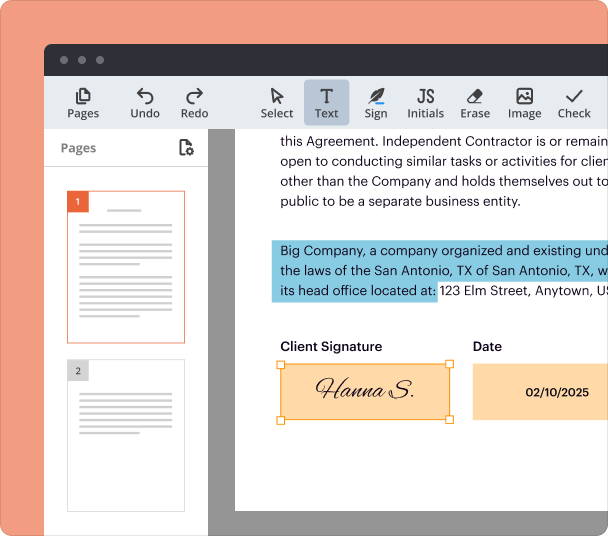

Edit and sign in one place

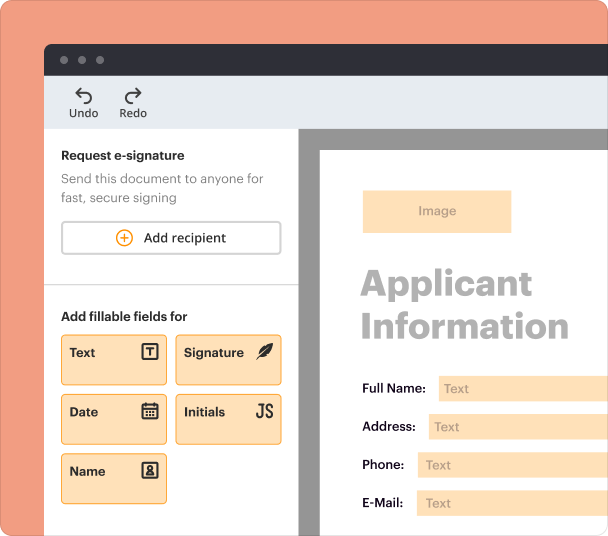

Create professional forms

Simplify data collection

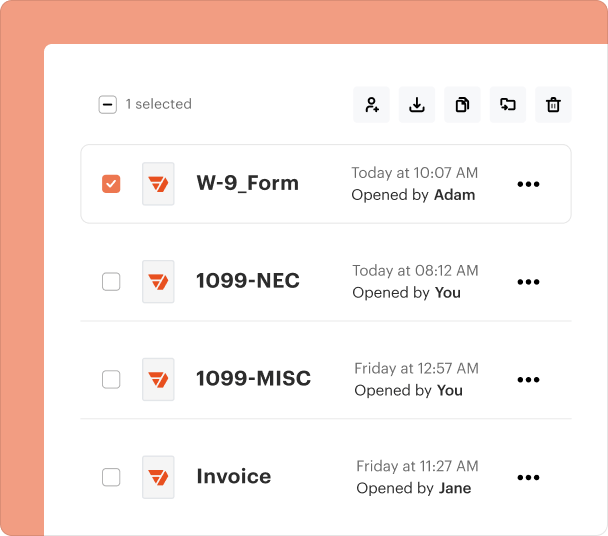

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

A complete guide to the Emerson Financial Gift Letter form

How do you define the Emerson Financial Gift Letter?

An Emerson Financial Gift Letter is a formal document that declares a monetary gift intended to assist with financial obligations, typically in the context of home buying. Its primary purpose is to clarify that the money given does not need to be repaid, distinguishing it from a loan. This letter is essential in many loan processes, particularly when a borrower is utilizing gifted funds for closing costs or down payments.

-

To confirm that the funds provided are a gift and not a loan, thereby avoiding confusion during loan underwriting.

-

Often required by lenders to verify the legitimacy of the source of funds.

-

Acts as a protective measure for both the donor and recipient in financial transactions.

What are the components of the gift letter form?

-

Clearly state the amount of money being gifted.

-

Include the date when the gift is given.

-

Provide information about the recipient, including their name and relationship to the donor.

-

An affirmation that the gift does not require repayment, alleviating any future misunderstandings.

-

State the specific intention, such as to assist with closing costs or other financial needs.

-

Clarify the relationship to establish credibility.

How do you fill out the Emerson Financial Gift Letter?

-

Collect details of both the donor and recipient to ensure accuracy.

-

Follow the specified guidelines to fill in all sections comprehensively.

-

Double-check for accuracy before finalizing the document.

-

Ensure that both the donor and the applicant sign the form.

-

Utilize platforms like pdfFiller to streamline document editing and signing.

What legal considerations should be kept in mind?

-

Understand the legal ramifications of declaring a monetary gift.

-

Be aware of specific laws governing financial gifts in your jurisdiction.

-

Know the tax responsibilities for both donors and recipients of financial gifts.

-

Maintain a copy of the gift letter for future reference and compliance.

What are common mistakes to avoid?

-

Failing to include the amount or date can lead to complications.

-

Errors can be detrimental; always proofread the letter.

-

Ensure signatures match the names provided to avoid delays.

-

Keep personal records to support any future claims or inquiries.

How can pdfFiller assist with the gift letter?

pdfFiller is an essential tool for anyone navigating the process of managing their gift letters. It simplifies the editing, signing, and collaboration involved when multiple donors are present.

-

pdfFiller makes it easy to modify your gift letter as needed.

-

Allows users to work together, especially practical when multiple individuals are involved.

-

Documents are kept securely in the cloud for easy access.

-

Offers user-friendly features for quick and organized form filling.

What future implications should be considered?

-

Understand how a financial gift might affect scholarships or aid eligibility for the recipient.

-

Gifts may need to be reported in tax filings, so awareness is crucial.

-

Consider any commitments that might arise from providing a financial gift.

What are best practices for document management?

-

Implement best practices for storing important documents securely and accessibly.

-

Keep a log of all donor-recipient interactions for clarity.

-

Stay updated on financial regulations to ensure adherence.

Frequently Asked Questions about mortgage gift letter template form

What is an Emerson Financial Gift Letter?

An Emerson Financial Gift Letter is a document used to confirm financial assistance provided as a gift, particularly for home purchasing, ensuring clarity that it doesn't need to be repaid.

How do you ensure the gift letter is valid?

To guarantee validity, the letter should include all necessary details such as the gift amount, date, relationship between the parties, and appropriate signatures.

What if I make a mistake on the gift letter?

If an error occurs, it's important to correct it promptly — verify all information and ensure that the correct details are captured to avoid complications.

Are there tax implications for the donor?

Yes, the donor may need to report the gift depending on the amount, as the IRS has specific guidelines for monetary gifts.

Can a gift letter affect my financial aid?

Yes, a financial gift may impact the recipient's eligibility for financial aid, so it's crucial to understand how it might influence their financial profile.

pdfFiller scores top ratings on review platforms