FSAFEDS Health Care Claim Form free printable template

Show details

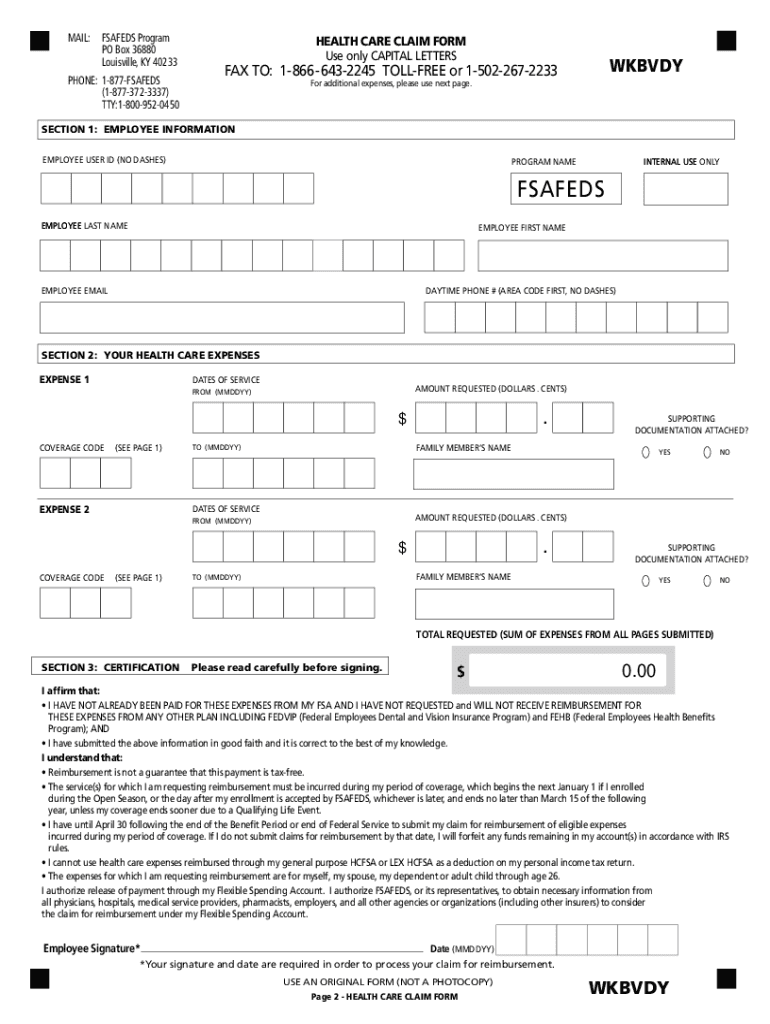

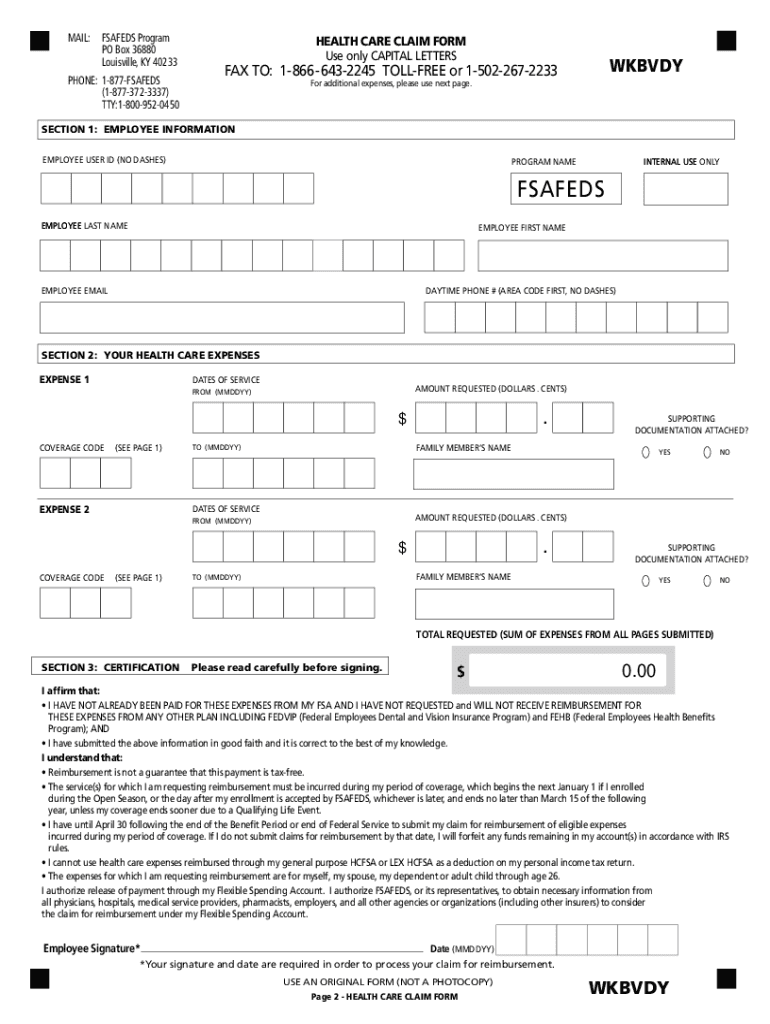

Eep a copy of your completed form and receipts for your records. K Please remember that FSAFEDS has a minimum reimbursement threshold of 25. 00. If your claim does not total 25. 00 it will be processed and you will receive a reimbursement statement but your payment will be pended until you submit another claim and reach the 25. FSAFEDS.com or contact an FSAFEDS Benefits Counselor at 1-877-FSAFEDS. Page 1 - HEALTH CARE CLAIM FORM MAIL FSAFEDS Program PO Box 36880 Louisville KY 40233 PHONE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fsafeds claim form

Edit your fsafeds health form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fsafeds claim form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fsafeds claim form flexible spending account online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fsafeds form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fsafeds claim form federal employees

How to fill out FSAFEDS Health Care Claim Form

01

Obtain the FSAFEDS Health Care Claim Form from the FSAFEDS website or your HR department.

02

Fill out the section for your personal information including your name, address, and email.

03

Provide your FSAFEDS account number if applicable.

04

List the medical expenses on the form, including the date of service, provider name, type of service, and the amount charged.

05

Attach itemized receipts or Explanation of Benefits (EOB) statements as proof of the expenses.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form along with attachments either via mail or electronically as instructed.

Who needs FSAFEDS Health Care Claim Form?

01

Employees participating in an FSAFEDS health care flexible spending account plan.

02

Individuals who have incurred out-of-pocket medical expenses that can be reimbursed through FSAFEDS.

03

Dependents of employees eligible for reimbursement for qualifying medical expenses.

Fill

fsafeds health online

: Try Risk Free

People Also Ask about fsafeds form pdf

Do you need to submit receipts for FSA?

Did You Know? For an FSA/HRA, you will usually not need to submit a receipt to verify the eligibility of a purchase made at an IIAS merchant, but save your receipt just in case. For an HSA, you should always save your receipts in case you are ever subject to an IRS audit.

What documentation is needed for FSA reimbursement?

Required Documentation: Itemized statement from the provider with a clear description of service provided, name of the patient, date of service, the amount paid for service, and name of the provider. A signed statement indicating there is no insurance coverage for the service provided.

What is the maximum contribution for FSAFEDS for 2023?

For the 2023 benefit period, you can contribute up to a maximum of $3,050 - an increase of $200 from the 2022 benefit period. You may also carry over unused funds up to a maximum of $610 - an increase of $40 from the 2022 benefit period as long as you re-enroll.

How do I submit a FSA claim?

Submit Your Claim in One of These Ways Log in to your account. Once you have logged into your account, click Submit Receipt or Claim and select your Reimbursement Option. Follow the step-by-step instructions. Upload digital copies of your itemized receipts (and other documentation if needed).

What is FSA form?

An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Allowed expenses include insurance copayments and deductibles, qualified prescription drugs, insulin, and medical devices.

How do I reimburse FSA items?

Flexible Spending Accounts will reimburse you for incurred expenses during your FSA plan year (period of coverage).You'll have to typically submit a reimbursement claims form with: your personal details, product/service details(provider information) amount owed. date of service provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fsafeds claim online?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific care claim form and other forms. Find the template you need and change it using powerful tools.

How can I fill out fsafeds health care claim form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your fsafeds medical reimbursement claim form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit fsafeds health hklumd on an Android device?

With the pdfFiller Android app, you can edit, sign, and share fsafeds claim printable on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is FSAFEDS Health Care Claim Form?

The FSAFEDS Health Care Claim Form is a document used by participants in the FSAFEDS program to request reimbursement for eligible health care expenses incurred.

Who is required to file FSAFEDS Health Care Claim Form?

Participants in the FSAFEDS program who wish to be reimbursed for eligible health care expenses must file the FSAFEDS Health Care Claim Form.

How to fill out FSAFEDS Health Care Claim Form?

To fill out the FSAFEDS Health Care Claim Form, participants should provide their personal information, details of the health care service received, the amount being claimed, and attach any required documentation such as receipts or invoices.

What is the purpose of FSAFEDS Health Care Claim Form?

The purpose of the FSAFEDS Health Care Claim Form is to facilitate the reimbursement process for eligible health care expenses for participants in the FSAFEDS program.

What information must be reported on FSAFEDS Health Care Claim Form?

The information that must be reported on the FSAFEDS Health Care Claim Form includes the participant's name, address, Social Security number, the date of service, provider name, type of service, amount paid, and any supporting documentation.

Fill out your fsafeds form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fsafeds Health Claim Form is not the form you're looking for?Search for another form here.

Keywords relevant to fsafeds claim fillable

Related to fsafeds claim form fill in

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.