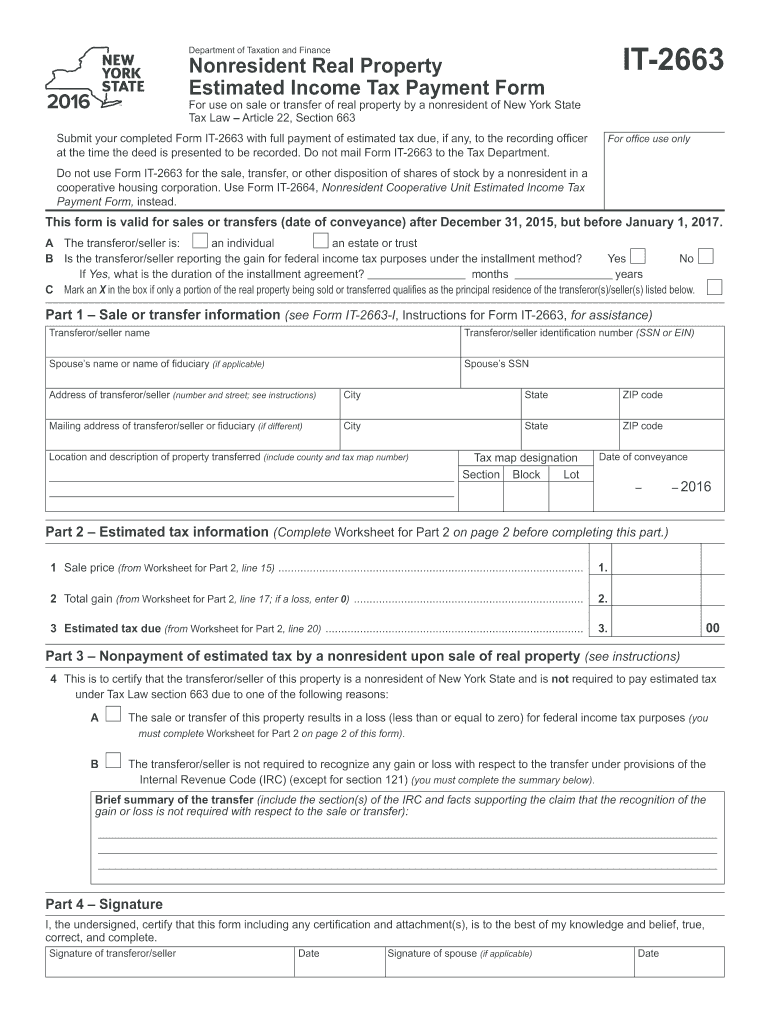

Who needs an IT-2663 form?

This Nonresident Real Property Estimated Income Tax Payment form is used by nonresidents in the state of New York in case of sale or transfer of real property. It’s completed by the seller/property rights transferor. The seller/transferor can be an individual, estate or trust.

What is the purpose of the IT-2663 form?

This Income Tax Payment form is used to compute the gain (or loss) and pay the required amount of taxes when selling or transferring real estate property in the state of New York. This form is submitted with full payment of the required tax sum. It is also used when preparing an individual tax return form.

What other documents and forms must accompany the IT-2663 form?

The Estimated Income Tax Payment form is accompanied by form IT-2663-V, Tax Payment Voucher. If the transferor has the right to tax exemption, he must file the corresponding Tax Exempt Form, for example, the TP-584 form.

When is the IT-2663 form due?

This form must be submitted at the time the deed is presented to the recording officer. The form is valid only for those sales and transfers made after the 31st of December 2015 and before the 1st of January 2017.

What information must be provided in the IT-2663 form?

The seller/transferor has to indicate the following:

- Type of business entity (individual, estate or trust)

- Information about the sale or transfer including the name of the seller, his SSN or EIN, his spouse’s name and SSN, address, location and description of the property, and the date of conveyance)

- Estimated tax information (sale price, total gain, estimated tax due)

- Details of nonpayment of estimated tax by a nonresident (check the appropriate box)

The seller should use the worksheets on the second page of the form to calculate the amount of taxes.

These documents must be signed and dated by the seller and his spouse as well.

The IT-2663-V form asks for the ID number of the seller (SSN or EIN), full name, spouse’s name and address. The ending of the fiscal year, date of conveyance and the total payment must also be indicated.

Where do I send the completed IT-2663 form?

This form is submitted to the officer who records the property transfer deed.