SSA-1699 2013 free printable template

Show details

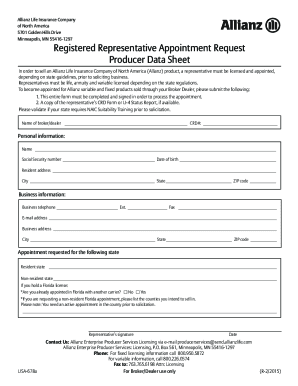

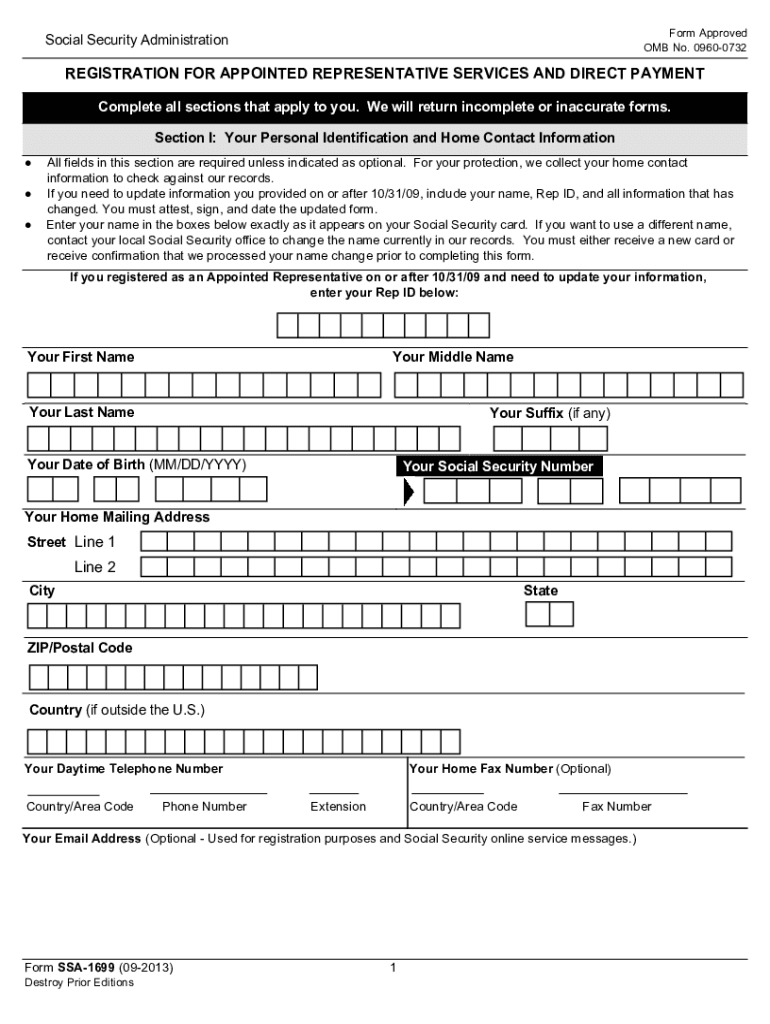

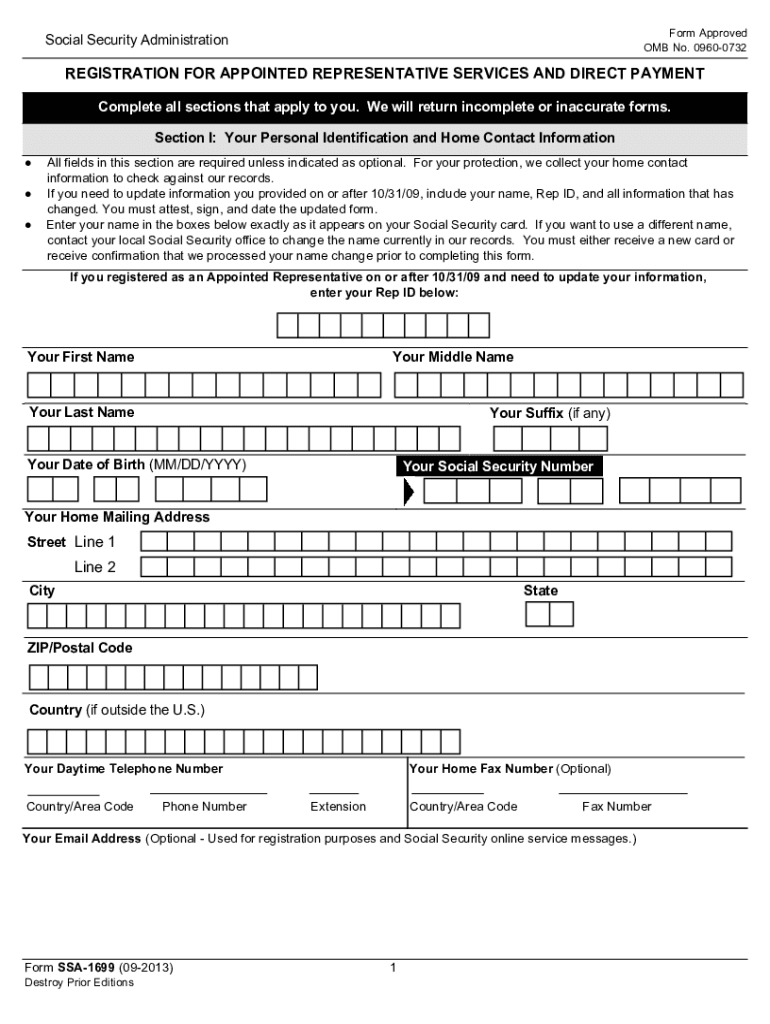

General Information and Instructions Form SSA-1699 at a time. You will receive a notice containing your Representative Identification Rep ID once your initial registration is complete. Socialsecurity. gov/ar. If you are hearing impaired call our TTY number at 1-800-325-0778. You may also visit your local Social Security office. Explanation of Terms for Completing This Form Representative an attorney or individual other than an attorney who meets all of our requirements and is appointed to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-1699

Edit your SSA-1699 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-1699 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-1699 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SSA-1699. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-1699 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-1699

How to fill out SSA-1699

01

Obtain the SSA-1699 form from the Social Security Administration website or local office.

02

Complete the identifying information section, including your name, Social Security number, and contact details.

03

Provide your current employment information, including your job title and employer's details.

04

Fill out the section regarding your professional qualifications and education.

05

List any relevant licenses or certifications you hold.

06

Review your information for accuracy before signing and dating the form.

07

Submit the completed form to the SSA via mail or in person.

Who needs SSA-1699?

01

Individuals who wish to become a representative payee for someone receiving Social Security benefits.

02

Professionals who need to establish their qualifications for work with the Social Security Administration.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax table for income?

Tax tables are a tool the IRS provides to make it easy to calculate the exact amount of taxes to report on your federal income tax return when filing by hand. States with state income tax returns also provide tax tables to aid in this portion of the tax preparation process.

Does everyone file a Schedule 1?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

How do I determine my tax level?

You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable bracket. Every bracket has its own tax rate. The bracket you're in depends on your filing status: if you're a single filer, married filing jointly, married filing separately or head of household.

What is a Schedule 1 for taxes?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

What is a tax table and how does it work?

A tax table is a chart that displays the amount of tax due based on income received. The IRS provides tax tables to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. Tax tables are divided by income ranges and filing status.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • 4 days ago

How do I find my tax table?

You can find the latest tax table which you'll use in 2023 to file 2022 taxes on the IRS' website, specifically its publication named Tax Year 2022—1040 and 1040-SR Tax and Earned Income Credit Tables.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)10%Up to $10,275Up to $20,55012%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,1003 more rows • Nov 28, 2022

How does the Schedule B work?

The Schedule B code is a U.S.-specific coding system administered by the Foreign Trade Division of the U.S. Census Bureau to track the amount of trade goods that are being exported from the U.S. The Census Bureau tracks the destination country, quantity and dollar amount of exports.

What will the standard deduction be for 2022?

This article has been updated for the 2022 tax year. The standard deduction is a specific dollar amount that reduces your taxable income. For the 2022 tax year, the standard deduction is $25,900 for joint filers, $19,400 for heads of household, and $12,950 for single filers and those married filing separately.

What are the income tax brackets for 2022 vs 2021?

When it comes to federal income tax rates and brackets, the tax rates themselves didn't change from 2021 to 2022. There are still seven tax rates in effect for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation.

How do you calculate taxable income on 2022?

Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

What is a Schedule B Code?

The Schedule B is a 10 digit international export code for exporting goods out of the United States (U.S). The Schedule B which is administered by the United States Census Bureau is used to track the amount of trade goods that are being exported from the U.S.

What is a schedule 1?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

What is a schedule B?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is a Schedule 1 Canada?

Schedule 1 is used to calculate your net federal tax payable (the amount you owe to the federal government) on your taxable income.

Is a Schedule B always required?

It is only required when the total exceeds certain thresholds. In 2022 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute SSA-1699 online?

pdfFiller makes it easy to finish and sign SSA-1699 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the SSA-1699 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your SSA-1699 in seconds.

Can I create an eSignature for the SSA-1699 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your SSA-1699 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is SSA-1699?

SSA-1699 is a form that is used by healthcare providers to establish a secure relationship with the Social Security Administration (SSA) for submitting Medicare claims and obtaining information.

Who is required to file SSA-1699?

Healthcare providers and organizations that wish to submit claims to the SSA or require access to information related to Medicare must file Form SSA-1699.

How to fill out SSA-1699?

To fill out SSA-1699, providers must provide identifying information such as their name, address, and National Provider Identifier (NPI), as well as information about their organization if applicable.

What is the purpose of SSA-1699?

The purpose of SSA-1699 is to facilitate the collection of information for healthcare providers to ensure they can efficiently submit claims and access patient information relevant to Medicare services.

What information must be reported on SSA-1699?

SSA-1699 requires reporting of personal information including the provider's name, address, and NPI, as well as information about the practice or organization and the types of services provided.

Fill out your SSA-1699 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-1699 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.