Fidelity Transfer of Assets 2014 free printable template

Show details

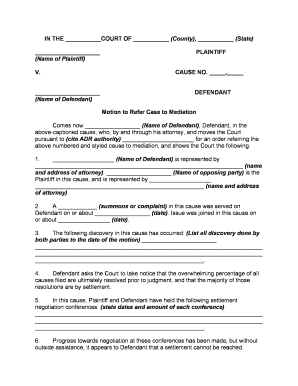

Ccept that Fidelity is not responsible for changes in the value of assets that may occur during the transfer process. Questions Go to Fidelity. com/toa or call 1-800-396-8982. Transfer of Assets Instructions Use this form to move some or all assets from another firm to Fidelity. 4. Transfer the following number of whole shares of Shares Cash Amount Required Approximate Cash Amount Optional All owners of both accounts must sign this form. By signing below you irect Fidelity and the delivering...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fidelity transfer of assets form

Edit your fidelity transfer of assets form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity forms transfer of assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity toa pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity transfer form pdf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Transfer of Assets Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fidelity transfer of assets pdf form

How to fill out fidelity transfer of assets:

01

Start by obtaining the fidelity transfer of assets form from your financial institution or investment firm. This form is typically provided by the custodian or trustee of your account.

02

Fill in your personal information accurately. This includes your full name, address, social security number, and contact details. Make sure to double-check the accuracy of the information provided.

03

Provide the details of the account or accounts from which you wish to transfer the assets. This may include the account numbers, types of accounts (such as individual retirement accounts or brokerage accounts), and the names of the financial institutions or firms holding these accounts.

04

Indicate where you want the assets to be transferred. This may include the name of the receiving financial institution or firm, the respective account numbers, and any specific instructions or restrictions.

05

Specify the types of assets you want to transfer. This may include stocks, bonds, mutual funds, cash balances, or other investment products. It is important to be specific and provide all relevant details for each asset, including the number or quantity of shares or units.

06

Determine how you want the assets to be transferred. This may include transferring the individual securities or funds as they are, liquidating them and transferring the cash proceeds, or a combination of both. Be sure to clearly specify your preferences.

Who needs fidelity transfer of assets:

01

Individuals who are changing investment firms or financial institutions may need to initiate a fidelity transfer of assets. This is commonly done when individuals want to consolidate their investments or take advantage of different services or offerings.

02

Business entities or organizations that are restructuring their investment portfolios, merging with other entities, or changing custodians may also require fidelity transfer of assets.

03

Investors who are moving or relocating to a different country may need to complete a fidelity transfer of assets to ensure their investments are properly managed and accessible in the new jurisdiction.

In summary, anyone looking to transfer their assets from one financial institution or investment firm to another may need to fill out a fidelity transfer of assets. It is important to accurately complete the form and provide all necessary information for a smooth and successful transfer.

Fill

fidelity hsa transfer form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fidelity toa form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including transfer of assets fidelity pdf. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find Fidelity Transfer of Assets?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Fidelity Transfer of Assets in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out Fidelity Transfer of Assets on an Android device?

On Android, use the pdfFiller mobile app to finish your Fidelity Transfer of Assets. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Fidelity Transfer of Assets?

Fidelity Transfer of Assets refers to the process by which financial assets are moved from one financial institution to another, typically involving a change in account holders or the transfer of investment accounts managed by Fidelity.

Who is required to file Fidelity Transfer of Assets?

Individuals or entities that wish to transfer assets held at Fidelity to another financial institution or account are required to file Fidelity Transfer of Assets.

How to fill out Fidelity Transfer of Assets?

To fill out the Fidelity Transfer of Assets form, provide your personal information, the details of the accounts involved (both the sending and receiving accounts), specify the assets to be transferred, and sign the form to authorize the transfer.

What is the purpose of Fidelity Transfer of Assets?

The purpose of Fidelity Transfer of Assets is to facilitate the efficient and secure movement of financial assets between accounts or institutions while ensuring accurate record-keeping and compliance with regulatory requirements.

What information must be reported on Fidelity Transfer of Assets?

The information that must be reported includes the account holder's name, address, Social Security number or tax identification number, details of both the originating and receiving accounts, the type and value of assets being transferred, and any necessary signatures.

Fill out your Fidelity Transfer of Assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Transfer Of Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.