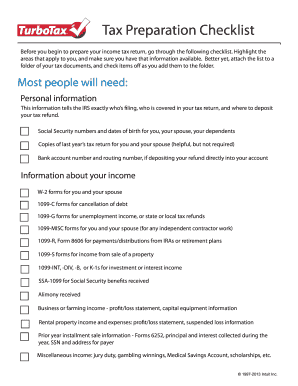

Haller Group AZ Tax Deduction Worksheet free printable template

Show details

Tax Deduction Worksheet For Realtors Auto Travel Telephone Expenses Client Meetings (me) Cellular, Telephone & Related Service Fees

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax deduction worksheet realtors form

Edit your tax worksheet realtors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deduction worksheet realtors form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deduction worksheet realtors form online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deduction worksheet realtors form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deduction worksheet realtors form

How to fill out Haller Group AZ Tax Deduction Worksheet For Realtors

01

Gather all relevant financial documents, including income statements, receipts for expenses, and any prior tax returns.

02

Download or obtain a copy of the Haller Group AZ Tax Deduction Worksheet for Realtors.

03

Start with your personal information at the top of the worksheet, including your name, address, and tax identification number.

04

Fill in the income section, detailing all sources of income from your real estate activities.

05

List your deductible expenses in the appropriate categories, such as advertising, office supplies, vehicle expenses, and professional fees.

06

Calculate totals for your income and expenses, ensuring that all entries are accurate and supported by documentation.

07

Review the worksheet for completeness and accuracy, then sign and date it where required.

08

Keep a copy for your records and submit it along with your tax return to ensure you receive the maximum deductions available.

Who needs Haller Group AZ Tax Deduction Worksheet For Realtors?

01

Realtors operating in Arizona who want to maximize their tax deductions.

02

Real estate professionals seeking to understand and document their business expenses.

03

Individuals preparing to file their taxes and needing to organize their financial information related to real estate.

Fill

form

: Try Risk Free

People Also Ask about

What can I write off as a realtor in Canada?

These may include the following: Professional membership fees or dues, like CREA (Canadian Real Estate Association), OREA (Ontario Real Estate Association), TREB (Toronto Real Estate Board) dues. Desk fees. License renewal fees. Commission paid to third parties. Listing fees. MLS fees.

What deductions can be taken on estate tax return?

What deductions are available to reduce the Estate Tax? Charitable Deduction: If the decedent leaves property to a qualifying charity, it is deductible from the gross estate. Mortgages and Debt. Administration expenses of the estate. Losses during estate administration.

What home improvements are tax deductible 2023?

What Home Improvements Are Tax Deductible in 2023? The Residential Clean Energy Credit: Claim up to 30% of the purchase price for environmentally friendly appliances and home fixtures. The Energy Efficient Home Improvement Credit: Claim up to 30% of the price of certain energy-conserving upgrades.

What is the standard deduction for real estate?

The standard deduction is set at these figures for the 2022 tax year: $12,950 for single taxpayers and married taxpayers filing separate returns. $25,900 for married taxpayers filing jointly and qualifying widow(ers) $19,400 for those who qualify to file as head of household3.

What are the IRS rules for real estate tax deductions?

Are property taxes deductible? Generally, yes. The SALT deduction allows you to deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales taxes.

What are the IRS limits on property tax deductions?

As of 2021, California property owners may deduct up to $10,000 of their property taxes from their federal income tax if they are filing as single or married filing jointly. Unfortunately, any property taxes you have paid in excess of $10,000 cannot be counted toward your deduction.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my deduction worksheet realtors form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign deduction worksheet realtors form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit deduction worksheet realtors form in Chrome?

deduction worksheet realtors form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit deduction worksheet realtors form on an Android device?

You can make any changes to PDF files, such as deduction worksheet realtors form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Haller Group AZ Tax Deduction Worksheet For Realtors?

The Haller Group AZ Tax Deduction Worksheet for Realtors is a document designed to help real estate professionals in Arizona track and calculate their deductible business expenses for tax purposes.

Who is required to file Haller Group AZ Tax Deduction Worksheet For Realtors?

Realtors and real estate agents operating in Arizona who wish to claim business deductions on their tax returns are required to file the Haller Group AZ Tax Deduction Worksheet.

How to fill out Haller Group AZ Tax Deduction Worksheet For Realtors?

To fill out the Haller Group AZ Tax Deduction Worksheet, individuals should gather relevant financial documents, categorize their expenses, and input the amounts into the designated fields of the worksheet.

What is the purpose of Haller Group AZ Tax Deduction Worksheet For Realtors?

The purpose of the Haller Group AZ Tax Deduction Worksheet is to organize and simplify the process of identifying deductible expenses, ensuring Realtors maximize their tax deductions and comply with tax regulations.

What information must be reported on Haller Group AZ Tax Deduction Worksheet For Realtors?

The Haller Group AZ Tax Deduction Worksheet requires reporting of various types of expenses including, but not limited to, office supplies, marketing costs, travel expenses, and professional fees related to real estate activities.

Fill out your deduction worksheet realtors form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduction Worksheet Realtors Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.