Get the free Application for Commercial Credit - bausreobbcombau

Show details

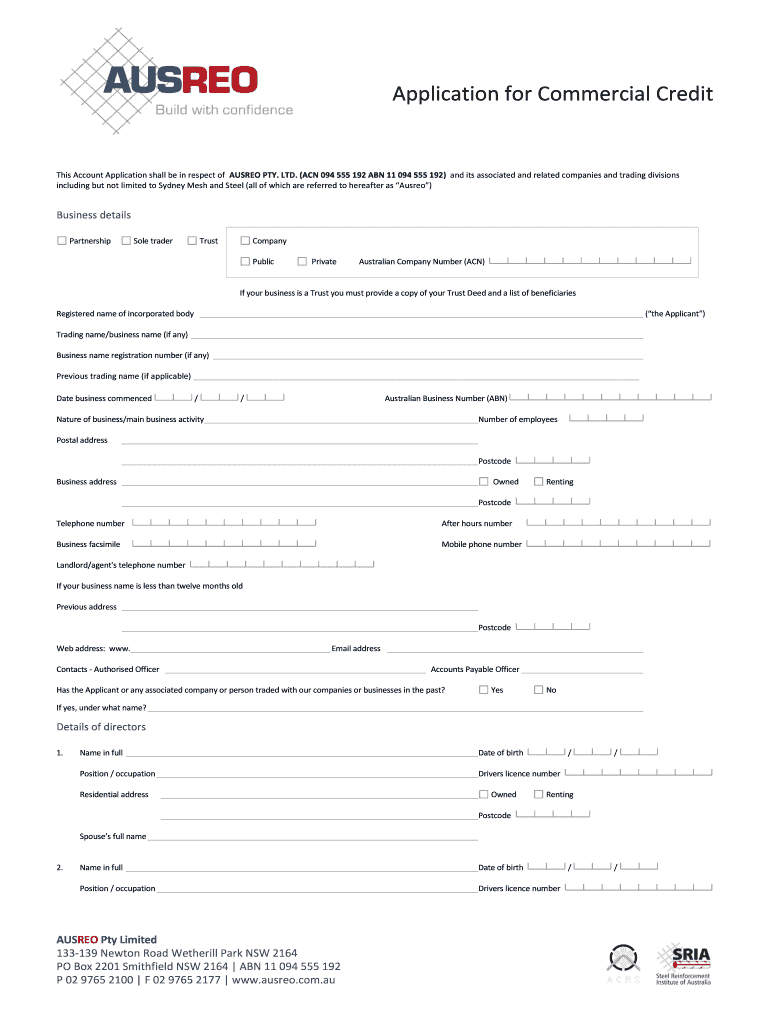

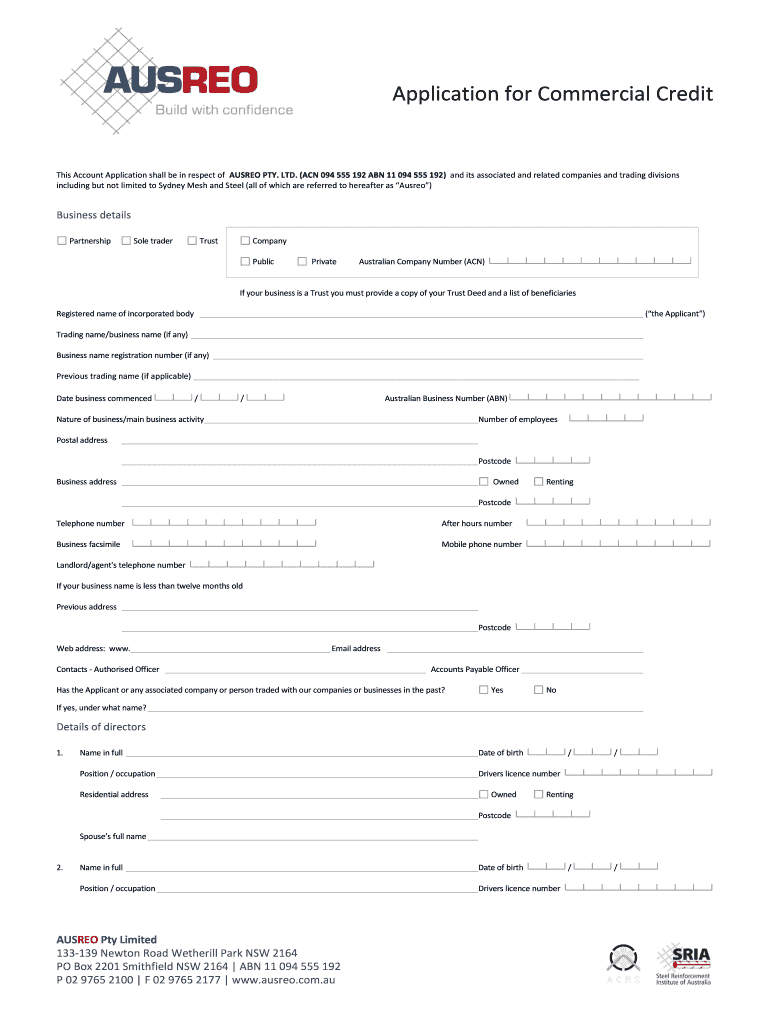

Application for Commercial Credit This Account Application shall be in respect of AUBREY PTY. LTD. (ACN 094 555 192 ABN 11 094 555 192) and its associated and related companies and trading divisions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for commercial credit

Edit your application for commercial credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for commercial credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for commercial credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for commercial credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for commercial credit

How to fill out an application for commercial credit:

01

Start by gathering all the necessary information and documentation required for the application process. This may include your company's financial statements, tax returns, bank statements, and any other relevant financial documents.

02

Research different banks and financial institutions that offer commercial credit and choose the one that best suits your needs and requirements. Make sure to consider factors such as interest rates, loan terms, and repayment options.

03

Visit the bank's website or contact them directly to obtain the commercial credit application form. Alternatively, you may be able to fill out the application online through their website.

04

Fill out the application form accurately and completely. Provide all the requested information, including your personal details, business information, and financial information. Be honest and transparent in your responses.

05

Attach any required supporting documents to your application. This may include your business plan, financial statements, balance sheets, and any other documents that may strengthen your application and provide evidence of your company's financial stability.

06

Double-check all the information provided on the application form and supporting documents to ensure accuracy. Any errors or inconsistencies may delay the processing of your application.

07

Submit your completed application and supporting documents to the bank. You may be required to do this in person at a branch office or through an online submission portal.

08

Wait for the bank to review and process your application. This may take some time, depending on the bank's internal processes and the complexity of your application.

09

If necessary, be prepared to provide additional information or clarification requested by the bank. This may involve answering questions about your business or providing updated financial statements.

10

Once your application is approved, carefully review the terms and conditions of the commercial credit agreement provided by the bank. Make sure you understand all the terms, interest rates, payment schedules, and any other relevant details.

11

Sign the commercial credit agreement and return it to the bank. Make sure to keep a copy for your records.

12

Start utilizing the commercial credit as agreed upon with the bank. Ensure you make timely payments and fulfill all the obligations outlined in the credit agreement to maintain a good credit history.

Who needs an application for commercial credit?

01

Small businesses looking to expand their operations or invest in new equipment may need to apply for commercial credit to secure funding for their growth plans.

02

Startups or entrepreneurs who need capital to launch their business or support their initial operations may require commercial credit.

03

Established companies experiencing cash flow challenges or needing additional working capital may turn to commercial credit as a short-term financing solution.

04

Businesses aiming to finance large purchases, such as real estate properties or vehicles, often apply for commercial credit to make these acquisitions possible.

05

Companies that want to establish a credit history or improve their credit score may utilize commercial credit to demonstrate their ability to manage debt responsibly.

06

Businesses that are looking to take advantage of opportunities for expansion, such as entering new markets or acquiring competitors, may seek commercial credit to finance these ventures.

07

Industries that rely on seasonal or cyclical revenue fluctuations, such as tourism or retail, may need commercial credit to bridge gaps in cash flow during slower periods.

08

Companies aiming to consolidate debt or refinance existing loans may utilize commercial credit as a means to streamline their financial obligations and potentially reduce interest rates.

09

Organizations that want to invest in research and development or implement technological advancements may require commercial credit to fund these innovation initiatives.

10

Any business or enterprise that requires capital or financial assistance for various purposes might find it necessary to apply for commercial credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for commercial credit straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit application for commercial credit.

How do I complete application for commercial credit on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your application for commercial credit, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit application for commercial credit on an Android device?

You can edit, sign, and distribute application for commercial credit on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is application for commercial credit?

An application for commercial credit is a document that a business fills out when applying for credit from a financial institution or vendor.

Who is required to file application for commercial credit?

Businesses or organizations that wish to obtain credit from a financial institution or vendor are required to file an application for commercial credit.

How to fill out application for commercial credit?

To fill out an application for commercial credit, the business must provide information such as their business name, address, financial details, and credit history.

What is the purpose of application for commercial credit?

The purpose of the application for commercial credit is for the financial institution or vendor to assess the creditworthiness of the business and determine if they are eligible for credit.

What information must be reported on application for commercial credit?

Information such as business details, financial statements, credit references, and personal information of the business owners may need to be reported on the application for commercial credit.

Fill out your application for commercial credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Commercial Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.