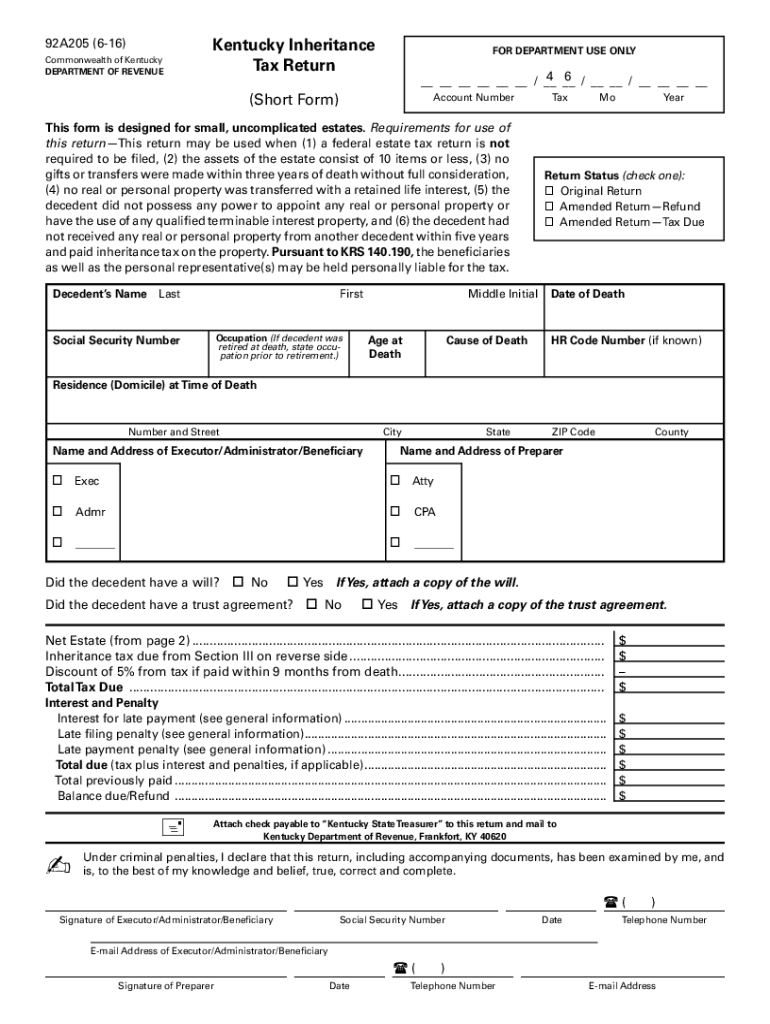

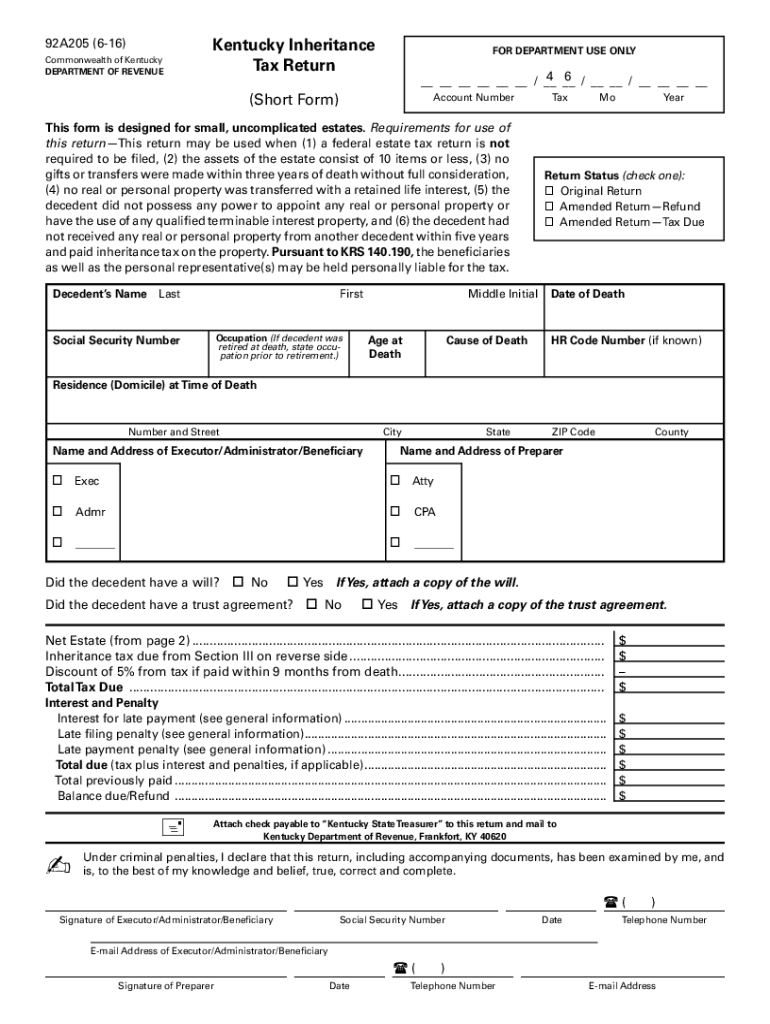

KY DoR 92A205 2016-2024 free printable template

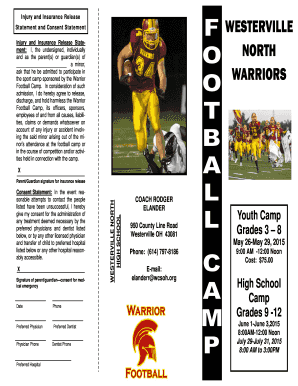

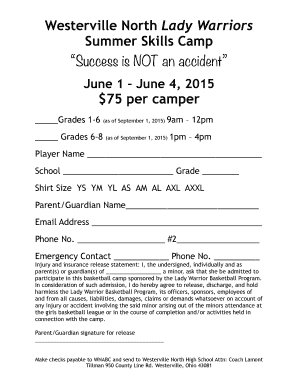

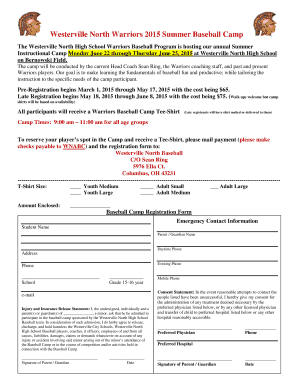

Get, Create, Make and Sign

Editing ky inheritance tax online

KY DoR 92A205 Form Versions

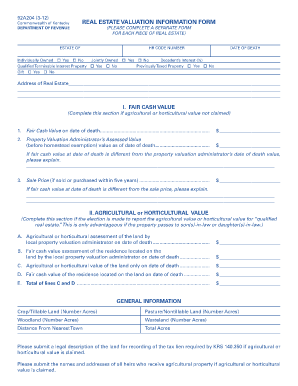

How to fill out ky inheritance tax 2016-2024

How to fill out KY Kentucky:

Who needs KY Kentucky:

Video instructions and help with filling out and completing ky inheritance tax

Instructions and Help about ky inheritance tax return form

In this video we're going to talk about the inheritance tax now like the estate tax which we talked about before the inheritance tax is often known informally as the death tax because it's a tax that kicks in when a person dies and has to do with their assets so but if there's a subtle distinction between the inheritance tax in the estate tax, so they're different, and I want to talk about that here, so the estate tax is based on inherited property and that is not imposed on the estate itself now that might seem weird to you, and you might think hey I don't even really understand what you're talking about well think about it this way right so when the person dies, so they're going to have their assets are going to go into in a state right that's just what we call the collection of their assets after a person dies their assets go into this pool which we call the estate then we have some deductions you pay their bills and so forth some other things and then the estate may or may not be taxed at the federal level right, so there's a federal estate tax now the heirs right they don't incur any federal tax and by heirs I'm just talking about the people who inherit the estate after these federal taxes have been paid right so when the heirs get that whatever it is they got a car or cash or anything they may also incur a tax themselves right and this is different this is at the state level right and that's what we call the inheritance tax right, so we've got the inheritance tax and not all states have an inheritance tax it's just good do something to be aware of right so in then of course over here they have the estate tax all right, so these are two different types of taxes, and again it might be that you're a state you incur federal tax on it, but it might be that your state doesn't have any kind of inheritance tax and so you don't even have to worry about this but just know that the estate tax is opposed on the estate and the state would have to pay out those taxes and so forth but then once the heirs get the property right whatever it is that's been inherited that's going to be what's covered by this inheritance now this will be calculated differently depending on what state we're talking about and again most states don't even have an inheritance tax but those that do it'll be different depends on where you live but another thing that is important is kind of your relationship to the person who died right so this relationship to the deceased person that may affect also assuming that your state has an inheritance tax the relationship to the person that the heir had will actually affect maybe the inheritance tax to for example somebody like a surviving spouse might be exempted right so if your state has an inheritance tax if the air is the spouse is still alive they got all the property then in that case a lot of the time there's some kind of exemption and so then they don't even have the inheritance tax, so it does matter what your what the...

Fill kentucky inheritance return : Try Risk Free

People Also Ask about ky inheritance tax

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ky inheritance tax 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.