Get the free Business Filers Income Tax Payment Voucher

Show details

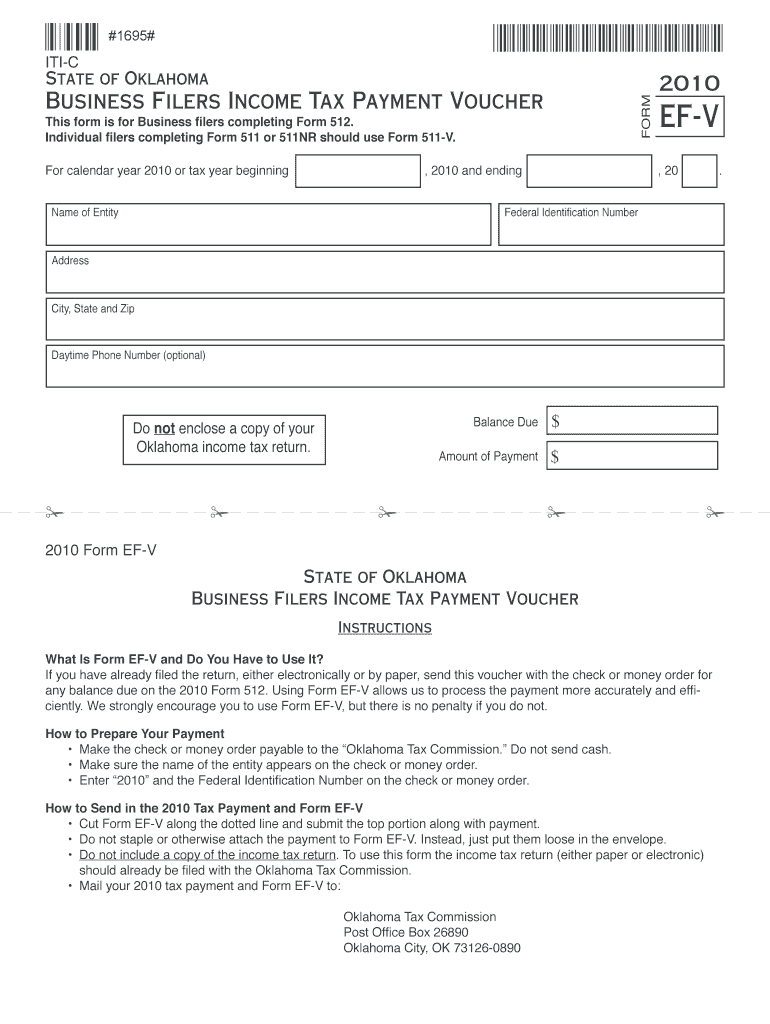

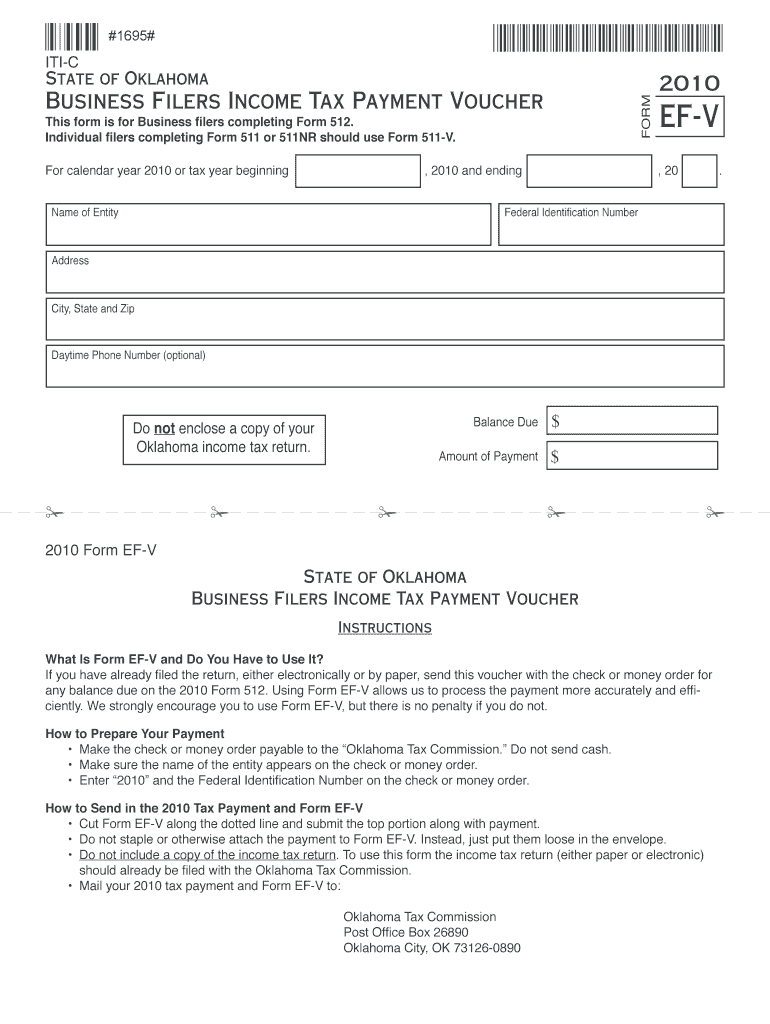

This voucher is used by business filers to submit payment for any balance due on their income tax return (Form 512). It assists in ensuring accurate and efficient processing of tax payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business filers income tax

Edit your business filers income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business filers income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business filers income tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business filers income tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business filers income tax

How to fill out Business Filers Income Tax Payment Voucher

01

Obtain the Business Filers Income Tax Payment Voucher form from your local tax authority or download it from their website.

02

Fill in the business name at the top of the form.

03

Enter the business address, including street, city, state, and zip code.

04

Provide the business's Tax Identification Number (TIN) or Employer Identification Number (EIN).

05

Specify the tax period for which you are making the payment.

06

Indicate the total amount of tax due for that period.

07

Include any payments already made or credits applicable to reduce the amount due.

08

Calculate the total amount to be paid and write it in the designated field.

09

Sign and date the form where indicated.

10

Submit the payment voucher along with the payment either by mail or electronically as specified by your tax authority.

Who needs Business Filers Income Tax Payment Voucher?

01

Businesses that are required to pay income tax based on their earnings.

02

Corporations that must report their income and remit payments to the state or federal tax authorities.

03

Partnerships and limited liability companies (LLCs) that elect to be taxed as corporations.

04

Any business entity obligated to pay estimated taxes, including sole proprietorships in certain cases.

Fill

form

: Try Risk Free

People Also Ask about

What is a payment voucher for income tax returns?

It's a statement you send with your check or money order for any balance due on the “Amount you owe” line of your 2024 Form 1040, 1040-SR, or 1040-NR. Consider Making Your Tax Payment. Electronically—It's Easy. You can make electronic payments online, by phone, or from a mobile device.

Why do I have a 1040 ES payment voucher?

Why did I get 1040 ES ? TurboTax will automatically include four quarterly 1040-ES vouchers with your printout if you didn't withhold or pay enough tax this year. You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year.

Are business income tax payments deductible?

If you're self-employed or own a small business, you get a perk from the federal tax code that many individual taxpayers do not: you get to write off part of the taxes you pay each year as a deductible expense. Granted, that provision doesn't extend to your state or local income taxes.

Why do I have a 1040-V payment voucher?

If you owe the IRS money, the last thing you want is for your payment to get lost or misapplied. That's where Form 1040-V comes in – a simple but important payment voucher that helps ensure your check or money order is correctly processed.

What is an income tax payment voucher?

Key Takeaways. Form 1040-V is a payment voucher used to pay a balance owed to the IRS for various tax forms. Personal information, including the SSN, owed amount, name, and address, needs to be included on the form, and it should not be stapled to a payment check or money order.

How do I get an IRS payment voucher?

How do I get an IRS payment voucher? Form 1040-V can be downloaded from the IRS website or requested by calling the IRS at 1-800-829-1040 for a payment voucher.

What is a payment voucher?

How do I get an IRS payment voucher? Form 1040-V can be downloaded from the IRS website or requested by calling the IRS at 1-800-829-1040 for a payment voucher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Filers Income Tax Payment Voucher?

The Business Filers Income Tax Payment Voucher is a form used by businesses to submit income tax payments to the tax authorities. It serves as a method for businesses to report their tax liabilities and ensure that their payments are properly credited.

Who is required to file Business Filers Income Tax Payment Voucher?

Businesses that are subject to income tax obligations under the jurisdiction's tax laws are required to file the Business Filers Income Tax Payment Voucher. This includes corporations, partnerships, and sole proprietorships that earn taxable income.

How to fill out Business Filers Income Tax Payment Voucher?

To fill out the Business Filers Income Tax Payment Voucher, a business must enter its name, address, tax identification number, the amount of payment, and the tax period for which the payment is being made. It is important to follow the instructions provided with the voucher to avoid errors.

What is the purpose of Business Filers Income Tax Payment Voucher?

The purpose of the Business Filers Income Tax Payment Voucher is to facilitate the submission of income tax payments by businesses, ensuring that these payments are processed accurately and timely, and to help maintain compliance with tax obligations.

What information must be reported on Business Filers Income Tax Payment Voucher?

The information required on the Business Filers Income Tax Payment Voucher typically includes the business's name, address, tax identification number, payment amount, and the tax period for which the payment applies. Additional details may be needed as specified by the relevant tax authority.

Fill out your business filers income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Filers Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.