KE KRA Swift/RTGS Application Form 2010-2025 free printable template

Show details

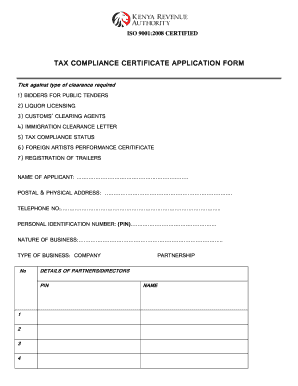

Tellers Stamp Signature KRA SWIFT /RTGS APPLICATION FORM Fill in Duplicate BANK BRANCH DATE dd mm yyyy a Applicants Details Taxpayer Name. PIN Account No* Address P. O. Box. Postal Code Email. Town. Mobile. Office Line. b Payment Details Payment Mode Cash Payment period Tick as appropriate Eslip/Entry No/ F147 Tax Type Tax code Currency Others Specify Income Tax only See overleaf for the tax codes Transfer Amount Figures. Amount Words. c Beneficiary Details For Bank...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to apply for kra tax waiver form

Edit your kra template download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kra format in word form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kra document online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kra form download. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kra format in excel

How to fill out KE KRA Swift/RTGS Application Form

01

Begin by downloading the KE KRA Swift/RTGS Application Form from the official KRA website.

02

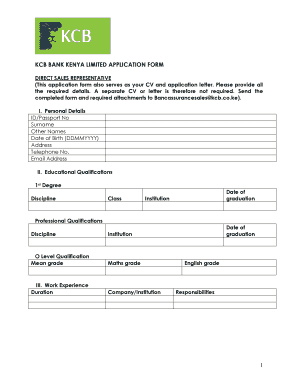

Fill in your personal details, including your full name, ID number, and contact information.

03

Provide the details of the bank account you wish to link, including the bank name, branch, and account number.

04

Specify the type of application you are submitting (Swift or RTGS).

05

Attach any required supporting documents, such as identification and proof of residence.

06

Review the completed form to ensure all information is correct and complete.

07

Submit the form to the nearest KRA office or through the specified online submission method.

Who needs KE KRA Swift/RTGS Application Form?

01

Individuals or businesses who need to make international money transfers.

02

Taxpayers who wish to pay their taxes using the Swift or RTGS method.

03

Banks and financial institutions facilitating such transactions on behalf of their clients.

Video instructions and help with filling out and completing kra forms download

Instructions and Help about kra format pdf

Fill

kra form

: Try Risk Free

People Also Ask about sample kra format in excel

What is KRA form in Word?

The full form of KRA is Key Result Area or Key Responsibility Area.

How do I make a KRA?

This is how you register for your KRA PIN. Visit itax.kra.go.ke. Select "New PIN Registration" Select "Non-Individual" and "Online Form" as your mode of registration. Fill in your basic information. Select suitable tax obligation by checking the relevant boxes. Enter details of company directors or partners.

What is a good KRA?

A good KRA includes the ongoing responsibilities of the position and the purpose and benefits of performing those responsibilities. Tasks and activities that focus on one or more specific areas are grouped together.

How do I write my own KRA?

Here are five steps to creating your own key result areas: Evaluate how you're performing. Discuss your KRAs with your manager. Outline specific tasks for your job. Determine KPIs to measure KRAs. Put your key result areas in writing. Review and revise KRAs regularly.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my kra format in excel download in Gmail?

kra forms and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the kra long form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sample kra format in seconds.

How can I edit kra excel sheet download on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit kra fill form.

What is KE KRA Swift/RTGS Application Form?

The KE KRA Swift/RTGS Application Form is a document used to facilitate the submission of requests for electronic fund transfers through the Kenya Revenue Authority's system, specifically for tax payment purposes.

Who is required to file KE KRA Swift/RTGS Application Form?

Taxpayers and businesses in Kenya who need to make electronic payments to the Kenya Revenue Authority through the SWIFT or RTGS systems are required to file the KE KRA Swift/RTGS Application Form.

How to fill out KE KRA Swift/RTGS Application Form?

To fill out the KE KRA Swift/RTGS Application Form, applicants should provide accurate information including their KRA PIN, payment details, amount to be transferred, and the purpose of the payment, ensuring all fields are completed as instructed.

What is the purpose of KE KRA Swift/RTGS Application Form?

The purpose of the KE KRA Swift/RTGS Application Form is to streamline and facilitate electronic payments to the Kenya Revenue Authority, ensuring timely and accurate processing of tax payments.

What information must be reported on KE KRA Swift/RTGS Application Form?

The KE KRA Swift/RTGS Application Form must report information such as the taxpayer's KRA PIN, payment reference number, payment amount, payment type, and details regarding the purpose of the payment.

Fill out your kra forms download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Kra Format For Employees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.