Get the free Application for Individual Life InsurancePart 2 Medical

Show details

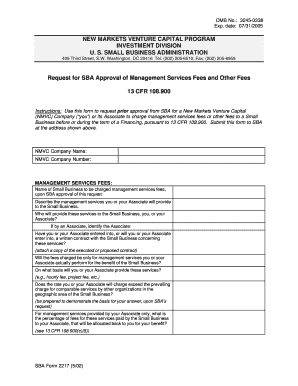

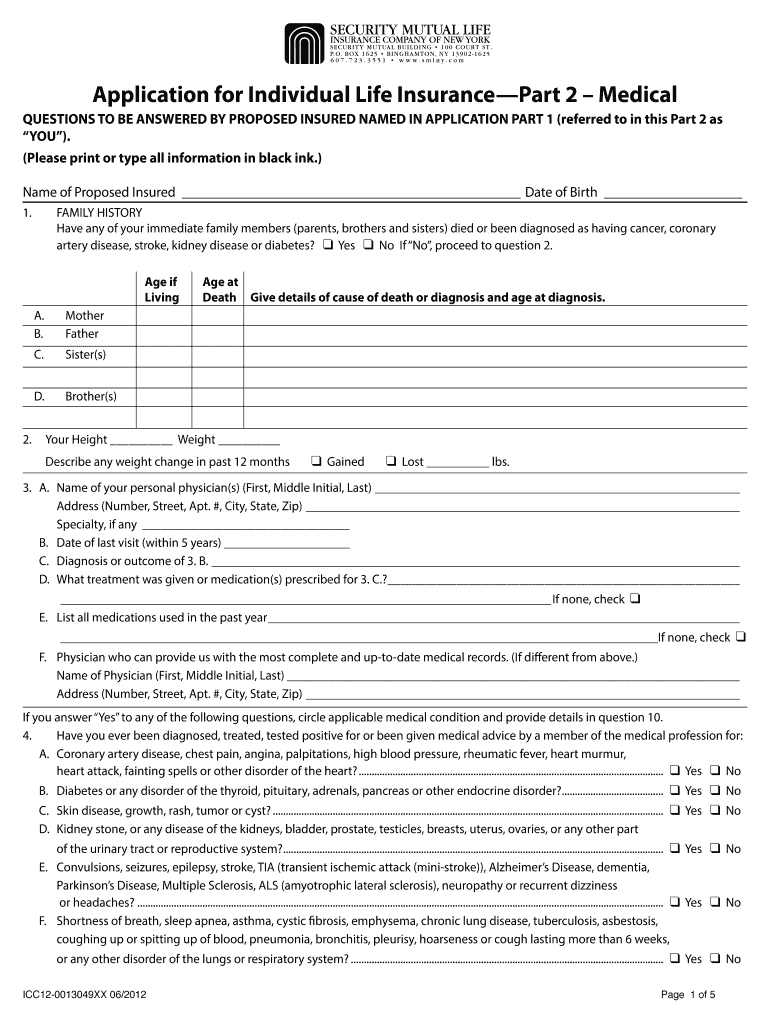

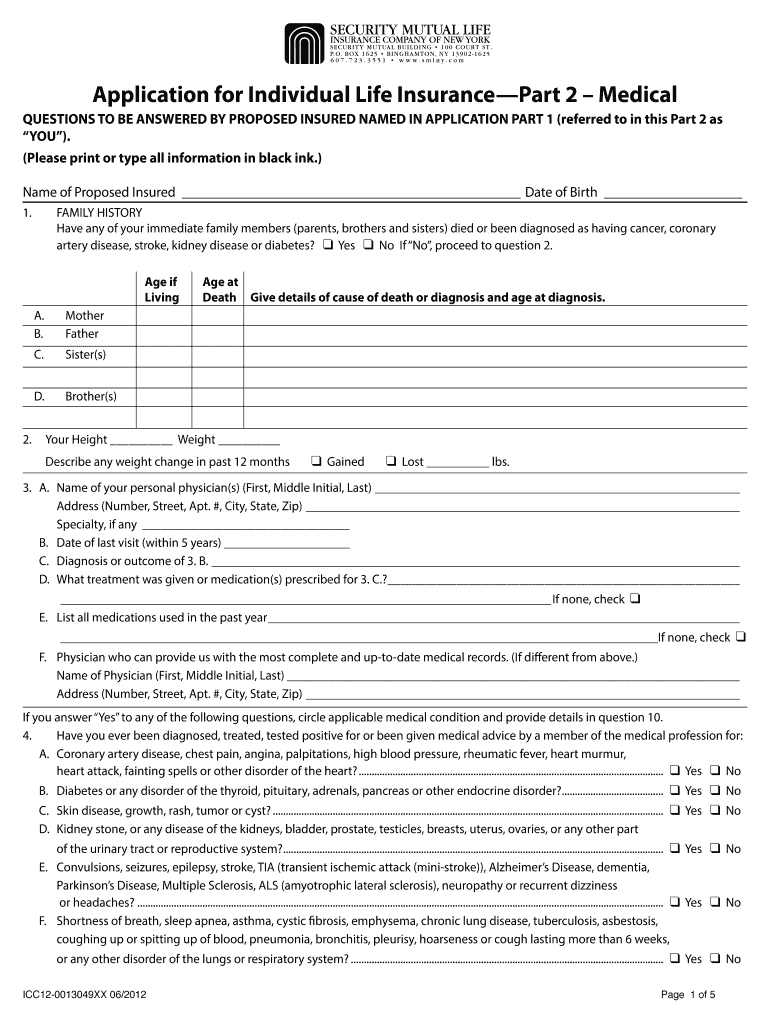

Application for Individual Life Insurance Part 2 Medical QUESTIONS TO BE ANSWERED BY PROPOSED INSURED NAMED IN APPLICATION PART 1 (referred to in this Part 2 as YOU). (Please print or type all information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for individual life

Edit your application for individual life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for individual life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for individual life online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for individual life. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for individual life

How to fill out an application for individual life insurance:

01

Begin by gathering all necessary information: Before starting the application, make sure you have important details at hand, including your personal information (name, date of birth, contact information), medical history, lifestyle habits, and financial information.

02

Choose the type and amount of coverage: Determine the type of individual life insurance policy that suits your needs, whether it's term life insurance or permanent life insurance. Decide on the coverage amount that would adequately protect your loved ones financially.

03

Research and compare insurance providers: Take the time to research different insurance companies and compare their offerings. Look for reputable providers with good financial stability, competitive premiums, and favorable customer reviews.

04

Complete the application truthfully: Fill out the application form accurately and truthfully, providing all the required information. Avoid any deliberate misrepresentation, as it may result in denial of coverage or cancellation of the policy.

05

Disclose your medical history: Be prepared to provide detailed information about your medical history, including any pre-existing conditions, surgeries, medications, or past illnesses. It is crucial to be transparent during this process.

06

Consider a medical examination: Depending on the coverage amount or your health condition, the insurance company may require you to undergo a medical examination. Follow their instructions and schedule the examination at a convenient time and location.

07

Review the application before submission: Take a moment to review the completed application thoroughly. Double-check all the entered information, ensuring accuracy and completeness. Make any necessary corrections or additions before submitting the application.

Who needs an application for individual life insurance:

01

Individuals seeking financial security for their loved ones: Anyone concerned about providing for their family's financial well-being in the event of their untimely death should consider applying for individual life insurance.

02

Sole income earners: If you are the primary breadwinner in your family or rely heavily on your income, having a life insurance policy can provide much-needed financial support and stability for your dependents.

03

Parents with young children: Parents with dependent children have added responsibilities to secure their future. Life insurance can help cover future expenses such as education costs or mortgage payments, ensuring your children's financial needs are met.

04

Business owners or partners: If you own a business or have partnerships, individual life insurance can protect your business interests and ensure its continuity in the event of your death. It can assist with business succession planning or provide funds to buy out your share from other partners.

05

Individuals with financial debts: If you have outstanding debts, such as a mortgage, car loan, or credit card debt, an individual life insurance policy can provide funds to settle these obligations, preventing your loved ones from inheriting these financial burdens.

Remember, it is always advisable to consult with a licensed insurance professional who can guide you through the application process and help you choose the most suitable policy for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute application for individual life online?

Easy online application for individual life completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit application for individual life online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your application for individual life and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete application for individual life on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your application for individual life from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is application for individual life?

An application for individual life insurance is a form that individuals are required to fill out when applying for life insurance coverage.

Who is required to file application for individual life?

Any individual who wishes to obtain life insurance coverage is required to file an application for individual life.

How to fill out application for individual life?

To fill out an application for individual life, individuals must provide personal information such as age, health history, and lifestyle habits.

What is the purpose of application for individual life?

The purpose of an application for individual life is to assess the risk associated with providing life insurance coverage to an individual.

What information must be reported on application for individual life?

Information such as personal details, medical history, and lifestyle habits must be reported on an application for individual life.

Fill out your application for individual life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Individual Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.