Get the free Tax Organizer Business Entities

Show details

8 Sep 2015 ... SEO auditor a: www.isomcpa.com ... Discharge El informed en PDF! ... IOM CPA LLC based in Houston solves IRS Tax Problems ... free learning seizures compromise services home referrals

We are not affiliated with any brand or entity on this form

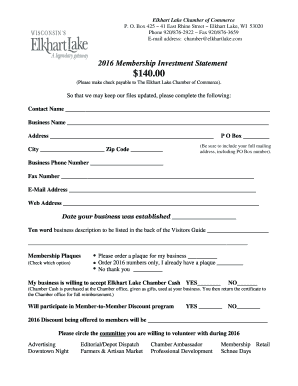

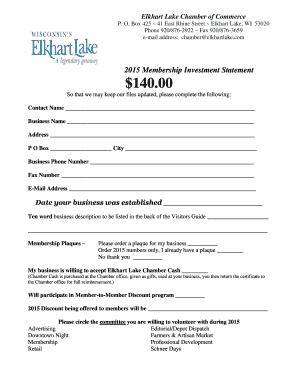

Get, Create, Make and Sign tax organizer business entities

Edit your tax organizer business entities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax organizer business entities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax organizer business entities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax organizer business entities. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax organizer business entities

How to fill out a tax organizer for business entities:

01

Begin by gathering all relevant financial documents for your business, such as income statements, balance sheets, and receipts for business expenses. These will help you accurately complete the tax organizer.

02

Review the tax organizer carefully and follow the instructions provided. The organizer may include sections for income, deductions, assets, and liabilities, among others. Pay attention to any specific requirements or additional forms that may need to be filled out depending on your business structure.

03

Start with the income section and enter all sources of business income. This could include sales revenue, rental income, investment income, or any other form of income generated by the business. Include supporting documentation for each income source.

04

Move on to the deductions section and list all allowable expenses that can be deducted from your business income. This can include business expenses such as rent, utilities, employee wages, office supplies, and advertising costs. Again, make sure to have supporting documentation for each deduction.

05

In the assets section, provide details about any assets owned by the business, such as real estate, vehicles, equipment, or inventory. Indicate their current value and any changes throughout the year. If there were any acquisitions or disposals during the year, make sure to provide the necessary details.

06

Update the liabilities section to include any outstanding loans or debts of the business. Provide relevant information about each liability, such as the principal amount, interest rate, and maturity date.

07

Complete any additional sections or forms specific to your business structure. For example, if you operate as a partnership or a corporation, you may need to provide additional information related to ownership, shareholders, or partners.

08

Review the completed tax organizer for accuracy and ensure that all required information has been provided. Double-check any calculations to minimize errors.

09

Finally, if you are unsure about any aspect of the tax organizer or need assistance, consider seeking professional help from a certified tax preparer or accountant who specializes in business taxes. They can guide you through the process and help you ensure compliance with tax regulations.

Who needs tax organizer business entities?

A tax organizer for business entities is useful for various types of businesses, including:

01

Sole Proprietorships: Individuals who operate a business as a sole proprietor should consider using a tax organizer to keep their business financial information organized for tax filing purposes.

02

Partnerships: Partnerships, which involve two or more individuals who share ownership in a business, can benefit from a tax organizer to coordinate the reporting of income and deductions among partners.

03

LLCs: Limited Liability Companies (LLCs) have flexibility in how they are taxed, but they still need to report their business income and deductions accurately. A tax organizer can help LLCs stay organized and ensure compliance with tax laws.

04

Corporations: Both S-Corporations and C-Corporations need to file separate tax returns and report their business income and expenses. A tax organizer can assist corporations in gathering and organizing the necessary financial information.

In conclusion, a tax organizer for business entities can streamline the process of gathering and organizing financial information for tax filing purposes. It is beneficial for sole proprietors, partnerships, LLCs, and corporations alike, helping them accurately report their business income, deductions, and other relevant financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax organizer business entities?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tax organizer business entities in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my tax organizer business entities in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your tax organizer business entities right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit tax organizer business entities on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute tax organizer business entities from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is tax organizer business entities?

Tax organizer business entities is a tool used to gather and organize financial information necessary for filing taxes for a business.

Who is required to file tax organizer business entities?

Any business entity, such as a corporation, partnership, or LLC, that is subject to tax filing requirements must file a tax organizer.

How to fill out tax organizer business entities?

To fill out a tax organizer for business entities, you will need to provide detailed financial information about the business, including income, expenses, assets, and liabilities.

What is the purpose of tax organizer business entities?

The purpose of a tax organizer for business entities is to simplify the process of gathering and organizing financial information necessary for tax filing.

What information must be reported on tax organizer business entities?

Information such as income, expenses, assets, liabilities, deductions, credits, and any other relevant financial details must be reported on a tax organizer for business entities.

Fill out your tax organizer business entities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Organizer Business Entities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.