NY DTF ST-120.1 2012 free printable template

Show details

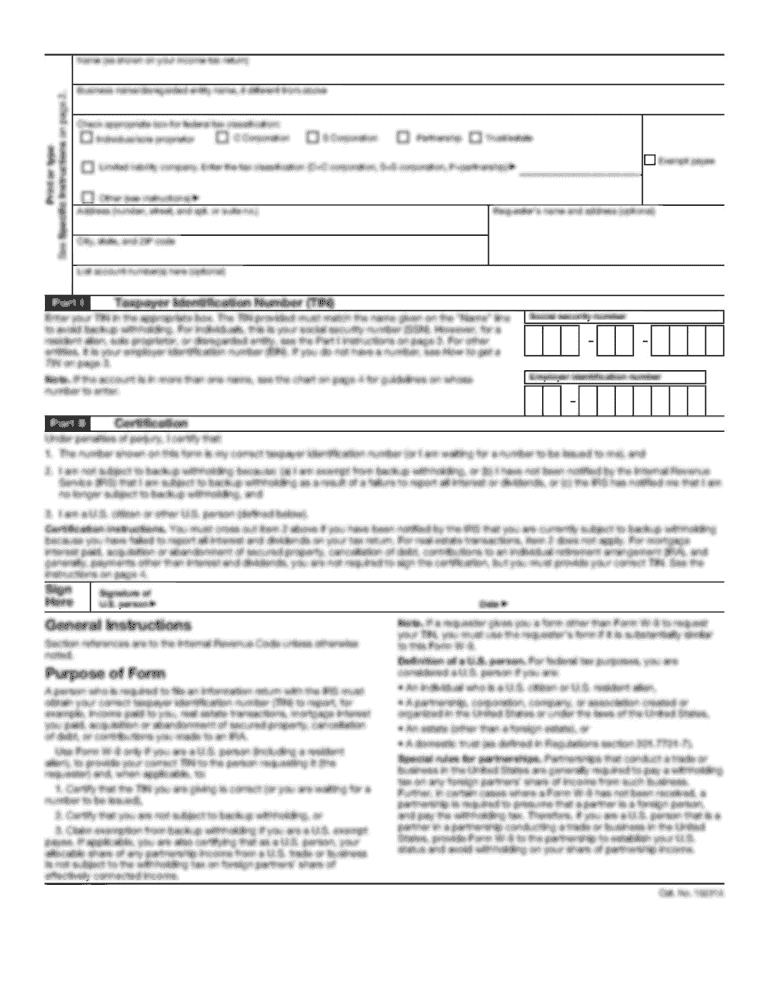

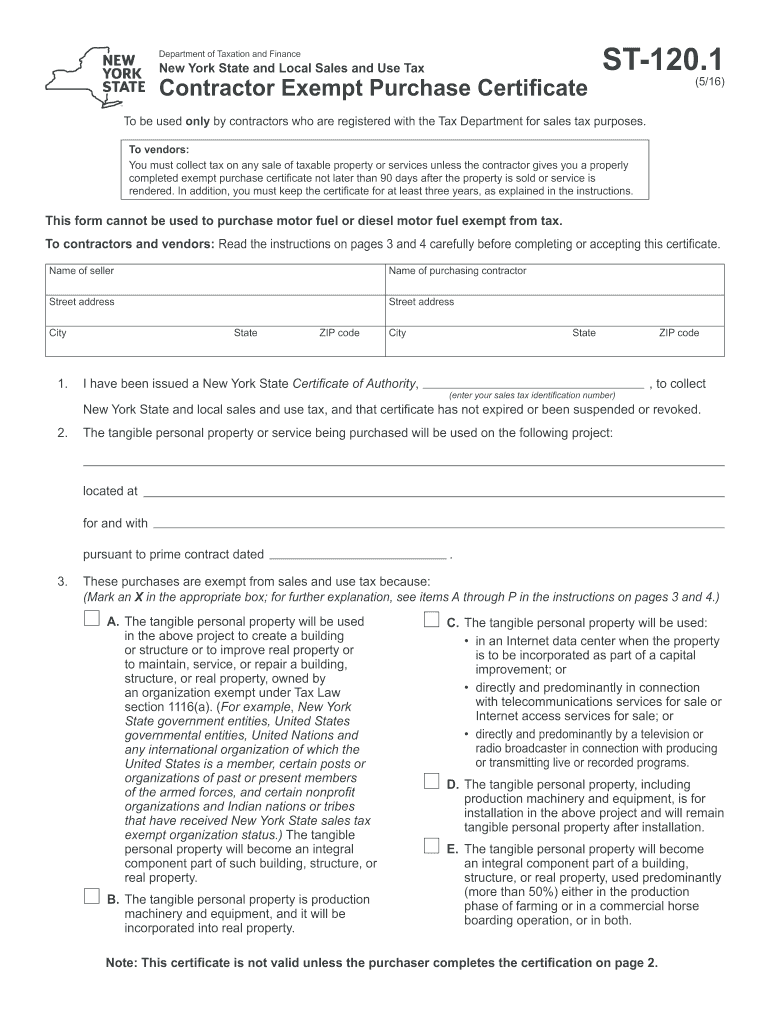

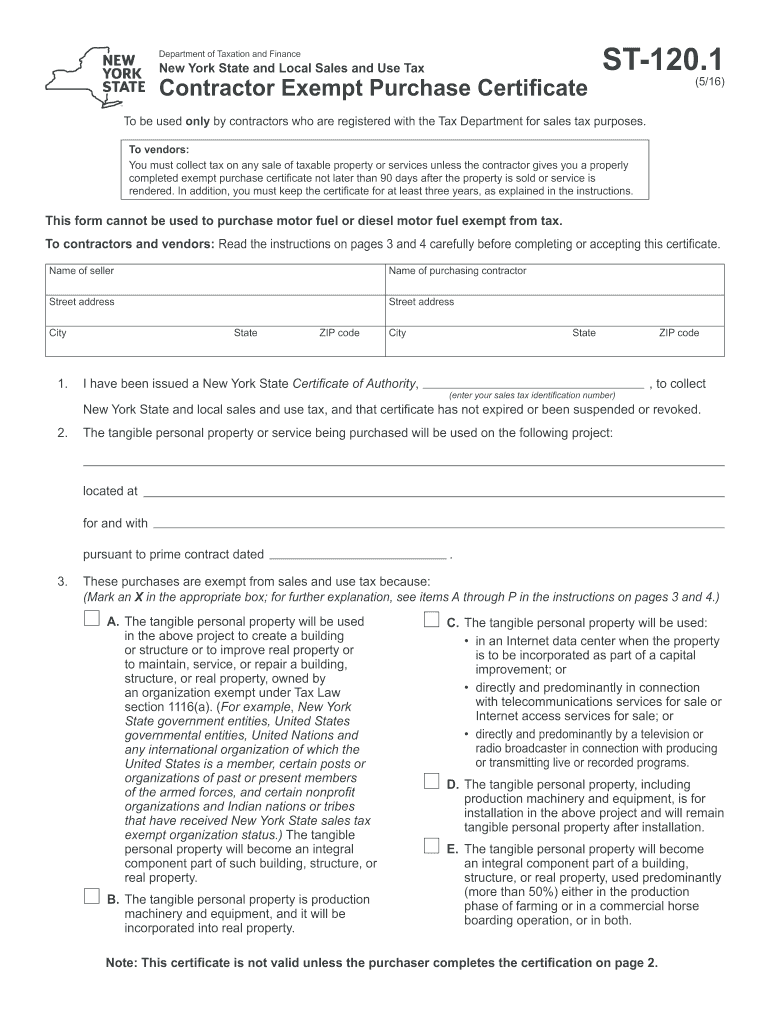

ST-120. 1 New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Contractor Exempt Purchase Certificate 12/12 To be used only by contractors who are registered with the Tax Department for sales tax purposes. To vendors You must collect tax on any sale of taxable property or services unless the contractor gives you a properly completed exempt purchase certificate not later than 90 days after the property is sold or service is rendered* In addition you must...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-1201

Edit your NY DTF ST-1201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-1201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ST-1201 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF ST-1201. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-120.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-1201

How to fill out NY DTF ST-120.1

01

Obtain the NY DTF ST-120.1 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name, address, and other identification details in the appropriate fields.

03

Indicate the type of exemption you are applying for, referring to the instructions provided with the form.

04

Provide information about the goods or services being purchased, including descriptions and amounts.

05

Sign and date the form after ensuring all information is accurate.

06

Submit the completed form to the seller or service provider.

Who needs NY DTF ST-120.1?

01

Individuals or businesses purchasing items or services that qualify for certain tax exemptions.

02

Tax-exempt organizations seeking to make purchases without incurring sales tax.

03

Resellers who plan to buy goods for resale purposes and need to prove their tax-exempt status.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my NJ sales tax certificate?

To request a copy of a filed tax return, submit a request to the Division of Taxation. This optional service, which provides processing within 8.5 business hours is available for these requests received in person, by FAX or by courier service. All FAX requests are considered to be requests for expedited service.

How to fill out California resale certificate?

Resale Certificates The name and address of the purchaser. The purchaser's seller's permit number (unless they are not required to hold one1). A description of the property to be purchase. An explicit statement that the described property is being purchased for resale. The date of the document.

How do I get sales tax exempt in NY?

Most sellers must have a valid Certificate of Authority in order to accept an exemption certificate. A properly completed exemption certificate accepted in good faith protects the seller from liability for the sales tax not collected from the purchaser.

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

How to fill out NY ST 120 form?

2:55 8:33 How To Fill Out ST-120 New York State Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip Number is blank. So if you're a new york state vendor. You click that one. And then you put in yourMoreNumber is blank. So if you're a new york state vendor. You click that one. And then you put in your certificate of authority number right here.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out NY DTF ST-1201 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY DTF ST-1201 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit NY DTF ST-1201 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NY DTF ST-1201 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete NY DTF ST-1201 on an Android device?

Use the pdfFiller app for Android to finish your NY DTF ST-1201. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY DTF ST-120.1?

NY DTF ST-120.1 is a form used in New York State for tax exemption claims related to sales and use taxes.

Who is required to file NY DTF ST-120.1?

Businesses or individuals who are claiming an exemption from sales and use tax on eligible purchases are required to file NY DTF ST-120.1.

How to fill out NY DTF ST-120.1?

To fill out NY DTF ST-120.1, provide accurate details of the purchaser, seller, and the items being purchased while specifying the reason for the tax exemption.

What is the purpose of NY DTF ST-120.1?

The purpose of NY DTF ST-120.1 is to formally document claims for sales tax exemptions to ensure compliance with New York tax laws.

What information must be reported on NY DTF ST-120.1?

The information required includes purchaser details, seller information, a description of products or services, the reason for the exemption, and any relevant tax identification numbers.

Fill out your NY DTF ST-1201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-1201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.