Get the free Notice to Filers of North Dakota Forms 58 and 60

Show details

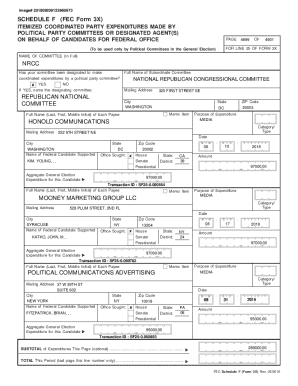

This notice provides information to filers of North Dakota Forms 58 and 60 regarding a new income tax credit related to property taxes paid by partnerships and S corporations, including instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice to filers of

Edit your notice to filers of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to filers of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice to filers of online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice to filers of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice to filers of

How to fill out Notice to Filers of North Dakota Forms 58 and 60

01

Obtain the Notice to Filers of North Dakota Forms 58 and 60 from the official website or local office.

02

Read the instructions carefully to understand the requirements and deadlines for filing.

03

Fill in your identifying information in the appropriate sections, including your name, address, and any other required details.

04

Complete the specific forms (58 and 60) as instructed, ensuring all relevant information is accurate and complete.

05

Review your filled-out forms for any errors or omissions.

06

Sign and date the forms where required.

07

Submit the forms either electronically or by mail, following the guidelines provided in the notice.

Who needs Notice to Filers of North Dakota Forms 58 and 60?

01

Individuals or businesses in North Dakota that are subject to specific tax regulations requiring the use of Forms 58 and 60.

02

Tax professionals assisting clients in fulfilling state tax obligations related to income or financial reporting.

03

Any entity that receives a notice requiring them to file these forms as part of compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who must file North Dakota nonresident tax return?

You must file an income tax return if you are a nonresident who owns a business operating in North Dakota and: You are required to file a federal return AND the business generates income you are required to report on your federal return.

Do you have to pay state income tax in North Dakota?

North Dakota has a graduated state individual income tax, with rates ranging from 1.95 percent to 2.50 percent. North Dakota has a graduated corporate income tax, with rates ranging from 1.41 percent to 4.31 percent.

Are non resident aliens required to file taxes?

If you are a nonresident alien engaged in a trade or business in the United States, you must pay U.S. tax on the amount of your effectively connected income, after allowable deductions, at the same rates that apply to U.S. citizens and residents.

How long does it take to get a ND state tax refund?

The anticipated time for refund processing is 30 days. You can check your refund status at Where's My Refund?

Who must file a North Dakota nonresident tax return?

A nonresident of North Dakota (which means you do not live here for more than 7 months) is required to file a North Dakota individual income tax return if: 1) you are required to file a federal return, AND 2) receive income from a source in North Dakota.

Is a non resident required to file income tax return?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Does North Dakota have an eFile form?

North Dakota participates in the Internal Revenue Service's Federal/State Modernized E-File program. This allows you to file and pay both your federal and North Dakota income tax return at the same time.

What makes you a North Dakota resident?

A person who has actually lived in, or maintained his or her legal residence, in North Dakota for the past six months, may qualify for resident licenses, providing he or she does not continue to claim residency in another state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice to Filers of North Dakota Forms 58 and 60?

The Notice to Filers of North Dakota Forms 58 and 60 is a communication issued to individuals and entities regarding the requirements and procedures for filing these specific forms which pertain to tax and financial reporting in North Dakota.

Who is required to file Notice to Filers of North Dakota Forms 58 and 60?

Individuals and businesses that engage in transactions or activities that require reporting under North Dakota tax regulations are obligated to file the Notice to Filers of North Dakota Forms 58 and 60.

How to fill out Notice to Filers of North Dakota Forms 58 and 60?

To fill out the Notice to Filers of North Dakota Forms 58 and 60, filers must complete the required fields including their identification details, the nature of the filing, and any pertinent financial information as outlined in the instructions provided with the forms.

What is the purpose of Notice to Filers of North Dakota Forms 58 and 60?

The purpose of the Notice to Filers of North Dakota Forms 58 and 60 is to ensure compliance with state reporting requirements, provide clarity on filing obligations, and facilitate accurate tax collection in North Dakota.

What information must be reported on Notice to Filers of North Dakota Forms 58 and 60?

The information that must be reported includes filer identification details, transaction descriptions, amounts involved, and any other data required by the North Dakota tax authority to assess compliance and tax obligations.

Fill out your notice to filers of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To Filers Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.