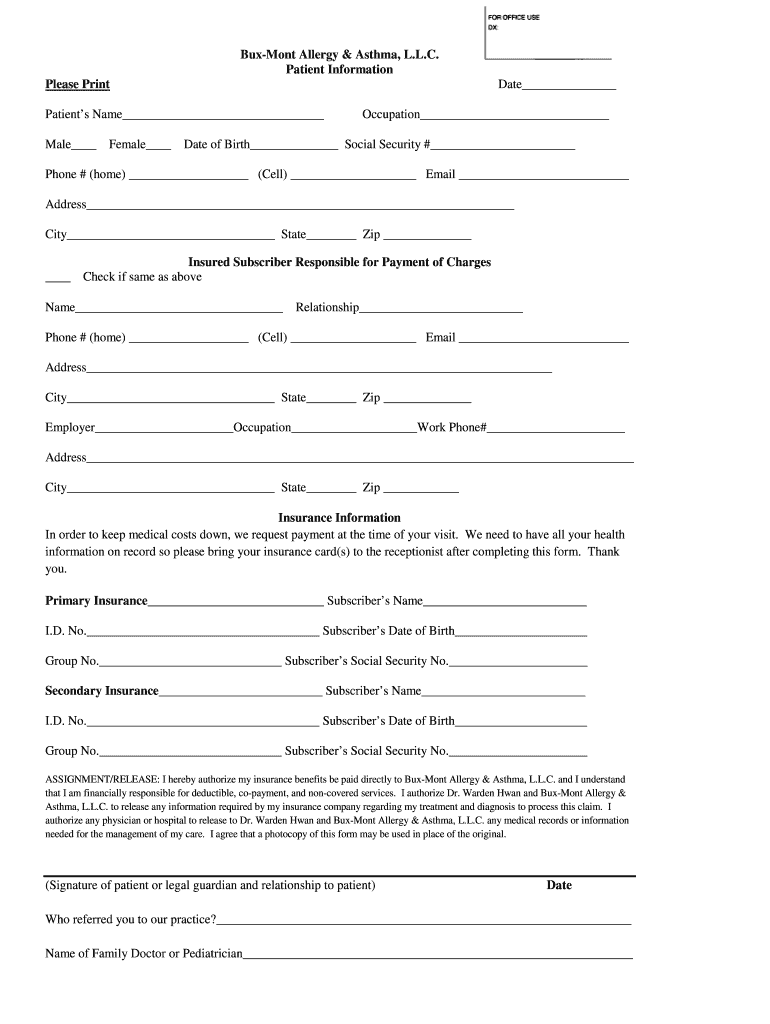

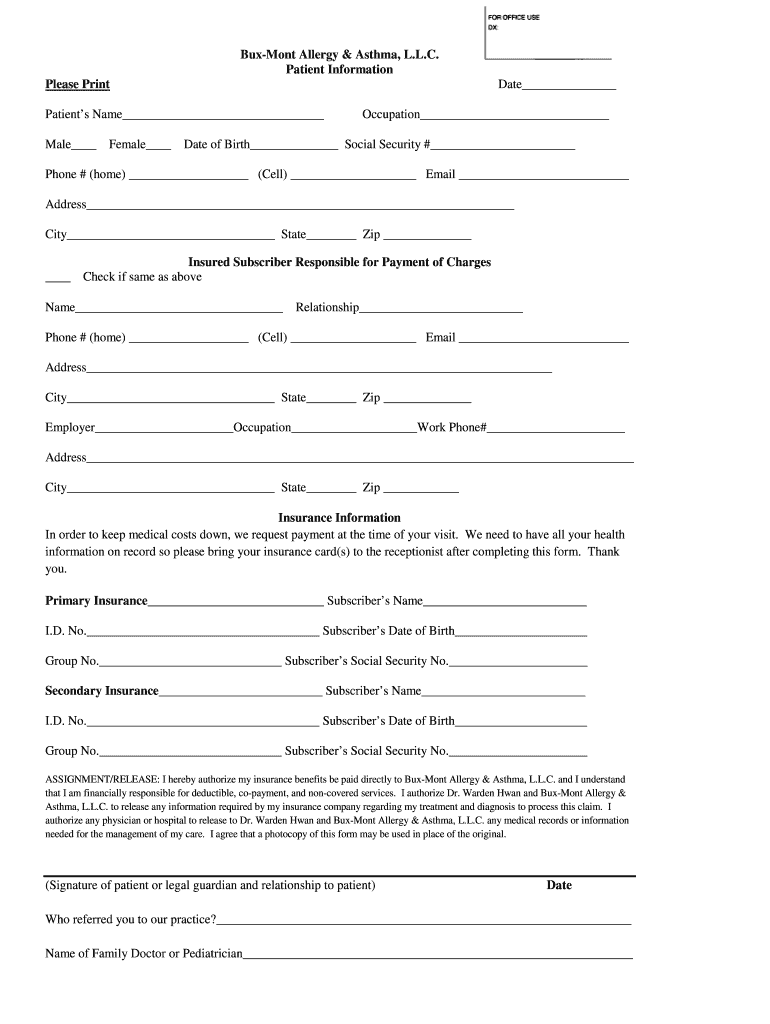

Get the free Medical Insurance Checklist - Bux-Mont Allergy & Asthma

Show details

Patient s Name Occupation Male Female Date of Birth Social Security # Phone # (home) (Cell) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical insurance checklist

Edit your medical insurance checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical insurance checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit medical insurance checklist online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit medical insurance checklist. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medical insurance checklist

How to fill out a medical insurance checklist:

01

Gather personal information - Start by providing your full name, date of birth, contact information, and any other required personal details.

02

Identify your insurance coverage - Determine the type of insurance plan you have, whether it's through your employer, government program, or private provider. Note down your policy number, group number, and any other relevant identification numbers.

03

Review coverage details - Familiarize yourself with the benefits and coverage provided by your insurance plan. Understand what services are included, such as doctor visits, hospital stays, prescription medications, and preventive care.

04

Verify network providers - Check if your insurance plan has preferred providers or a selected network. Ensure your healthcare providers, such as primary care physicians and specialists, are in-network to maximize coverage and minimize out-of-pocket expenses.

05

Evaluate deductibles and copayments - Understand the amount you are responsible for paying before your insurance coverage begins (deductible) and the fixed amount you need to pay for each visit or service (copayment). Note these amounts to anticipate your financial obligations.

06

Check referral or pre-authorization requirements - Some insurance plans require referrals from primary care providers or pre-authorization for certain procedures or specialty care. Make sure you understand these requirements to avoid potential claim denials.

07

Document existing conditions or medications - If you have pre-existing medical conditions or take specific medications regularly, include this information in your medical insurance checklist. This can help ensure proper coverage for these conditions and medications.

08

Understand claim submission processes - Familiarize yourself with the procedures for submitting claims to your insurance provider. Note if there are any specific forms to fill out or documentation required for reimbursement.

09

Keep track of important dates - Make a note of important dates, such as open enrollment periods, renewal dates, and premium payment deadlines. Staying organized with these dates can help you maintain continuous coverage.

10

Review and update your checklist regularly - As your circumstances or insurance coverage changes, such as getting married, having a child, or switching plans, update your medical insurance checklist accordingly to ensure accurate information.

Who needs a medical insurance checklist?

01

Individuals enrolling in a new insurance plan - Anyone who is signing up for a new health insurance plan can benefit from having a checklist to guide them through the process and ensure they provide all the necessary information.

02

Individuals reviewing their existing coverage - Those who already have medical insurance but want to review their coverage details, network providers, and other aspects can use a checklist to ensure they have a clear understanding of their plan.

03

Individuals experiencing major life changes - Significant life events like getting married, having a baby, or changing jobs often require individuals to reassess their medical insurance needs. A checklist can help them navigate these transitions and make informed decisions.

04

Caregivers or family members assisting others - If you are helping a loved one or someone else with their medical insurance, having a checklist can ensure you gather the required information and understand their coverage to advocate for their healthcare needs effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the medical insurance checklist form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign medical insurance checklist. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit medical insurance checklist on an iOS device?

Use the pdfFiller mobile app to create, edit, and share medical insurance checklist from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit medical insurance checklist on an Android device?

You can make any changes to PDF files, such as medical insurance checklist, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is medical insurance checklist?

The medical insurance checklist is a list of required information and documentation related to a person's medical insurance coverage.

Who is required to file medical insurance checklist?

Individuals or organizations responsible for managing or providing medical insurance coverage are typically required to file the medical insurance checklist.

How to fill out medical insurance checklist?

To fill out the medical insurance checklist, you need to provide accurate and up-to-date information about your medical insurance coverage, including policy details and coverage limits.

What is the purpose of medical insurance checklist?

The purpose of the medical insurance checklist is to ensure that individuals or organizations have adequate and appropriate medical insurance coverage in place.

What information must be reported on medical insurance checklist?

Information such as policy number, coverage start and end dates, deductible amount, and co-payments may need to be reported on the medical insurance checklist.

Fill out your medical insurance checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Insurance Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.