Get the free Oregon Property Tax Deferral for Disabled and Senior Citizens - co josephine or

Show details

This document provides information and application details for property tax deferral for disabled and senior citizens in Oregon, including eligibility requirements, application process, and relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon property tax deferral

Edit your oregon property tax deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon property tax deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon property tax deferral online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oregon property tax deferral. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

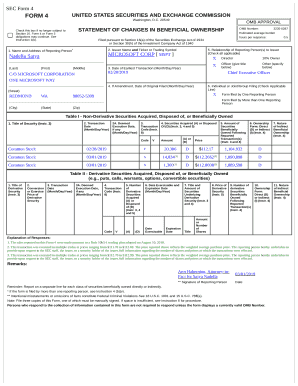

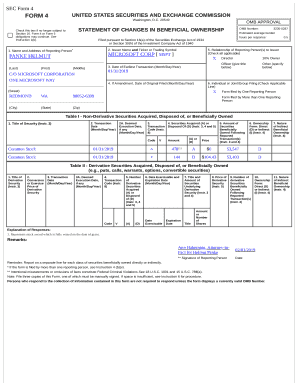

How to fill out oregon property tax deferral

How to fill out Oregon Property Tax Deferral for Disabled and Senior Citizens

01

Obtain the Oregon Property Tax Deferral for Disabled and Senior Citizens application form from the Oregon Department of Revenue website or local county assessor's office.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide information regarding your age or disability status, including any necessary documentation to prove eligibility.

04

Indicate your income and asset details to demonstrate financial need.

05

Include information about your property, including its tax account number and assessed value.

06

Sign and date the application, certifying that the information provided is accurate.

07

Submit the completed application form to your local county assessor's office by the deadline.

Who needs Oregon Property Tax Deferral for Disabled and Senior Citizens?

01

Seniors aged 62 or older who own their home and meet income criteria.

02

Disabled individuals who own their home and can provide documentation of their disability.

03

Individuals seeking to defer property taxes to manage financial burdens.

Fill

form

: Try Risk Free

People Also Ask about

Does Oregon tax senior citizens?

Oregon is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed.

At what age can you stop paying property taxes in Oregon?

Property Tax Deferral – Two Types 1. Senior Citizens – Applicants must be age 62 on or before April 15 of application year. 2. Disabled Citizens – Applicants must be determined eligible to receive or be receiving Federal Social Security disability benefits on or before April 15 of the application year.

Do property taxes go down after age 65?

Often, if you're 65 or older, you'll be able to reduce your property tax bill not only on a house but mobile and manufactured homes, houseboats, townhomes, iniums and so on. You will have to apply: You typically need to apply for a senior freeze.

Do disabled veterans pay property taxes in Oregon?

Oregon Property Tax Exemption If you are a disabled veteran, you may be entitled to exempt some of your homestead property's assessed value from your property taxes.

Do my taxes go down when I turn 65?

The IRS offers an additional standard deduction amount for taxpayers who are 65 and older. If you or your spouse are unable to care for yourself and need outside care while the other spouse is working, you may qualify for a tax credit.

Does Iowa offer property tax relief for seniors?

Senior and Disabled Property Tax Credit. The Senior and Disabled Property Tax Credit program provides property tax relief to elderly homeowners and homeowners with disabilities. Eligible persons must be 65 or older or totally disabled, and meet annual household income requirements.

At what age do you stop paying property taxes in the USA?

Most senior property tax exemption programs require applicants to be at least 65 years old.

In what states do you stop paying property taxes at 65?

Summary State Property Tax Freeze and Assessment Freeze Programs StateYear EnactedAge Requirement Oklahoma 2004 Age 65 or older Rhode lsland 2009 Age 65 or older South Dakota 1980 Age 65 or older Washington 1995 Age 61 or older7 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oregon Property Tax Deferral for Disabled and Senior Citizens?

Oregon Property Tax Deferral for Disabled and Senior Citizens is a program that allows eligible seniors and disabled individuals to defer their property taxes, meaning they don't have to pay them until they sell the property or the title is transferred.

Who is required to file Oregon Property Tax Deferral for Disabled and Senior Citizens?

Eligible seniors aged 62 and older or disabled individuals who own and occupy their property as their primary residence must file for the Oregon Property Tax Deferral.

How to fill out Oregon Property Tax Deferral for Disabled and Senior Citizens?

To fill out the Oregon Property Tax Deferral application, individuals need to complete the application form provided by the Oregon Department of Revenue, providing necessary personal information, proof of age or disability, and information about the property.

What is the purpose of Oregon Property Tax Deferral for Disabled and Senior Citizens?

The purpose of the Oregon Property Tax Deferral program is to help seniors and disabled individuals manage their property taxes, ensuring they can stay in their homes without financial strain.

What information must be reported on Oregon Property Tax Deferral for Disabled and Senior Citizens?

Applicants must report their personal information, age or disability status, the assessed value of the property, and any other relevant financial information as required by the application form.

Fill out your oregon property tax deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Property Tax Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.