PHH Mortgage Workout Option free printable template

Fill out, sign, and share forms from a single PDF platform

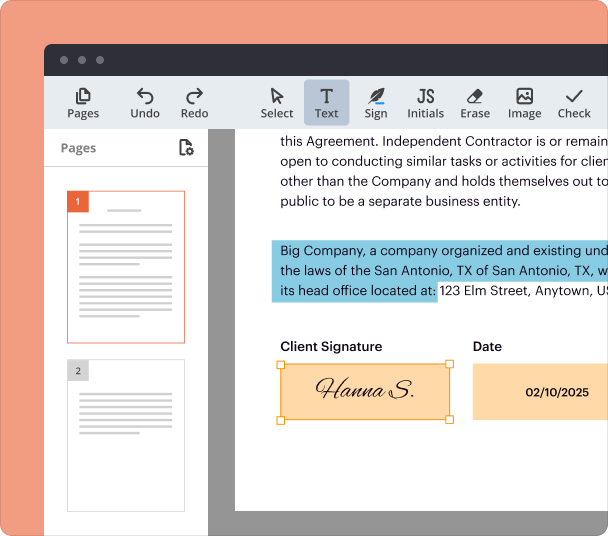

Edit and sign in one place

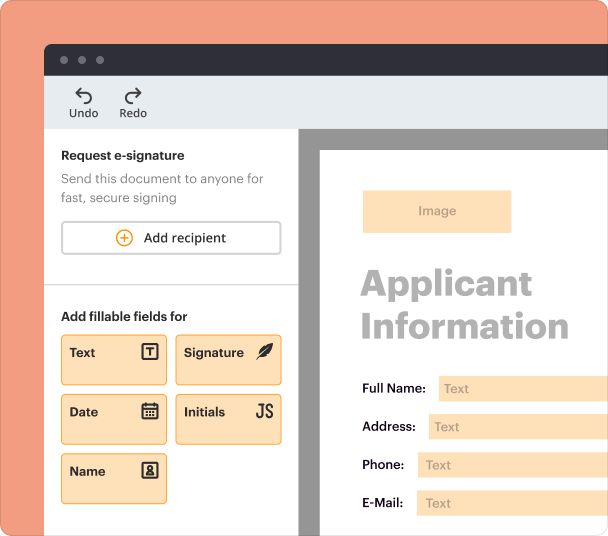

Create professional forms

Simplify data collection

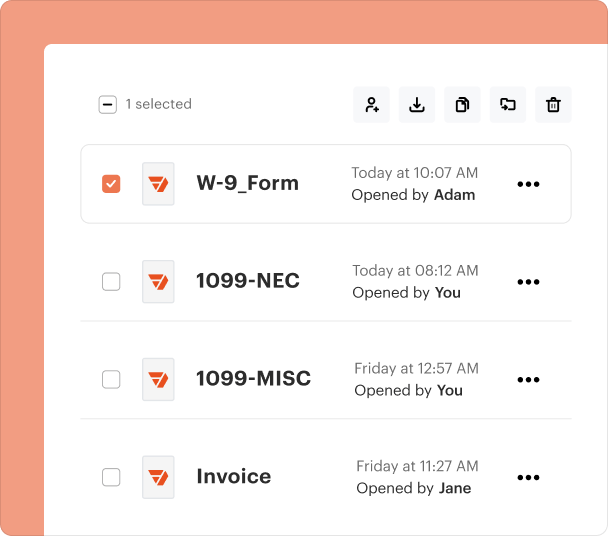

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

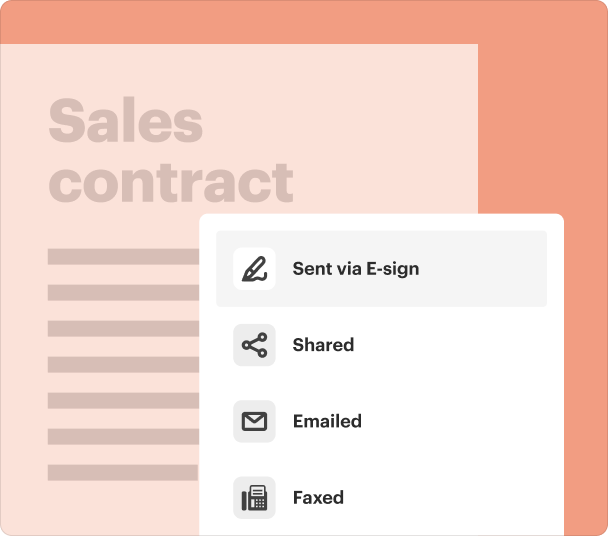

End-to-end document management

Accessible from anywhere

Secure and compliant

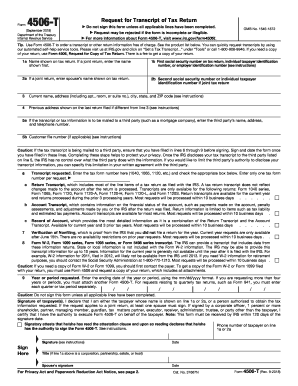

Understanding the PHH Mortgage Workout Option Form

What is the PHH mortgage workout option form?

The PHH mortgage workout option form is a document used by homeowners who face financial difficulties and wish to explore alternatives to foreclosure. This form allows borrowers to outline their current financial situation and request assistance in modifying their mortgage terms. By submitting this form, individuals can initiate a review process with their mortgage servicer to determine eligibility for various workout options, which aim to make it easier to manage mortgage payments.

Eligibility Criteria for the PHH mortgage workout option form

To qualify for a workout option under the PHH mortgage workout option form, borrowers must demonstrate a genuine need for financial relief. Common eligibility criteria include showing proof of income loss due to various circumstances, such as unemployment, reduced income, or unexpected medical expenses. It's essential to provide detailed information about any hardships impacting the ability to make mortgage payments, along with supporting documentation.

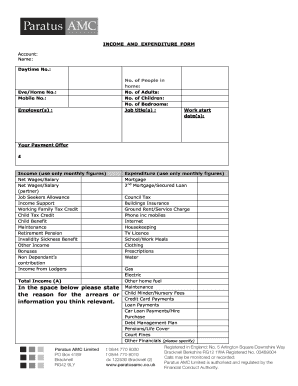

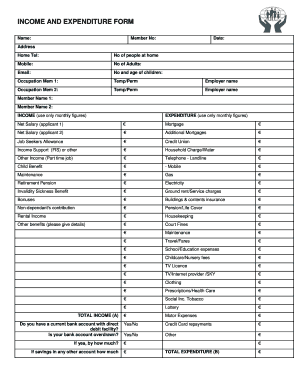

Required Documents and Information

When completing the PHH mortgage workout option form, several documents and pieces of information will be necessary. Borrowers should prepare their financial statements that include income records, asset details, and any outstanding debts. Additional documentation might include proof of hardship, such as medical bills or unemployment notices. Ensuring all required documents are attached will help facilitate a smoother review process.

How to Fill the PHH mortgage workout option form

Filling out the PHH mortgage workout option form involves several key steps to ensure accuracy and completeness. Start by providing personal information, such as names and contact details. Clearly describe your financial difficulties in the space provided and select the hardship types that closely align with your situation. Review each section to confirm all information entered is current and correct before submission to avoid delays in processing.

Common Errors and Troubleshooting

When submitting the PHH mortgage workout option form, borrowers may encounter several common errors. These can include missing information, inaccurate financial details, or failing to sign the document. To avoid these issues, take the time to double-check all entries and ensure all required signatures are in place. If problems arise during the review process, contacting the mortgage service center for guidance can ease any concerns.

Frequently Asked Questions about phh reverse mortgage forms

How long does it take to process the PHH mortgage workout option form?

Processing times can vary, but it generally takes a few weeks for the mortgage service center to review the form and provide a response.

What happens after I submit the PHH mortgage workout option form?

After submission, the mortgage service center will review your financial information and hardship details. Based on this review, they will reach out to discuss potential workout options.

pdfFiller scores top ratings on review platforms