Get the free printable new hire forms

Fill out, sign, and share forms from a single PDF platform

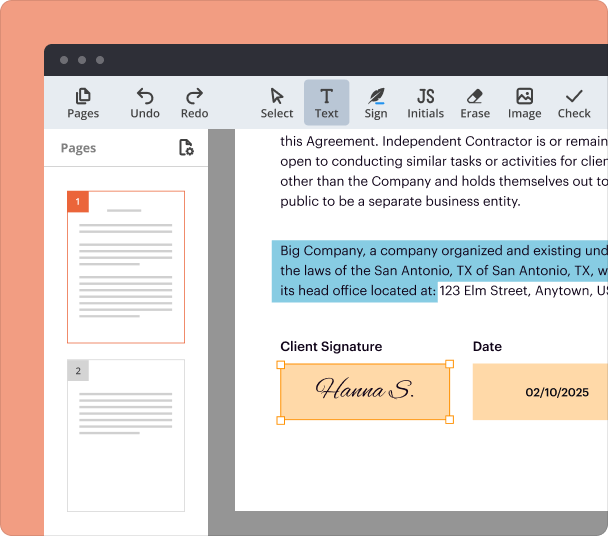

Edit and sign in one place

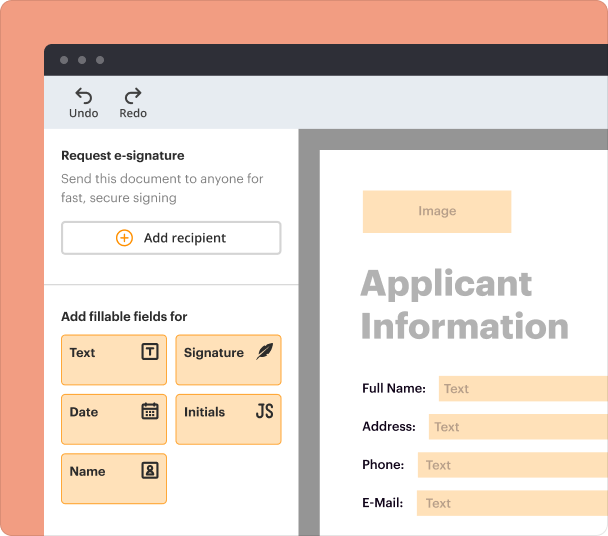

Create professional forms

Simplify data collection

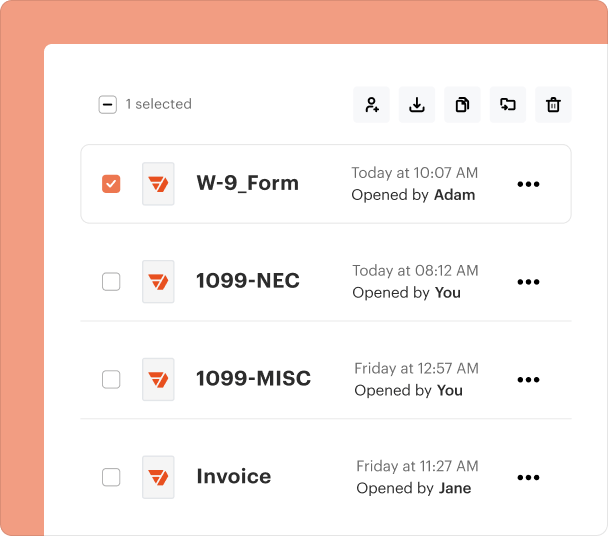

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

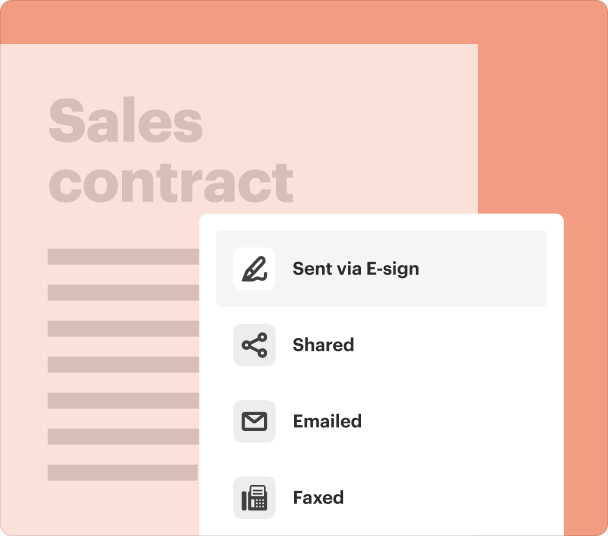

End-to-end document management

Accessible from anywhere

Secure and compliant

New hire paperwork printable form guide

Filling out a new hire paperwork printable form is an essential step in the onboarding process. This guide outlines the key components and best practices for completing this important documentation.

What is new hire paperwork and why is it important?

New hire paperwork encompasses a series of documents that employers require new employees to complete. This paperwork serves several crucial purposes, including collecting personal information, ensuring legal compliance, and defining the employment relationship.

-

These forms gather necessary data about the employee, which helps the employer manage payroll, taxes, and benefits.

-

Certain documents are legally required to comply with federal and state regulations, ensuring the company operates within legal parameters.

-

Efficiently completed forms result in a smoother transition for new hires, aiding their integration into the company.

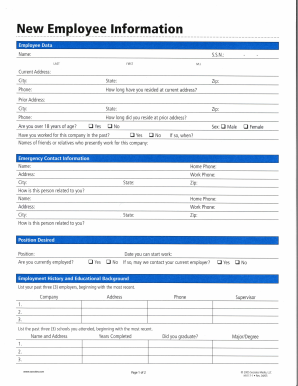

What personal data should be included?

-

This includes the legal name of the new hire, which is critical for tax and record purposes.

-

Collecting a Social Security Number is essential for tax reporting but should be done with care regarding privacy.

-

This information is necessary to comply with age-related employment laws and regulations.

How to collect address and emergency contact information

Accurate address information is important for tax and legal purposes. Additionally, having emergency contact details can be crucial in case of an incident involving the new hire.

-

Employers should request a full residential address to fulfill tax obligations and for record-keeping.

-

Guidelines should be provided to employees about who they should select as emergency contacts, emphasizing the importance of reliable and reachable individuals.

-

Compliance with privacy regulations requires that this sensitive information be managed and stored securely.

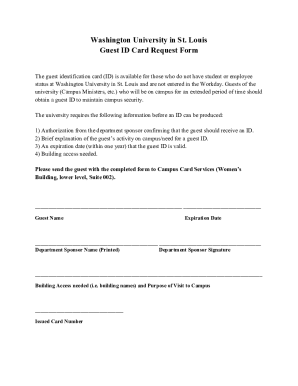

What employer-completed sections are critical?

-

Clearly documenting the employee's position and responsibilities helps in defining their role within the organization.

-

Assigning the correct division ensures that employees are classified appropriately for budget and operational purposes.

-

Clarification on whether an employee is full-time, part-time, or temporary is essential for benefits and compliance.

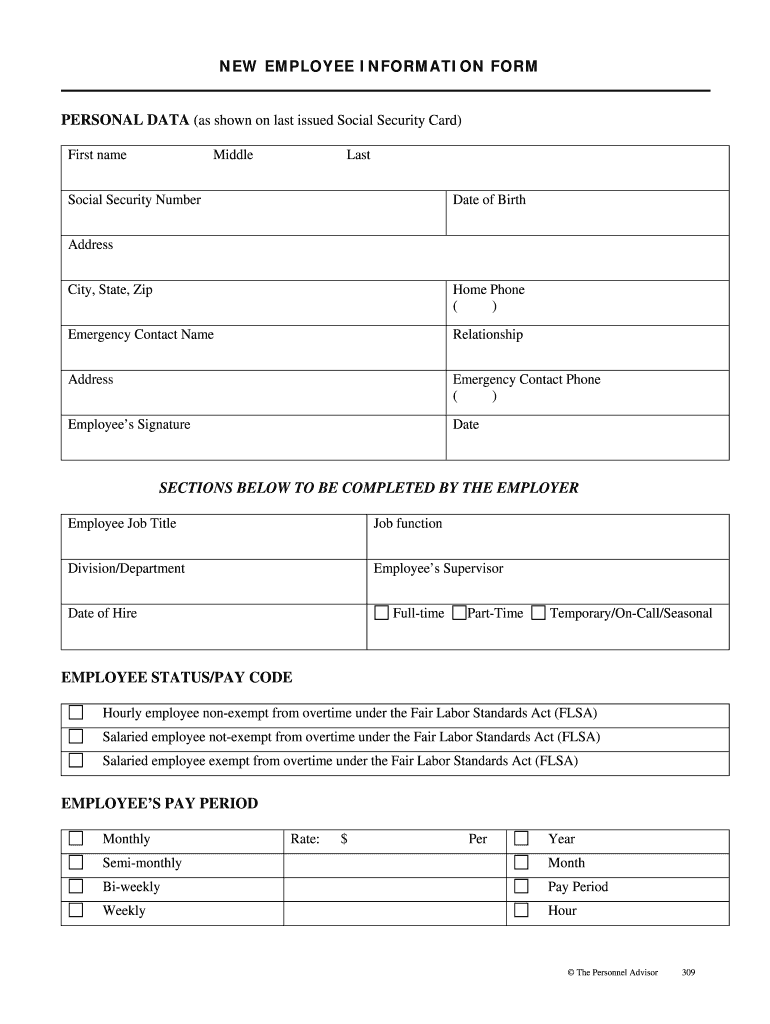

How to clarify employee status and pay codes?

Understanding the difference between exempt and non-exempt employees under the Fair Labor Standards Act (FLSA) is crucial for adherence to labor laws.

-

Employers must ensure that employees' classifications align with legal definitions to avoid compliance issues.

-

Clearly defining pay periods and rates supports financial planning and transparency for employees.

-

Providing detailed information about pay classifications helps new hires understand their compensation and benefits.

What are the best practices for completing new hire paperwork?

-

Creating a checklist of required documents ensures that nothing is overlooked during the onboarding process.

-

Providing clear instructions on how to complete forms accurately can prevent errors and miscommunication.

-

Identifying and communicating common mistakes helps streamline the hiring process and reduces delays.

How can pdfFiller help manage new hire forms?

pdfFiller offers a robust platform for editing, signing, and managing new hire documents efficiently. This ensures that all forms are up-to-date and compliant.

-

Users can easily fill out and eSign forms directly within the pdfFiller interface.

-

The platform allows multiple team members to collaborate and check for compliance before finalizing documentation.

-

pdfFiller safely stores all forms in the cloud, making them accessible from anywhere and ensuring easy management.

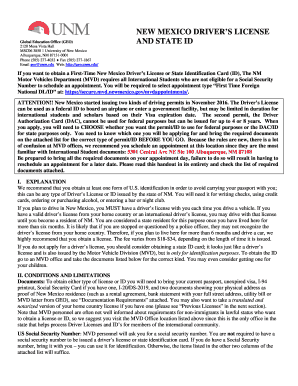

How to navigate compliance and record-keeping?

Staying informed about federal and state compliance is essential for managing new hire submissions and background check forms.

-

Employers must familiarize themselves with the federal and state laws governing employee documentation.

-

It’s necessary to retain these records for specific durations, fulfilling both legal and operational needs.

What’s the conclusion on streamlining your onboarding process?

Creating a streamlined onboarding process starts with proper new hire paperwork, ensuring all forms are completed accurately and legally compliant. Leveraging technology such as pdfFiller can greatly enhance efficiency in managing these documents.

Frequently Asked Questions about new hire paperwork printable pdf form

What types of forms are typically included in new hire paperwork?

New hire paperwork usually includes tax documents like W-4, employment eligibility verification forms (I-9), and personal information sheets. Additional forms may cover benefits enrollment and direct deposit information.

How can I ensure compliance when completing new hire paperwork?

To ensure compliance, familiarize yourself with both federal and state requirements regarding documentation. Consulting with HR experts and using tools like pdfFiller can help manage these requirements effectively.

What is the purpose of the I-9 form in new hire paperwork?

The I-9 form verifies the identity and employment authorization of individuals hired for employment in the U.S. Completing it accurately is essential to comply with immigration laws.

Can new hire paperwork be completed electronically?

Yes, many companies utilize electronic forms for new hire paperwork, allowing for easier completion and submission. Tools like pdfFiller streamline this process for efficiency.

What steps can I take to avoid errors in new hire paperwork?

To avoid errors in paperwork, ensure clear instructions are provided to new hires and establish a checklist of required documents. Regular training and reminders about common mistakes can also be beneficial.

pdfFiller scores top ratings on review platforms