TX TWC C-42 2006 free printable template

Show details

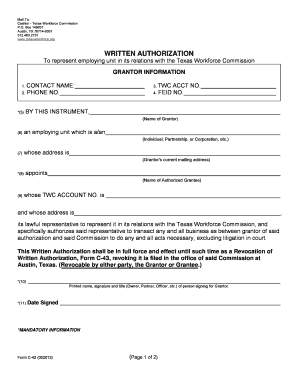

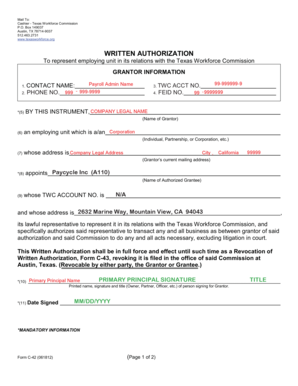

Mail To: Cashier Texas Workforce Commission P.O. Box 149037 Austin, TX 78714-9037 512.463.2731 www.texasworkforce.org WRITTEN AUTHORIZATION To represent employing unit in its relations with the Texas

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TWC C-42

Edit your TX TWC C-42 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TWC C-42 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX TWC C-42 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX TWC C-42. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TWC C-42 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TWC C-42

How to fill out TX TWC C-42

01

Begin by downloading the TX TWC C-42 form from the Texas Workforce Commission website.

02

Fill in your company name and address at the top of the form.

03

Enter your Texas Unemployment Tax Account Number in the designated field.

04

Provide the reporting period for which you are filing.

05

Fill in the number of employees for the reporting period.

06

Calculate your total payroll for the period and enter it in the appropriate box.

07

Follow the instructions to calculate your tax liability based on Texas rates.

08

Review the completed form for any errors or omissions.

09

Sign and date the form before submission.

10

Submit the form electronically or via mail to the appropriate TWC address.

Who needs TX TWC C-42?

01

Employers in Texas who are required to report their unemployment tax information.

02

Businesses that have employees and are subject to Texas unemployment compensation tax laws.

03

Entities that must report their wages and number of employees to the Texas Workforce Commission.

Fill

form

: Try Risk Free

People Also Ask about

Is it too late to apply for unemployment in Texas?

Apply for benefits as soon as you are unemployed because your claim starts the week you complete the application. However, you may not apply until after your last work day. We cannot pay benefits for weeks before your claim effective date. The effective date is the Sunday of the week in which you apply.

How long does an employer have to respond to unemployment claim in Texas?

We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there. By law, your employer has 14 days to respond.

Does Texas Workforce pay for TWIC cards?

Effective immediately we will provide short-term financial aid for TWIC cards and personal transportation only to customers who have a job or job offer and need the assistance to work and to customers who are required to work with us in order to maintain a benefit such as TANF or SNAP.

Is there a time limit to file for unemployment in Texas?

To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began.

What disqualifies you for unemployment in Texas?

After you have been unemployed for eight weeks, you must be willing to accept a suitable job that pays at least 75 percent of your normal wage. If you do not apply for suitable work, accept suitable work, or return to your regular self-employment work, TWC may disqualify you for benefits.

What disqualifies you from unemployment in Texas?

After you have been unemployed for eight weeks, you must be willing to accept a suitable job that pays at least 75 percent of your normal wage. If you do not apply for suitable work, accept suitable work, or return to your regular self-employment work, TWC may disqualify you for benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the TX TWC C-42 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your TX TWC C-42 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit TX TWC C-42 on an iOS device?

Create, modify, and share TX TWC C-42 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit TX TWC C-42 on an Android device?

You can make any changes to PDF files, like TX TWC C-42, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TX TWC C-42?

TX TWC C-42 is a form used by employers in Texas to report unemployment compensation information to the Texas Workforce Commission.

Who is required to file TX TWC C-42?

Employers in Texas who have unemployment insurance obligations and are reporting wages and employment information are required to file TX TWC C-42.

How to fill out TX TWC C-42?

To fill out TX TWC C-42, employers need to provide detailed information about their employees, such as Social Security numbers, total wages paid, and reasons for wages paid in the specified reporting period. Instructions can be found on the form itself or the Texas Workforce Commission website.

What is the purpose of TX TWC C-42?

The purpose of TX TWC C-42 is to ensure accurate reporting of employment and wage information, which is necessary for the administration of unemployment insurance benefits in Texas.

What information must be reported on TX TWC C-42?

TX TWC C-42 requires reporting of employee Social Security numbers, total wages paid during the reporting period, the number of employees, and specific information related to any claims for unemployment benefits.

Fill out your TX TWC C-42 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TWC C-42 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.