Get the free Audit Documentation - aicpa

Show details

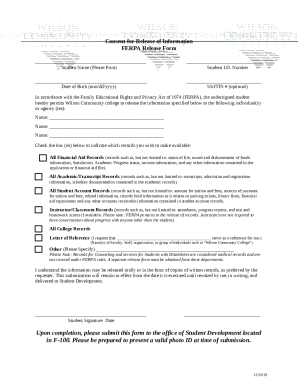

This document outlines the procedures and responsibilities of auditors regarding audit documentation and the obligations to maintain confidentiality while providing access to regulators when requested

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit documentation - aicpa

Edit your audit documentation - aicpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit documentation - aicpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing audit documentation - aicpa online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit audit documentation - aicpa. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit documentation - aicpa

How to fill out Audit Documentation

01

Begin by identifying the purpose of the audit and the specific areas being audited.

02

Gather all relevant financial records and supporting documentation.

03

Create an outline or checklist of the required sections in the audit documentation.

04

Document the findings, including any discrepancies or areas of concern, in a clear and concise manner.

05

Provide evidence for each finding, such as invoices, receipts, or contracts.

06

Ensure all information is organized chronologically and categorized appropriately.

07

Include an executive summary of the findings, recommendations, and overall audit results.

08

Have the documentation reviewed and approved by a qualified auditor or supervisor.

Who needs Audit Documentation?

01

Companies undergoing a financial audit to ensure compliance and accuracy.

02

Regulatory bodies and agencies that need to verify financial practices.

03

Internal stakeholders, such as management and board members, for decision-making purposes.

04

Investors and shareholders to assess the financial health of the organization.

05

External auditors and consultants involved in the audit process.

Fill

form

: Try Risk Free

People Also Ask about

What does audit documentation include?

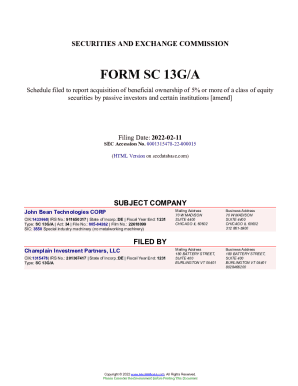

Among other things, audit documentation includes records of the planning and performance of the work, the procedures performed, evidence obtained, and conclusions reached by the auditor. Audit documentation also may be referred to as work papers or working papers.

What are examples of audit documents?

Examples of audit documentation include memoranda, confirmations, correspondence, schedules, audit programs, and letters of representation. Audit documentation may be in the form of paper, electronic files, or other media. 5.

How is audit evidence documented?

Audit evidence can include physical documents, electronic records, oral statements, and more. Proper documentation methods may vary, but they often involve maintaining detailed files, capturing screenshots, recording interviews, and maintaining a clear audit trail. 3.

How do you write an audit document?

Title should mention that it is an 'Independent Auditor's Report'. Mention that responsibility of the Auditor is to express an unbiased opinion on the financial statements and issue an audit report. State the basis on which the opinion as reported has been achieved. Facts of the basis should be mentioned.

What is an example of audit documentation?

Auditing is defined as the on-site verification activity, such as inspection or examination, of a process or quality system, to ensure compliance to requirements.

What is auditing information in English?

Title should mention that it is an 'Independent Auditor's Report'. Mention that responsibility of the Auditor is to express an unbiased opinion on the financial statements and issue an audit report. State the basis on which the opinion as reported has been achieved. Facts of the basis should be mentioned.

What are four documents used in auditing?

What Documents Are Required for an Audit? Financial statements. Bank statements and reconciliations. Invoices, purchase orders, and other supporting documentation. Payroll records. Tax returns. Inventory records. Contracts and agreements. Policy and procedure manuals.

What documents are required for an audit?

Which Financial Documents Are Required for an Audit? Financial Statements. Bank Statements. Accounts Receivable (AR) and Accounts Payable (AP) Reports. Sales Invoices/Bills. General Ledger. Payroll Accounting. Tax Forms. Agreements and Contracts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Audit Documentation?

Audit documentation refers to the records and evidence that auditors create and maintain to support their audit conclusions and opinions. It serves as a framework that provides a detailed account of the audit process, including the audit plan, procedures performed, and findings.

Who is required to file Audit Documentation?

Typically, auditors conducting financial audits are required to file audit documentation. This includes both internal and external auditors who need to comply with standards set by regulatory bodies and professional organizations.

How to fill out Audit Documentation?

To fill out audit documentation, auditors should gather evidence, record observations, and document conclusions based on audit procedures performed. This may include checklists, working papers, and narratives that clearly outline the audit process and findings.

What is the purpose of Audit Documentation?

The purpose of audit documentation is to provide a comprehensive record of the audit process, ensuring that the audit is conducted in accordance with applicable standards, enabling another auditor to understand the work performed, and helping to support the auditor's conclusions.

What information must be reported on Audit Documentation?

Audit documentation must include information such as the objectives of the audit, evidence gathered, methodology used, findings, conclusions, and any significant issues encountered during the audit process.

Fill out your audit documentation - aicpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Documentation - Aicpa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.