Get the free cash confirmation

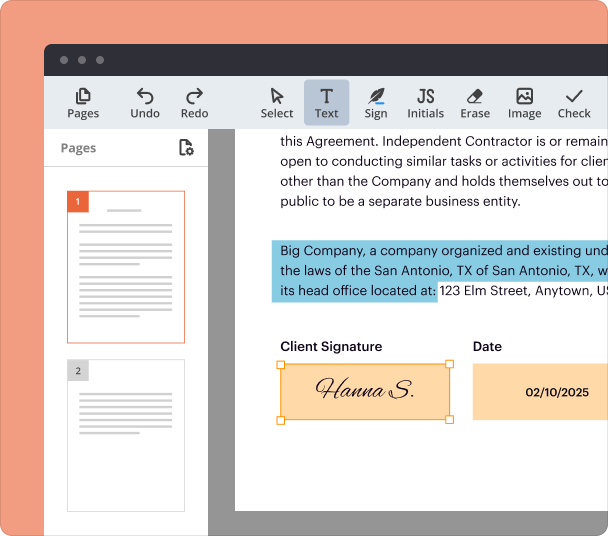

Fill out, sign, and share forms from a single PDF platform

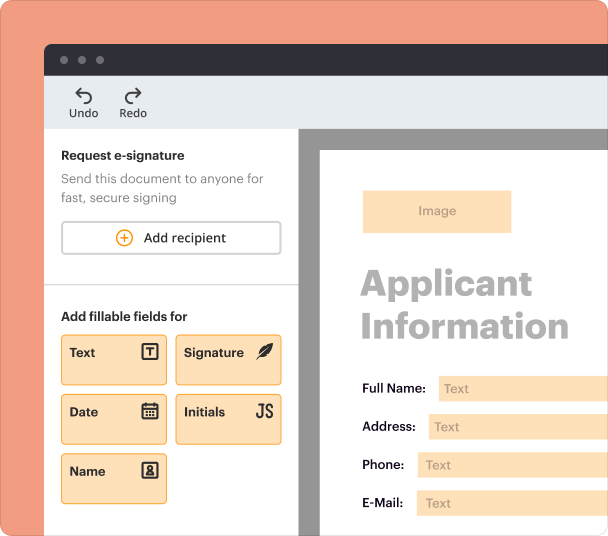

Edit and sign in one place

Create professional forms

Simplify data collection

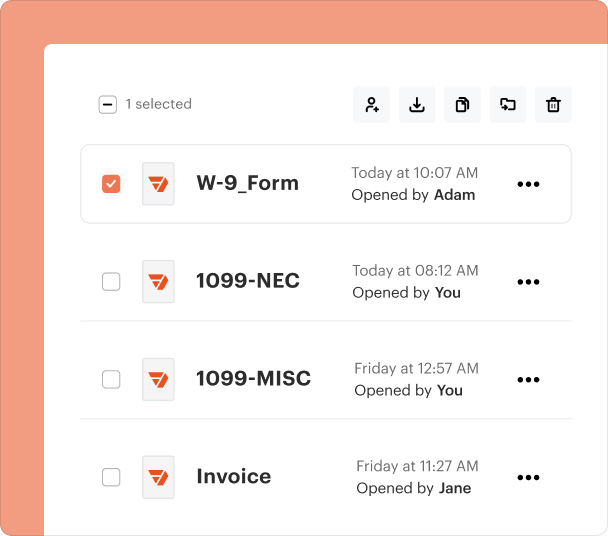

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

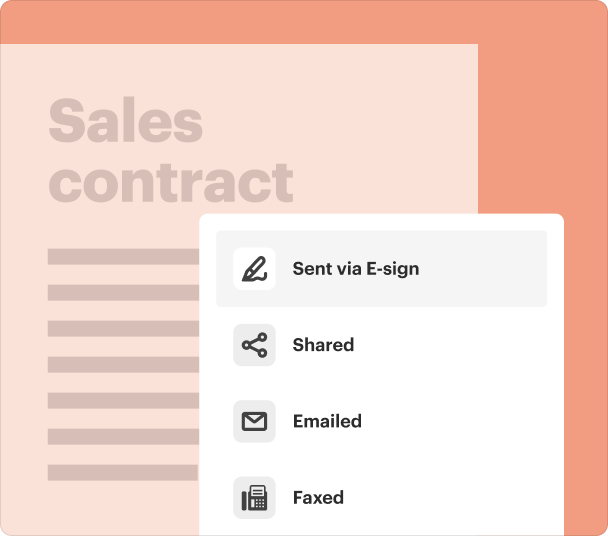

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Cash Confirmation Form

What is the cash confirmation form?

A cash confirmation form is a crucial document used by organizations to verify and confirm the cash balance held by custodians. This form serves as an official record detailing the amount of cash on hand, including petty cash, and reconciliations against receipts or dockets. It is typically required at the end of fiscal periods for auditing and compliance purposes.

When to Use the cash confirmation form

This form is generally utilized during year-end audits, financial reconciliations, or anytime a formal verification of cash held by an individual or department is required. It may also be used when changing custodians or during quarterly reviews. Ensuring accurate and timely completion of this form can help prevent discrepancies and maintain financial integrity.

Key Features of the cash confirmation form

The cash confirmation form includes essential features such as the custodian's name, department, cash balance, and total acquitted dockets. It typically requires signatures from both the custodian and an authorised supervisor, ensuring accountability and validation. Additionally, the form may include a section for notes on any discrepancies, providing clarity for audits and record-keeping.

Best Practices for Accurate Completion

Accurate completion of the cash confirmation form involves properly documenting each transaction and ensuring that all amounts are reconciled before submission. Users should double-check calculations and confirm that all dockets are accounted for. Maintaining clear communication with supervisors regarding any discrepancies can enhance the review process and improve transparency.

Required Documents and Information

To properly fill out the cash confirmation form, users should gather all relevant financial documentation, including receipts, transaction logs, and previous cash confirmations. It's necessary to record the current cash balance and list any unmatched dockets along with explanations for discrepancies. This comprehensive approach ensures that the confirmed balance accurately reflects actual cash holdings.

Review and Validation Checklist

Implementing a review and validation checklist before submitting the cash confirmation form can help catch errors. This checklist should include verifying the completeness of documentation, confirming signatures, checking calculations, and ensuring all inconsistencies are addressed. Following this practice minimizes the likelihood of issues during audits.

Common Errors and Troubleshooting

Common errors when completing the cash confirmation form include miscalculations of cash balances, missing signatures, and omitted dockets. To troubleshoot these issues, regularly review the form for accuracy, keep detailed records throughout the reporting period, and communicate with the finance department to clarify any uncertainties.

Frequently Asked Questions about cash in hand confirmation letter format

Who needs the cash confirmation form?

The cash confirmation form is typically required by departments or individuals responsible for managing cash, particularly in environments with significant cash transactions, such as retail, hospitality, and accounting sectors.

How is the cash confirmation form submitted?

The completed cash confirmation form should be submitted to the Central Accounts Office or the relevant financial department for review and record-keeping, adhering to any specified submission deadlines.

pdfFiller scores top ratings on review platforms