Get the free escrow reconciliation

Show details

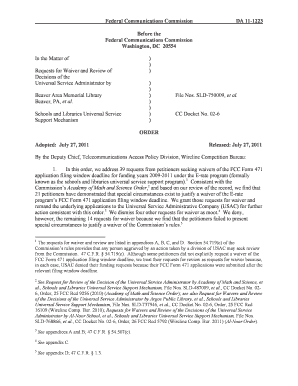

Form 59E As of 00/15/00 Escrow Custodial Reconciliation Worksheet - Monthly Account Statement You must complete a consolidated reconciliation if you have more than one Escrow Custodial Account Seller/Servicer Number 1a 2a Section 1 - Adjusted Bank Balance Bank Balance as of 1b Subtract Outstanding debits 1c Add Deposits in Transit Adjusted bank balance lines 1a-1b 1c Section 2 - Total Liability Escrow trial balance total as of Enter cumulative to...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign escrow reconciliation ending balance form

Edit your what is escrow reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your escrow reconciliation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit escrow reconciliation form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit escrow reconciliation form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out escrow reconciliation form

How to fill out 3 way reconciliation worksheet?

01

Gather all relevant financial documents, such as bank statements, credit card statements, and cash receipts.

02

Start by recording the beginning balances on the worksheet. This includes the beginning balance in the bank account, the ending balance from the previous reconciliation period, and the book balance (total cash recorded in the company's books).

03

Compare the bank statement balance with the book balance and identify any differences. These differences may include outstanding checks, deposits in transit, or bank errors.

04

Adjust the book balance by adding or subtracting any outstanding items found in step 3. This will give you the adjusted book balance.

05

Compare the adjusted book balance with the bank statement balance and make sure they match. If they don't match, you may need to repeat the process to identify any errors or discrepancies.

06

Once the balances match, record the adjusted book balance as the ending balance on the worksheet and proceed to the next step.

07

Compare the individual transactions on the bank statement with the transactions recorded in the company's books. Reconcile any discrepancies by adjusting the book balance accordingly.

08

Record all adjustments made during the reconciliation process on the worksheet. This includes outstanding checks, deposits in transit, bank fees, and any other adjustments necessary to reconcile the book balance with the bank statement balance.

09

Finally, calculate the ending balance on the worksheet by considering all the adjustments made in the previous steps.

Who needs 3 way reconciliation worksheet?

01

Businesses and organizations that handle large volumes of financial transactions, such as banks, financial institutions, and retail companies.

02

Accountants and bookkeepers responsible for reconciling financial records and ensuring accuracy in the company's financial statements.

03

Auditors and financial regulators who perform independent evaluations of a company's financial records to ensure compliance with accounting standards and regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the formula for reconciliation?

A bank reconciliation can be thought of as a formula. The formula is (Cash account balance per your records) plus or minus (reconciling items) = (Bank statement balance). When you have this formula in balance, your bank reconciliation is complete.

What is reconciliation worksheet?

Reconciliation Worksheet means the Performance Worksheet, as revised as of the close of business on the second Business Day immediately preceding the Closing Date, which shall reflect the actual operating results of the Company and the Subsidiaries during the applicable period and shall be reviewed and approved by

What is a 3 way trust reconciliation?

In the Three-Way reconciliation, there are three items in the process: the trust ledger (internal books), the client ledgers, and the trust account bank statement. The trust ledger provides a summary of all the transactions in and out of a trust account.

What is a reconciliation worksheet?

Reconciliation Worksheet means the Performance Worksheet, as revised as of the close of business on the second Business Day immediately preceding the Closing Date, which shall reflect the actual operating results of the Company and the Subsidiaries during the applicable period and shall be reviewed and approved by

What is the 3 way reconciliation process?

There are three elements that go into a three-way reconciliation: Trust Ledger. A trust ledger is the internal record of all transactions going in and out of a client trust account. Client Ledgers. Trust Account Bank Statement. Compare New Entries to the Reconciled Bank Statement.

What is a reconciliation document?

Reconciliation is the process of comparing transactions and activity to supporting documentation. Further, reconciliation involves resolving any discrepancies that may have been discovered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my escrow reconciliation form in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your escrow reconciliation form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit escrow reconciliation form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your escrow reconciliation form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send escrow reconciliation form for eSignature?

escrow reconciliation form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

What is escrow reconciliation?

Escrow reconciliation is the process of reviewing and verifying the transactions and balances in an escrow account to ensure that all funds are accounted for and properly allocated.

Who is required to file escrow reconciliation?

Typically, real estate professionals, escrow officers, and institutions managing escrow accounts are required to file escrow reconciliation.

How to fill out escrow reconciliation?

To fill out escrow reconciliation, gather transaction records, verify the account balance, document the details of deposits and disbursements, and complete the reconciliation form with accurate figures.

What is the purpose of escrow reconciliation?

The purpose of escrow reconciliation is to ensure the accuracy of account balances, maintain transparency, detect errors or discrepancies, and provide a clear audit trail of all transactions.

What information must be reported on escrow reconciliation?

Escrow reconciliation must report the account balance, transaction dates, amounts for deposits and disbursements, and any discrepancies found during the reconciliation process.

Fill out your escrow reconciliation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Escrow Reconciliation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.