DISTRIBUTION TO USERS BY AGGREGATE IRA DISTRIBUTION TO USERS BY CUSTOMER'S STATE or AREA OF RESIDENCE OF BENEFICIARY ELECTION STATUS (as of the close of the offering date):

(1) The distributions will be made in the form of Qualified Distributions. See the definitions below and the section entitled “Amounts” beginning on page 13 for additional details regarding the Qualified Distributions.

(2) Qualified Distributions will be distributed to each of the recipients in equal monthly payments on the first and fourth of each month that the distribution is made, but with no maximum. The first monthly payment will be made no later than ten business days after the end of the month that the qualified distribution was distributed; the second monthly payment will be made no later than thirty business days after the end of the month that the qualified distribution was distributed; and the third monthly payment will be made no later than forty business days after the end of the month that the qualified distribution was distributed. Each recipient will receive a single payment. The payment of the first, second and third monthly payments may be postponed on a quarterly basis by mutual written agreement of the beneficiaries upon 60 days written notice to the Company and the beneficiaries. Each quarterly payment will be made no later than twenty business days after the end of the prior quarter. Each quarterly payment will be made with the same dividend yield and tax rate that would have been paid under the original distribution agreement. The Company may also elect to pay each recipient in a lump sum. No payment will be made to a recipient until at least 10 business days of written notice of the recipient's election to receive a lump sum distribution have occurred. The Company will make any payment to a recipient no later than ten business days following the receipt of its own annual statement of federal tax return, but no later than six business days after receipt of the last payment to which the recipient would be entitled under the original distribution agreement.

The Company will receive payment of the distribution to each of the beneficiaries no later than the same time that the distribution is distributed to another beneficiary.

The Company will furnish or make available to each beneficiary a copy of the distribution agreement and any instructions the distribution is subject to.

(3) Distribution payments will be made to each of the recipients in cash, unless and until the required withholding has been paid by the recipient's financial institution.

Get the free Traditional Beneficiary IRA Distribution Form SAMPLEl

Show details

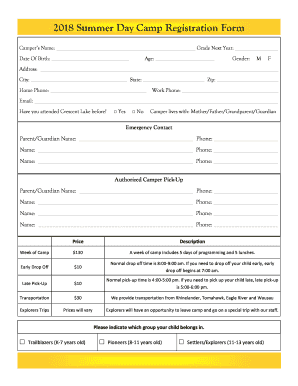

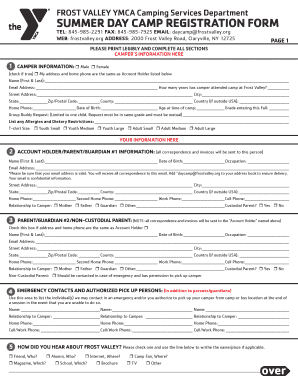

Traditional Beneficiary IRA Distribution Form BENEFICIARY IRA ACCOUNTHOLDER INFORMATION WITHHOLDING ELECTION SIGNATURES DISTRIBUTION INFORMATION PAYMENT INSTRUCTIONS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your traditional beneficiary ira distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional beneficiary ira distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing traditional beneficiary ira distribution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit traditional beneficiary ira distribution. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Fill form : Try Risk Free

People Also Ask about traditional beneficiary ira distribution

What is the form for IRA distributions?

How is an IRA distributed to beneficiaries?

Do I get a 1099-R for an inherited IRA?

When a beneficiary inherits a traditional IRA?

How are IRA accounts distributed to beneficiaries?

How is an inherited IRA split between siblings?

How do you distribute an IRA after death?

How do I distribute my traditional IRA?

How do I take distributions from an inherited IRA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send traditional beneficiary ira distribution for eSignature?

When you're ready to share your traditional beneficiary ira distribution, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get traditional beneficiary ira distribution?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the traditional beneficiary ira distribution in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit traditional beneficiary ira distribution on an Android device?

You can make any changes to PDF files, like traditional beneficiary ira distribution, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your traditional beneficiary ira distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.