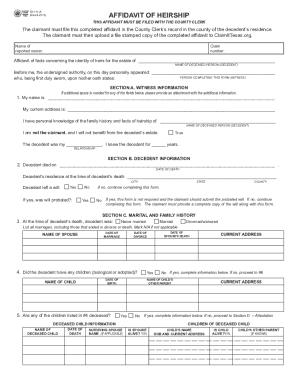

TX 53-111-A 2007 free printable template

Get, Create, Make and Sign TX 53-111-A

How to edit TX 53-111-A online

Uncompromising security for your PDF editing and eSignature needs

TX 53-111-A Form Versions

How to fill out TX 53-111-A

How to fill out TX 53-111-A

Who needs TX 53-111-A?

Instructions and Help about TX 53-111-A

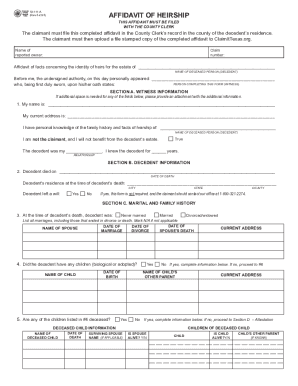

Hi if you're looking to fill in a free affidavit of warship form, or basically it's a form that allows you to remove a dead person's name off of a deed you've come to the right place what you want to do is come right to this webpage, and we have all these states specific forms right here so for example if the person of the property that you're interested is in the state of Florida you just click on the state of Florida here and once this page loads you'll be able to download an affidavit of warship form little slow right now which will allow you to go to the land records office in the state of Florida and be able to file this form and remove that person off of the deed now if you just want to download a generic form we'll go right back to that page we were just on, and you can scroll all the way down to the bottom here and download just our generic form here so getting right into it all what you want to do is just a two-page form you want to write the person who died in this line here this is a fillable PDF and to the state county enter the affine or basically you the person that is claiming the property that they are the person who is the heir to the deceased you want to enter the number of years that you knew the person your relationship with the person then you want to enter where the person died and at the address where they died how old was the person if they keep the name for this is in design resided that enter their address where they died I mean where they were living at the time of death enter if the destitute left a will and if they did, they leave it with the that was a filed with a probate office if yes was the court where it was filed if not have administrative proceedings begun basically as someone else filed anything or is anything that filed all and if so name where it's been filed the Delta DN't was into their marital status here and enter all previous spouses that the person may have had again you want to enter the children if they had any scrolling down if say they had no children you want to enter any and all the family members on this line here if there was real property which is yes where is it, and you probably want to list the all the legal information such as tax map lot numbers and deed in page book numbers if there was any debt on the property you want to list that here sign address, and you want to do that all in front of a notary public and that's it that is how you can fill out this form and then what you want to do is turn this form in to the office that handles property in your jurisdiction of where the person died and that's it you have filled out an affidavit of warship

People Also Ask about

What happens when you file an affidavit of heirship in Texas?

How do you get an affidavit of heirship in Texas?

What happens after an affidavit of heirship is filed in Texas?

Can I do my own affidavit of heirship in Texas?

Can a heir file a affidavit of heirship Texas?

Who can witness an affidavit of heirship in Texas?

Who fills out an affidavit of heirship in Texas?

What papers do I file for heirship in Texas?

What is required for an affidavit of heirship in Texas?

How much does it cost to do an heirship in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX 53-111-A in Chrome?

Can I create an eSignature for the TX 53-111-A in Gmail?

Can I edit TX 53-111-A on an Android device?

What is TX 53-111-A?

Who is required to file TX 53-111-A?

How to fill out TX 53-111-A?

What is the purpose of TX 53-111-A?

What information must be reported on TX 53-111-A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.