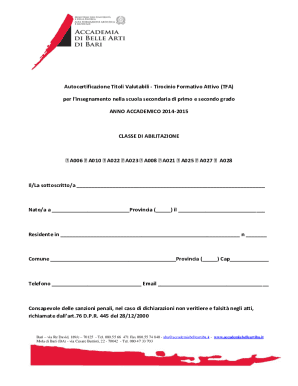

Get the free vtr 68 a form pdf

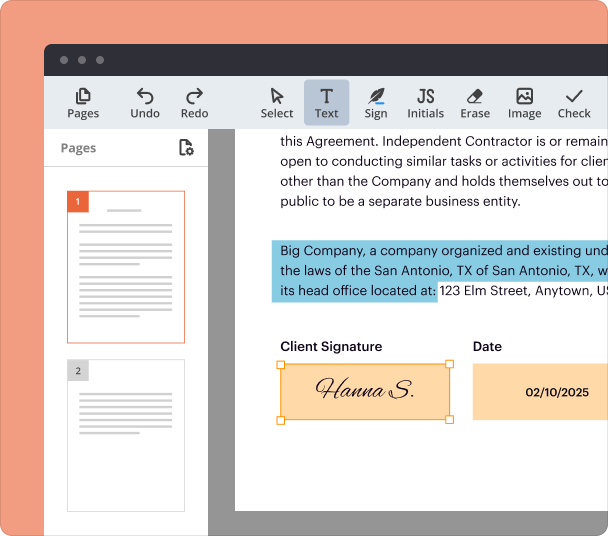

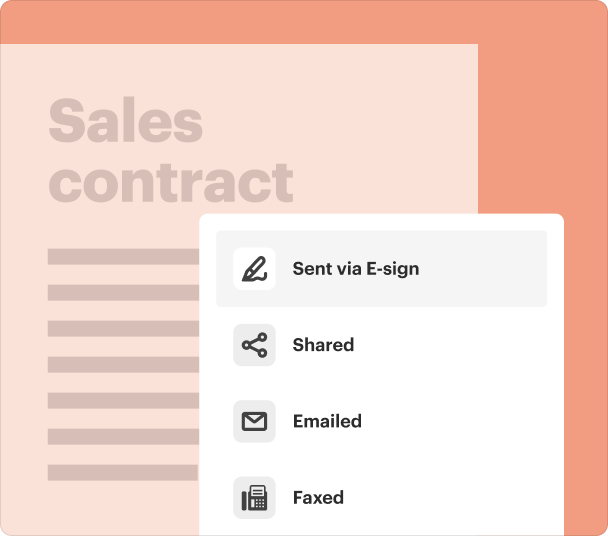

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

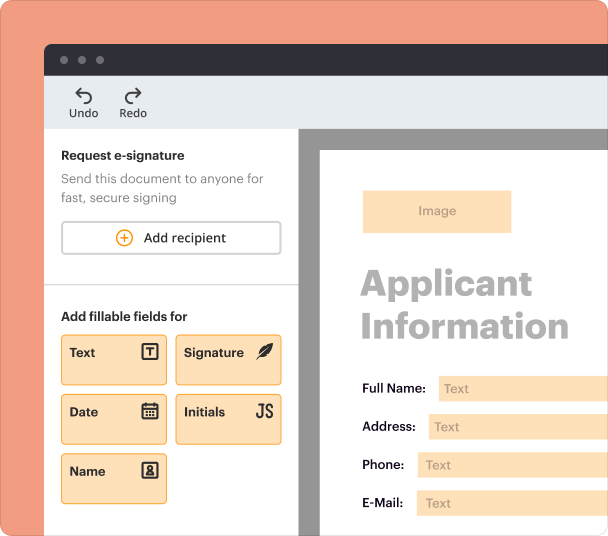

Create professional forms

Simplify data collection

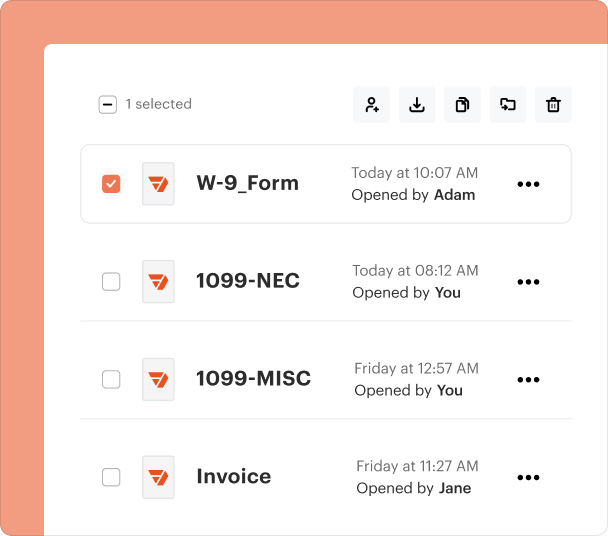

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

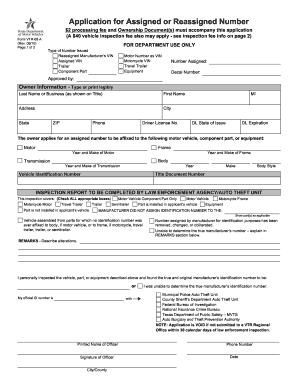

Understanding the VTR 68 A Form

What is the VTR 68 A Form?

The VTR 68 A form is an essential document used in the state of Texas for vehicle ownership transfer, particularly when a vehicle or vessel is being acquired through a transaction that is not a sale. This form helps to ensure that both the buyer and the seller have clear records regarding the ownership and condition of the vehicle.

Key Features of the VTR 68 A Form

The VTR 68 A form includes critical information necessary for the transfer of ownership, such as the vehicle's identification number, the buyer's and seller's details, and any applicable fees. It also requires the seller's signature, confirming the accuracy of the information provided.

Who Needs the VTR 68 A Form?

Individuals or entities involved in the ownership transfer of a vehicle in Texas may need to complete the VTR 68 A form. This includes private sellers and buyers, as well as businesses engaging in such transactions. Additionally, it may be necessary for individuals acquiring vehicles as gifts or through inheritance.

Required Information for the VTR 68 A Form

To complete the VTR 68 A form accurately, certain information must be provided. This includes:

-

A unique identifier for the vehicle.

-

Complete name, address, and contact details.

-

Complete name, address, and contact details.

-

The date when ownership is transferred.

-

Select whether it is a sale, gift, or another reason.

Best Practices for Accurate Completion

When filling out the VTR 68 A form, it is advisable to double-check all entries for accuracy. Ensuring that the VIN is correct is crucial, as this is a major identifier for the vehicle. Additionally, both parties should read the form thoroughly before signing to avoid misunderstandings. Keeping a copy of the completed form for personal records is also beneficial.

Submission Methods for the VTR 68 A Form

Once the VTR 68 A form is completed, it can typically be submitted in person at the local county tax office or via mail. It's important to verify with the local authority regarding the preferred submission method to ensure that the transfer of ownership is processed without delays.

Common Errors to Avoid

When completing the VTR 68 A form, users should be aware of potential mistakes such as incomplete information, misspelled names, or incorrect VIN entries. Any errors can lead to delays in processing, or worse, complications in ownership transfer. Taking the time to carefully review the form before submission can help avoid these issues.

Frequently Asked Questions about Vtr 68 A Form

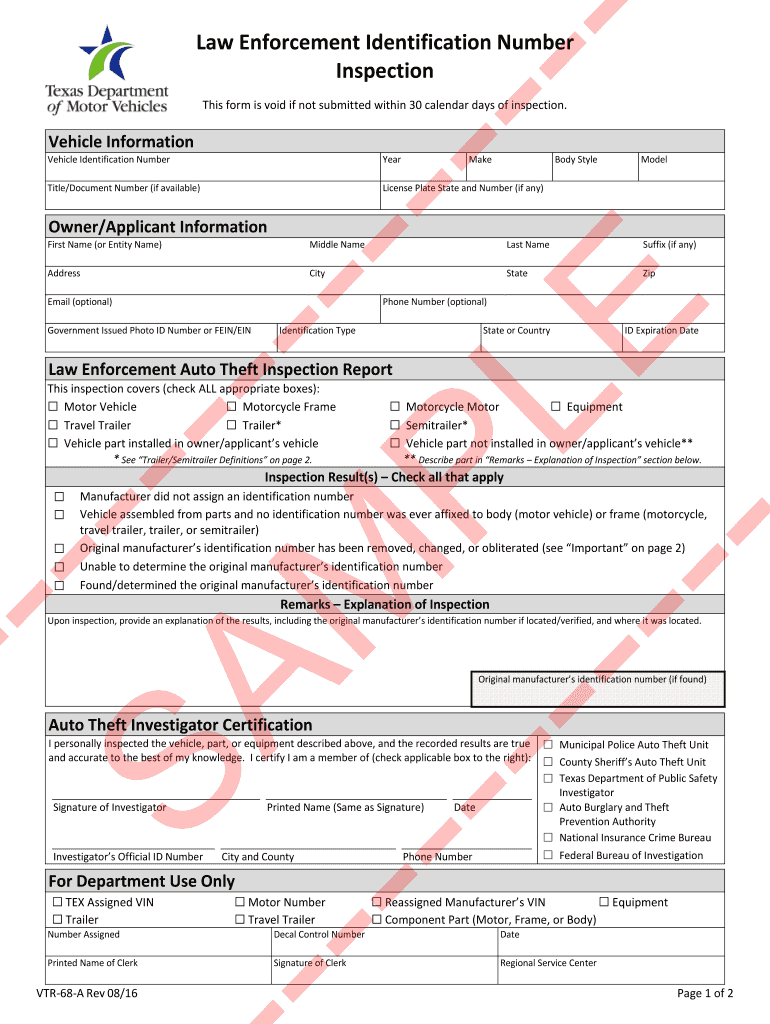

Can the VTR 68 A form be filled out electronically?

Yes, the VTR 68 A form can be completed electronically using available PDF editing tools, which allows for seamless entry of the necessary information.

Is there a fee associated with submitting the VTR 68 A form?

While there is typically no fee for submitting the form itself, there may be associated fees for vehicle registration or title transfers required by the local government.

pdfFiller scores top ratings on review platforms