TX 89-224 2016 free printable template

Show details

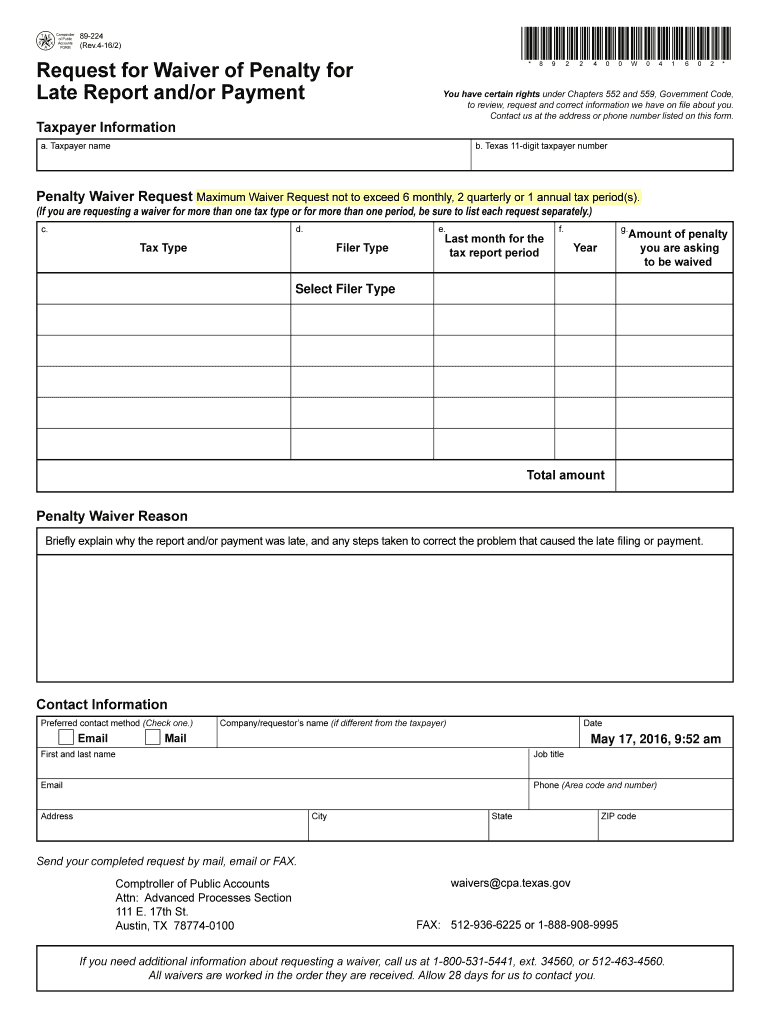

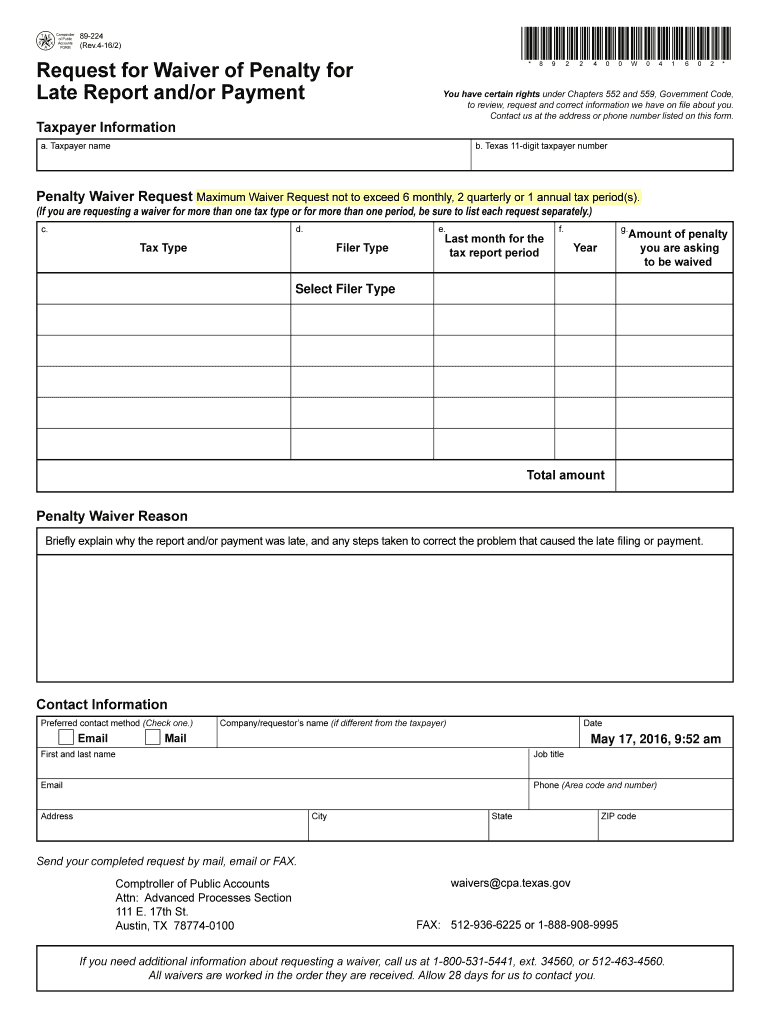

8922400W041602 PRINT FORM RESET FORM 89-224 Rev.4-16/2 Request for Waiver of Penalty for Late Report and/or Payment W You have certain rights under Chapters 552 and 559 Government Code to review request and correct information we have on file about you. Contact us at the address or phone number listed on this form* Taxpayer Information a* Taxpayer name b. Texas 11-digit taxpayer number Penalty Waiver Request Maximum Waiver Request not to exceed 6 monthly 2 quarterly or 1 annual tax period s....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 89-224

Edit your TX 89-224 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 89-224 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX 89-224 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX 89-224. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 89-224 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 89-224

How to fill out TX 89-224

01

Obtain Form TX 89-224 from the appropriate state agency website or office.

02

Fill in your personal information including your name, address, and contact details.

03

Provide specific details about the transaction or request that the form pertains to.

04

Include any relevant identification numbers or account information required.

05

Review the form for completeness and accuracy.

06

Sign and date the form at the specified section.

07

Submit the completed form as instructed, either electronically or via mail.

Who needs TX 89-224?

01

Individuals or businesses engaging in specific transactions that require state approval.

02

Anyone needing to comply with state regulations or fulfill legal obligations related to the state.

03

Professionals seeking a permit or license that involves state authority.

Instructions and Help about TX 89-224

Fill

form

: Try Risk Free

People Also Ask about

How do I write a letter requesting abatement of IRS penalties?

State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.

How do you write a first penalty abatement letter to the IRS?

To Whom It May Concern: We respectfully request that the [failure-to-file/failure-to-pay/failure-to-deposit] penalty be abated based on the IRS's First Time Abate administrative waiver procedures, as discussed in IRM 20.1. 1.3. 6.1, First Time Abate (FTA).

How do I get my IRS penalty waived?

You can file an appeal if all the following have occurred: You received a letter that the IRS assessed a failure to file and/or failure to pay penalty to your individual or business tax account. You sent a written request to the IRS asking them to remove the penalty.

What is a penalty waiver request?

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver. Interest cannot be waived.

What is good reasonable cause for IRS penalty abatement?

Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What is a reasonable cause for penalty abatement letter?

Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX 89-224 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX 89-224 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the TX 89-224 form on my smartphone?

Use the pdfFiller mobile app to complete and sign TX 89-224 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit TX 89-224 on an Android device?

You can make any changes to PDF files, like TX 89-224, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TX 89-224?

TX 89-224 is a form used by taxpayers in Texas to report specific information related to their income and finances for state taxation purposes.

Who is required to file TX 89-224?

Individuals and businesses in Texas who meet certain income thresholds or financial criteria as defined by the Texas Comptroller are required to file TX 89-224.

How to fill out TX 89-224?

To fill out TX 89-224, taxpayers should provide their personal information, financial details, and any specific data requested on the form, following the instructions provided by the Texas Comptroller.

What is the purpose of TX 89-224?

The purpose of TX 89-224 is to collect information for state tax assessment and compliance, ensuring that taxpayers report their financial activities accurately.

What information must be reported on TX 89-224?

TX 89-224 requires reporting of income, deductions, credits, and any other financial activities relevant to state taxation as specified in the form's instructions.

Fill out your TX 89-224 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 89-224 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.