Get the free Chart Of Account - GST Code

Show details

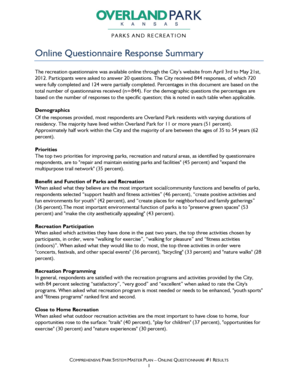

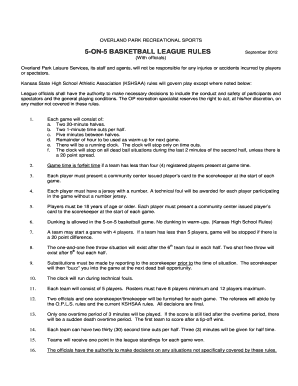

Chart Of Account GST CodeNoTypeAccounting Items Tax Code1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chart of account

Edit your chart of account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chart of account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chart of account online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chart of account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chart of account

Point by point instructions on how to fill out a chart of account:

01

Start by identifying the categories of accounts you need in your chart of account. These categories may include assets, liabilities, equity, revenue, and expenses.

02

Assign a unique account number to each category. This will help organize and identify accounts easily.

03

Within each category, create subcategories or sub-accounts as needed. For example, within the expenses category, you may have sub-accounts for rent, utilities, and salaries.

04

Determine the account names for each category and subcategory. Ensure that the names accurately reflect the nature of the account.

05

Decide on the account type for each account. This includes determining whether it is an asset, liability, equity, revenue, or expense account.

06

Set up the opening balance for each account. This is the initial balance of each account when you start using the chart of accounts. It is usually based on financial statements or records from the previous period.

07

Ensure that the accounts are properly classified and grouped in a logical manner. This will make it easier to track and analyze financial information.

08

Regularly review and update the chart of accounts as needed. This could involve adding new accounts, merging or deleting accounts that are no longer relevant, or making any necessary adjustments.

Who needs a chart of account?

01

Small businesses: A chart of accounts is essential for small businesses as it helps organize and track financial transactions, enabling better financial management and analysis.

02

Large corporations: Large corporations with complex financial structures often require a comprehensive chart of accounts to efficiently manage and report on their financial activities.

03

Non-profit organizations: Non-profit organizations, just like businesses, need a chart of accounts to track their financial transactions and comply with reporting requirements specific to their sector.

04

Individuals: While individuals may not require a chart of accounts as extensive as businesses or organizations, it can still be helpful for tracking personal finances, investments, and expenses.

In summary, filling out a chart of account involves organizing accounts into categories, assigning account numbers, determining account names and types, setting up opening balances, and regularly reviewing and updating the chart. This tool is crucial for businesses, corporations, non-profits, and even individuals to effectively track and manage their financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chart of account in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing chart of account and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out chart of account using my mobile device?

Use the pdfFiller mobile app to fill out and sign chart of account. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out chart of account on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your chart of account. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is chart of account?

A chart of accounts is a list of all the accounts used by an organization to classify financial transactions.

Who is required to file chart of account?

Organizations, businesses, and individuals who need to keep track of their financial transactions are required to file a chart of accounts.

How to fill out chart of account?

A chart of accounts can be filled out by listing all the accounts used by the organization and assigning each account a unique number or code.

What is the purpose of chart of account?

The purpose of a chart of accounts is to provide a standardized way of classifying financial transactions so that they can be easily recorded and tracked.

What information must be reported on chart of account?

The chart of accounts must include information such as account names, numbers, descriptions, and account types.

Fill out your chart of account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chart Of Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.