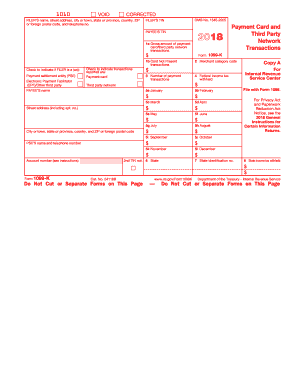

IRS Instructions 1099-K 2016 free printable template

Show details

2016 Department of the Treasury Internal Revenue Service Instructions for Form 1099-K Payment Card and Third Party Network Transactions Section references are to the Internal Revenue Code unless otherwise

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1099-K

Edit your IRS Instructions 1099-K form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1099-K form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instructions 1099-K online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 1099-K. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1099-K Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1099-K

How to fill out IRS Instructions 1099-K

01

Obtain a copy of the IRS Form 1099-K and the corresponding instructions.

02

Identify the payment transactions that require reporting, ensuring they meet the $600 threshold.

03

Fill in the payer's information including name, address, and TIN (Taxpayer Identification Number).

04

List the recipient's information including name, address, and TIN.

05

Report the gross amount of payment transactions in the appropriate box.

06

Check the box for federal income tax withheld if applicable.

07

Indicate the method of payment, including credit card, debit card, or third-party network.

08

Ensure all information is accurate and free of errors.

09

File the form with the IRS by the designated deadline, usually by January 31st of the following year.

Who needs IRS Instructions 1099-K?

01

Businesses and individuals that receive payments via credit card, debit card, or third-party payment networks.

02

Payment settlement entities that process these transactions and are required to report them.

03

Self-employed individuals who receive payments for services rendered through these platforms.

Fill

form

: Try Risk Free

People Also Ask about

What is distributable income of a trust?

The distributable income of the Trust includes, whether derived directly or indirectly (including by entitlement through other Trusts) all capital gains (including any discount capital gain under subdivision 115-A Income Tax Assessment Act 1997 (Cth)) received by the Trust during the relevant period and that capital

What is distributable net income?

The term distributable net income (DNI) refers to income allocated from a trust to its beneficiaries. Distributable net income is the maximum amount received by a unitholder or a beneficiary that is taxable. This figure is capped to ensure there is no instance of double taxation.

Where do beneficiary distributions go on 1041?

The distribution amount will be reported on Form 1041 Schedule B, Line 10 - Other Amounts paid, credited, or otherwise required to be distributed.

What is total distributable income?

The maximum taxable amount that can be distributed from a trust to a beneficiary is called distributable net income (DNI).

What is the difference between distributable net income and accounting income?

While the distributable net income is the aggregate income that is taxed to the beneficiaries, the trust accounting income is the income available to pay only the trust income beneficiaries. The trust accounting income includes interests, ordinary income, and dividends.

What expenses can be deducted on Form 1041?

What expenses are deductible? State and local taxes paid. Executor and trustee fees. Fees paid to attorneys, accountants, and tax preparers. Charitable contributions. Prepaid mortgage interest and qualified mortgage insurance premiums. Qualified business income. Trust income distributed to beneficiaries (attach Schedule K-1)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Instructions 1099-K directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your IRS Instructions 1099-K along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit IRS Instructions 1099-K in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IRS Instructions 1099-K, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit IRS Instructions 1099-K on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRS Instructions 1099-K, you need to install and log in to the app.

What is IRS Instructions 1099-K?

IRS Instructions 1099-K provide guidelines for filing Form 1099-K, which is used to report payment card and third-party network transactions for tax purposes.

Who is required to file IRS Instructions 1099-K?

Businesses and payment settlement entities are required to file IRS Instructions 1099-K if they make payments to a payee that exceed $600 in a calendar year for goods and services.

How to fill out IRS Instructions 1099-K?

To fill out IRS Instructions 1099-K, report the total gross amount of payment transactions, including any adjustments, as well as the payee's information such as name, address, and taxpayer identification number.

What is the purpose of IRS Instructions 1099-K?

The purpose of IRS Instructions 1099-K is to ensure that income received through payment cards and third-party networks is accurately reported to the IRS and taxed appropriately.

What information must be reported on IRS Instructions 1099-K?

The information that must be reported on IRS Instructions 1099-K includes the gross amount of reportable transactions, the number of transactions, and the payee's name, address, and taxpayer identification number.

Fill out your IRS Instructions 1099-K online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1099-K is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.