Who Needs Instructions for Form 943?

The Internal Revenue Service prepared Instructions for Form 943 to help employers figure out how to properly file the Employer’s Annual Federal Tax Return for Agricultural Employees. The instruction will be relevant to all employers engaged in the farming business, especially those obliged to report:

- $150 or more than wages in a year

- paid a total of over $2,500 to all those employed in farm work

What Kind of Information does the Instruction Provide?

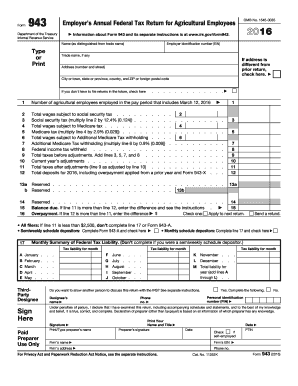

The IRS Instructions cover all the basic details and provisions that the filler must pay due attention to and follow in order to report the wages in the prescribed way: how to calculate the payments and all types of taxes due and a monthly summary of federal tax liability, how to fill out the payment voucher and actually pay.

When are the Instructions for Form 943 Updated?

The Internal Revenue Service typically issues a revised instruction for every tax form that must be filed on an annual basis every year. The latest updated Form 943 Instruction is issued for the year 2016.

Do I Need to File the Instruction?

No, there is no need to write anything on the instruction or to file it, as it is supposed to be used only for reference.