WI PC-220 2016-2025 free printable template

Show details

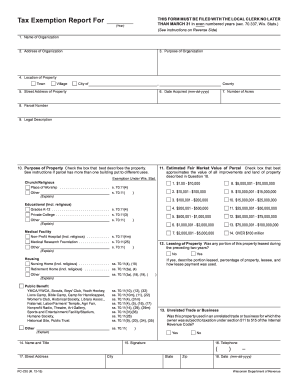

Important to ensure this form works properly, save it to your computer before completing the form. Tax Exemption Report Forgave (Year)PrintClearTHIS FORM MUST BE FILED WITH THE LOCAL CLERK NO LATER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wisconsin dor form pc220 report online

Edit your wisconsin form pc 220 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin form 220 tax exemption report fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wi form pc220 exemption report download online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wi form pc 220 exemption report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI PC-220 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wisconsin dor pc exemption make form

How to fill out WI PC-220

01

Obtain the WI PC-220 form from the Wisconsin Department of Revenue website or a local office.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated sections, including your name, address, and Social Security number.

04

Provide details of your income and any deductions you wish to claim.

05

If applicable, enter information regarding your dependents.

06

Review the filled-out form for any errors or omissions.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate office, either by mail or electronically.

Who needs WI PC-220?

01

Residents of Wisconsin who need to report their income for tax purposes.

02

Individuals claiming certain deductions or credits on their state taxes.

03

Anyone who is required to file a state income tax return in Wisconsin.

Fill

wisconsin dor form pc220 tax exemption make

: Try Risk Free

People Also Ask about wisconsin dor pc 220 exemption printable

What does it mean when you put exempt on your tax form?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

What is the difference between a w9 and tax exemption certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

What does IRS tax-exempt mean?

A "tax-exempt" entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

What is an example of an exemption?

Children are exemptions, or deductions, on tax forms; the more children you have the less taxes you pay. Some non-profits are tax-exempt; their exemption means they pay no taxes at all. Exemptions also spare people from fighting in wars and doing some jobs.

What does an exemption mean on tax returns?

What are exemptions? An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What does it mean when you claim exemption?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year.

How many exemptions should I claim Virginia?

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Is 0 the same as exempt?

For a “zero-rated good,” the government doesn't tax its sale but allows credits for the value-added tax paid on inputs. If a good or business is “exempt,” the government doesn't tax the sale of the good, but producers cannot claim a credit for the VAT they pay on inputs to produce it.

Is it better to exempt?

The advantages of hiring exempt employees include no overtime pay and more knowledge and responsibility. Downsides include higher pay rates and no ability to deduct pay for hours not worked.

Is it better to claim 0 or exempt?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

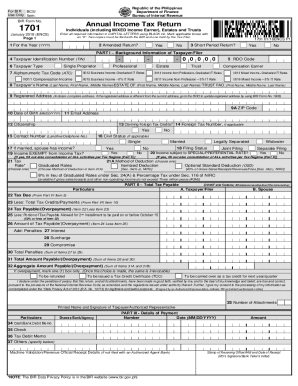

How do I claim exemptions on 1040?

Personal exemptions are claimed on Form 1040 lines 6a, 6b, and line 42. You lose at least part of the benefit of your exemptions if your adjusted gross income is more than a certain amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wi form 220 exemption report print online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your wisconsin dor pc220 exemption template to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit pc 220 tax exemption report search on an iOS device?

Create, modify, and share pc 220 tax exemption report printable using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit wisconsin dor form pc220 tax exemption get on an Android device?

You can edit, sign, and distribute form pc220 tax exemption report download on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is WI PC-220?

WI PC-220 is a form used in Wisconsin for reporting certain types of business income, typically related to partnership and corporate tax obligations.

Who is required to file WI PC-220?

Businesses operating as partnerships or corporations in Wisconsin that have certain income or tax obligations are required to file WI PC-220.

How to fill out WI PC-220?

To fill out WI PC-220, businesses must provide relevant financial information, including income, expenses, and deductions, as specified in the instructions for the form.

What is the purpose of WI PC-220?

The purpose of WI PC-220 is to collect information on business income and its allocation among partners or shareholders for proper tax assessment in Wisconsin.

What information must be reported on WI PC-220?

The information that must be reported on WI PC-220 includes total income, expenses, distributions to partners or shareholders, and any applicable deductions or credits.

Fill out your wisconsin pc 220 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wi pc220 Exemption Report is not the form you're looking for?Search for another form here.

Keywords relevant to pc 220 tax report fillable

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.