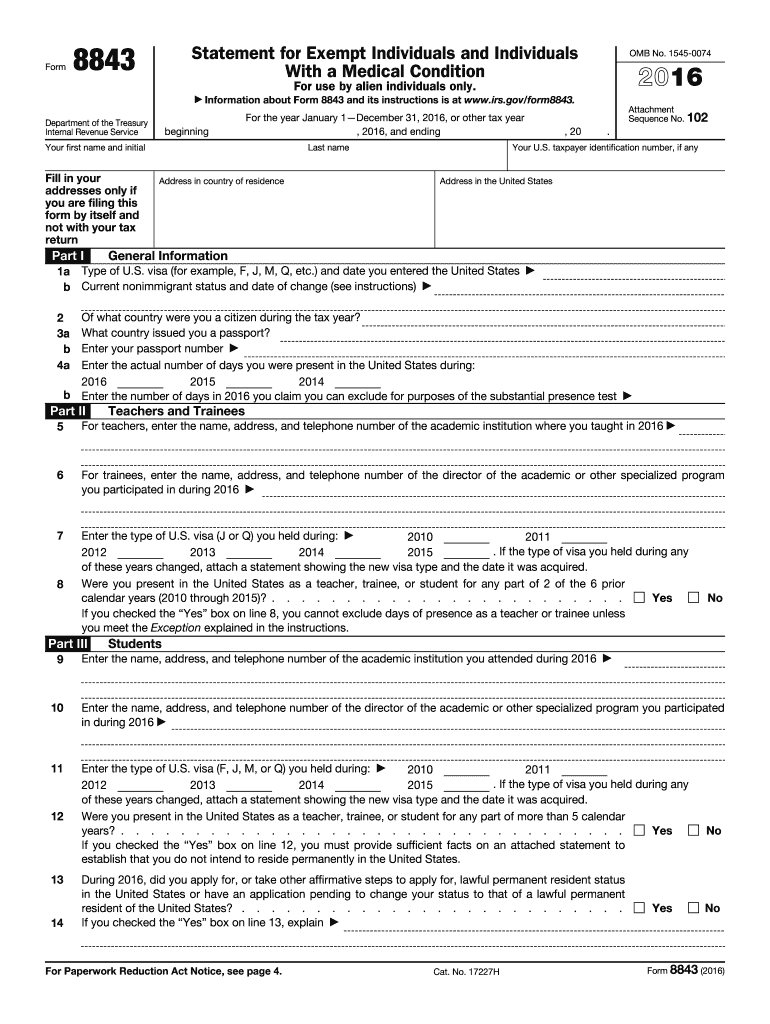

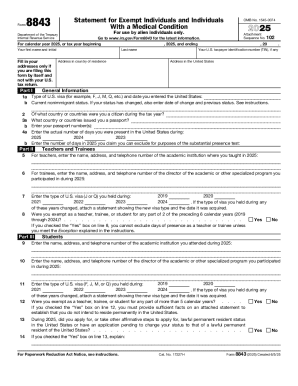

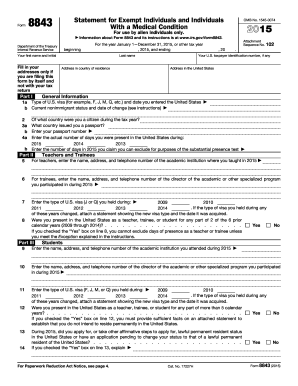

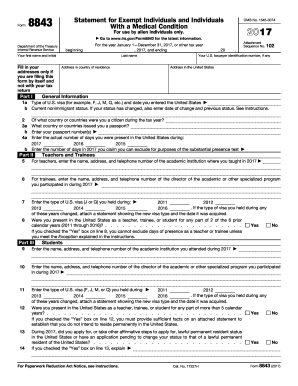

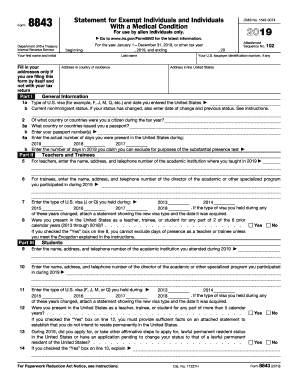

Who Needs Form 8843?

This statement is used by foreigners who spent some time outside the USA due to a medical condition or other reasons. Usually among these individuals are foreign students, teachers and trainers or professional athletes. On the basis of this statement the tax responsibility is determined. US residents are not required to file this statement with the IRS.

What is the Purpose of Form 8843?

The main purpose of the form is to report the number of days you have spent outside the US to the IRS. This number determines the amount of tax you have to pay.

What Other Forms Must Accompany Form 8843?

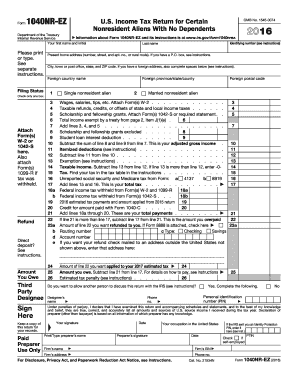

This statement can be attached to Form 1040NR, 1040NR-EZ.

When is Form 8843 Due?

The due date for the statement in 2017 is the 18th of April (for individuals who receive a taxable income). For others the due date is the 1st of June.

What Information Should be Provided in Form 8843?

The form’s preparer has to indicate the tax year. After this they have to complete the following sections:

- Personal information (name, address in the country of residence, address in the USA)

- General information (type of visa, current nonimmigrant status, passport details)

- Teachers and trainers (if applicable): indicate name and address of the academic institution, director or program, type of visa

- Students (if applicable)

- Professional athletes (if applicable): indicate name and ID number of the employer

- Individuals with a medical condition or medical problem: description of a medical condition, physician’s statement.

If Form 8843 is filed without a tax return, it should be signed and dated by the preparer.

What do I Do with the Statement after its Completion?

The completed form is forwarded to the IRS office. Find more information in the instructions for the statement.