Get the free rental property income and expenses worksheet

Show details

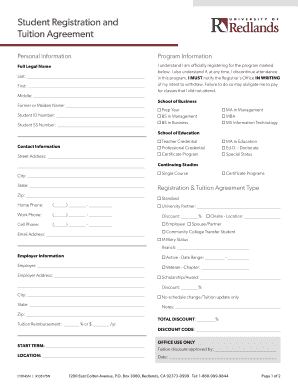

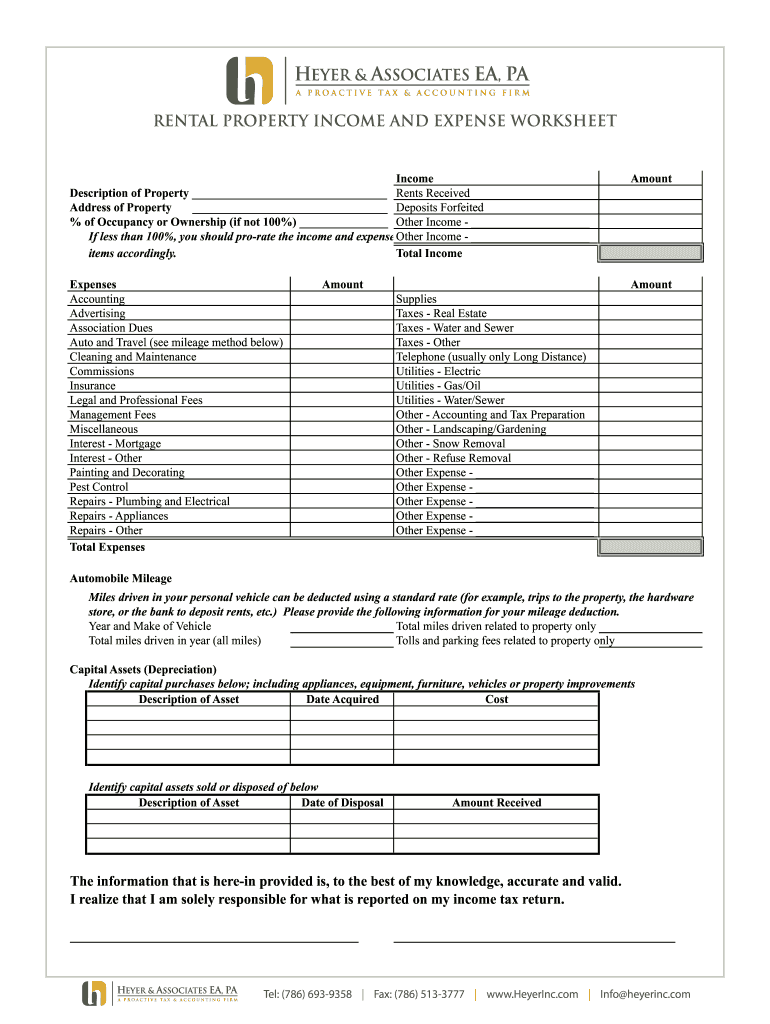

Rental Property Income and Expense worksheet Income Description of Property Rents Received Address of Property Deposits Forfeited % of Occupancy or Ownership (if not 100%) Other Income If less than

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental property income and

Edit your rental property income and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental property income and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental property income and online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental property income and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental property income and

How to fill out rental property income and?

01

Gather all necessary documents: Before starting the process, gather all the essential documents related to your rental property income. This may include rental agreements, receipts, records of expenses, and any other relevant financial documentation.

02

Calculate rental income: List all the rental income you received during the tax year. This includes the rent collected from tenants, any late fees or penalties, and income from services provided, such as laundry facilities or parking fees. Make sure to accurately report the amounts received.

03

Deduct rental expenses: Next, subtract any eligible rental expenses from your rental income. These may include property management fees, repairs and maintenance costs, insurance premiums, property taxes, mortgage interest, and utilities. Keep track of these expenses throughout the year to ensure accuracy.

04

Determine net rental income or loss: After deducting the expenses from the rental income, you will arrive at your net rental income or loss. If the expenses exceed the income, you may have a net loss to report. This can be used to offset other sources of income, potentially reducing your overall tax liability.

05

Report the rental income and expenses: On your tax return, use Schedule E (Supplemental Income and Loss) to report the rental income and expenses. Provide all the necessary information, including the property address, rental income, expenses, and any depreciation claimed.

06

Keep accurate records: It is important to keep accurate and organized records of your rental property income and expenses for at least three to seven years. This includes receipts, invoices, bank statements, and any other relevant documentation. Proper recordkeeping can help you avoid any issues with the tax authorities and make the process easier in the future.

Who needs rental property income and?

01

Landlords: Individuals who own and rent out residential or commercial properties need to report their rental property income and expenses. This includes those who own multiple properties or have rental income as a significant source of their overall income.

02

Property managers: If you are a property manager responsible for handling the financial affairs of rental properties, you need to correctly report and document the rental income and expenses on behalf of the property owners.

03

Real estate investors: Investors who earn rental income from properties as part of their investment portfolio must report their rental property income and expenses. This is applicable even if they hire property managers to handle the day-to-day operations.

In summary, to fill out rental property income and, gather all necessary documents, calculate rental income, deduct rental expenses, determine net rental income or loss, report the income and expenses on Schedule E of your tax return, and maintain accurate records. Landlords, property managers, and real estate investors are among those who need to report rental property income and expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find rental property income and?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the rental property income and. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my rental property income and in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your rental property income and and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit rental property income and on an Android device?

You can make any changes to PDF files, such as rental property income and, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is rental property income and?

Rental property income is the income earned from renting out a property to tenants.

Who is required to file rental property income and?

Individuals who earn income from renting out properties are required to file rental property income.

How to fill out rental property income and?

To fill out rental property income, individuals must report the rental income received and any related expenses.

What is the purpose of rental property income and?

The purpose of rental property income is to accurately report rental income to the tax authorities for tax purposes.

What information must be reported on rental property income and?

The information that must be reported on rental property income includes rental income, expenses, and any depreciation of the property.

Fill out your rental property income and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Property Income And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.