Get the free irs form 147c printable

Show details

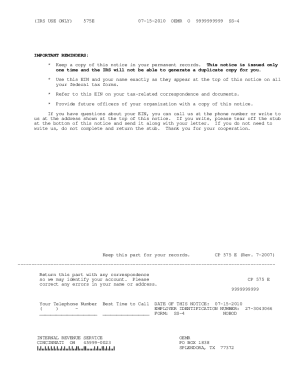

Irs Form 147c Download PDF Document Backup withholding for missing and incorrect name/tin s can download the tin matching after the submissio Form 147c pdf 0baa34b8710b29b13609d5a6b8b4ecc9 form 147c pdf 0baa34b8710b29b13609d5a6b8b4ecc9 bac Irs form ss-4 - irs note form ss-4 begins on the next page of this do Irs 147c form sorg3-i1fpdf-2 - solarsurfer pdf file irs 147c form - sorg3-i1fpdf-2 2/3 irs 1 Irs form 147c download if1d11-daus7 - dailymeditation pdf file irs form 147c download...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 147c printable

Edit your irs form 147c printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 147c printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 147c printable online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs form 147c printable. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 147c printable

Point by point instructions on how to fill out form 147c pdf are as follows:

01

Start by opening the form 147c pdf on your computer or device.

02

Review the form and read the instructions carefully to understand what information is required.

03

Fill in the top section of the form, providing your business name and any other relevant details as indicated.

04

If you are an individual, provide your full legal name instead of a business name.

05

Enter your mailing address in the designated section. Make sure to provide accurate and up-to-date information.

06

Fill in your business contact information, including phone number and email address.

07

If you have a previously assigned employer identification number (EIN), enter it in the appropriate field. If not, leave it blank.

08

Indicate whether you are making any changes to your business entity type or address by checking the appropriate boxes.

09

If you are making changes, provide the old and new information as required.

10

Sign and date the form at the bottom to certify the accuracy of the information provided.

Who needs form 147c pdf?

01

Individuals or businesses that require proof of their employer identification number (EIN).

02

Those who are applying for certain types of business licenses, permits, or contracts.

03

Individuals or businesses who need to verify their tax-exempt status or eligibility for certain tax benefits.

Please note that the specific circumstances in which form 147c pdf is necessary may vary, so it is advisable to consult with the relevant authorities or legal professionals to determine if you need to fill out this form in your particular situation.

Fill

form

: Try Risk Free

People Also Ask about

Can I get a 147C letter online?

Can you get a 147c letter online? The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

How do I get a letter of 147C or ss 4 confirmation letter?

SS4 EIN Verification Letter (147C) The only way to get the EIN verification letter or 147C is to call the IRS at 1800-829-4933. You can either receive the EIN verification letter via mail or fax. Due to security reasons and data privacy, the IRS doesn't send the letter via email.

How do I get a copy of my IRS EIN confirmation letter?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

How do I get my 147C letter online?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

How do I get a 147C form from the IRS?

How Do I Request a 147c Letter? To request a 147c letter from the IRS, contact the IRS Business and Specialty Tax line at 1-800-829-4933. They are open Monday through Friday from 7:00 AM to 7:00 PM, taxpayer local time (Alaska and Hawaii follow Pacific Time).

How do I get an IRS confirmation letter?

You can contact the IRS directly and request a replacement confirmation letter called a 147C letter. Start by calling the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 (or if you are calling outside the United States at 267-941-1099) between 7:00 AM and 7:00 PM EST. Press 1, Press 1 again, then Press 3.

How do I download my EIN confirmation letter online?

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

Can I get a copy of my EIN online?

Copies can be requested online (search “Forms and Publications) or by calling 800-TAX-FORM.

Can I request a 147c letter by mail?

You can ask the IRS to send you the letter in the mail. The letter should arrive at your address in seven business days or so. AFTER YOU GET THE 147C LETTER…. Send a copy of the 147c letter to Public Partnerships by fax, e-mail, or mail.

Can I get a copy of my 147C letter online?

Call IRS at 800–829–4933 Once connected, ask the person to fax you a copy of the verification letter. Voila! It should show up in your virtual fax inbox instantly.

Can I request a 147C letter by mail?

You can ask the IRS to send you the letter in the mail. The letter should arrive at your address in seven business days or so. AFTER YOU GET THE 147C LETTER…. Send a copy of the 147c letter to Public Partnerships by fax, e-mail, or mail.

How do I get a copy of my 147C letter?

To request a 147c letter from the IRS, contact the IRS Business and Specialty Tax line at 1-800-829-4933. They are open Monday through Friday from 7:00 AM to 7:00 PM, taxpayer local time (Alaska and Hawaii follow Pacific Time).

Can I get a copy of my 147c letter online?

And don't call on Monday (the busiest day). An EIN Verification Letter 147C can only be requested by phone (for security reasons). You can't request it by mail or fax. And there is no other number to call besides the one have listed below.

How long does it take to get a 147C letter?

If you choose mail, it can take 4-6 weeks before your EIN Verification Letter (147C) arrives. The IRS will mail your 147C Letter to the mailing address they have on file for your LLC.

Can I download my 147C letter online?

Can you get a 147c letter online? The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

Can I get a copy of my EIN letter online?

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

How do I get a copy of my IRS letter 147c?

To request a 147c letter from the IRS, contact the IRS Business and Specialty Tax line at 1-800-829-4933. They are open Monday through Friday from 7:00 AM to 7:00 PM, taxpayer local time (Alaska and Hawaii follow Pacific Time).

How do I get a copy of my original EIN confirmation letter?

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs form 147c printable directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your irs form 147c printable as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find irs form 147c printable?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific irs form 147c printable and other forms. Find the template you need and change it using powerful tools.

How do I make changes in irs form 147c printable?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your irs form 147c printable and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is form 147c pdf?

Form 147C is a document issued by the IRS that verifies an employer's identification number (EIN) and provides proof of an entity's tax status.

Who is required to file form 147c pdf?

Form 147C does not need to be filed. Instead, it is requested by businesses or individuals who need to obtain a confirmation of their EIN or tax status from the IRS.

How to fill out form 147c pdf?

Form 147C is not filled out in the traditional sense. Instead, to obtain a copy, an individual or business must request it from the IRS, typically by calling or submitting a written request.

What is the purpose of form 147c pdf?

The purpose of Form 147C is to provide verification of an entity's Employer Identification Number (EIN) and to confirm its tax status for banking, employment, or tax purposes.

What information must be reported on form 147c pdf?

Form 147C contains the EIN, the legal name of the entity, and the entity's tax classification, along with any other relevant tax status information provided by the IRS.

Fill out your irs form 147c printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 147c Printable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.