UK HMRC P60(Single sheet) 2017 free printable template

Show details

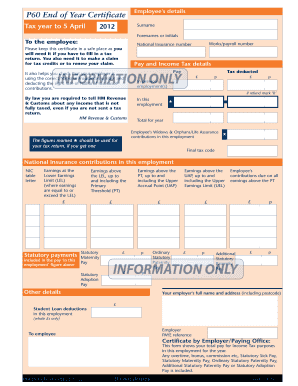

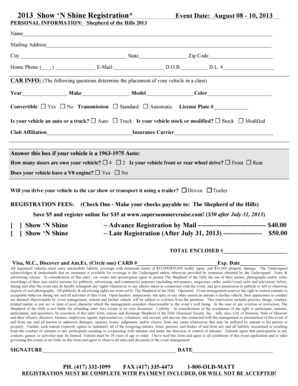

P60 End of Year Certificate Tax year to 5 April Employee s details Surname Forenames or initials To the employee Works/payroll number National Insurance number Please keep this certificate in a safe place as you will need it if you have to fill in a tax return. You also need it to make a claim for tax credits or to renew your claim. Pay and Income Tax details Pay Tax deducted It also helps you check that your employer is using the correct National Insurance number and deducting the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC P60Single sheet

Edit your UK HMRC P60Single sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC P60Single sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC P60Single sheet online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK HMRC P60Single sheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC P60(Single sheet) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC P60Single sheet

How to fill out UK HMRC P60(Single sheet)

01

Obtain your P60 form from your employer, which is usually provided at the end of the tax year.

02

Check your personal details at the top of the P60, including your name, address, and National Insurance number.

03

Review the income section which shows your total earnings for the year, including any taxable benefits.

04

Verify the tax deductions column, which lists the total tax deducted from your earnings during the year.

05

Check for any student loan deductions if applicable.

06

Ensure the final totals are correct and match your payslips for the tax year.

07

Keep a copy of your P60 for your records, as it is important for tax returns and verifying income.

Who needs UK HMRC P60(Single sheet)?

01

Employees in the UK who receive a P60 from their employer at the end of the tax year.

02

Individuals who need to provide proof of income for loans or mortgages.

03

People filing their self-assessment tax returns.

04

Any worker who has received taxable earnings from an employer during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is a P60 form UK?

Your P60 shows the tax you've paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs every tax year. There's a separate guide to getting P60s if you're an employer. If you're working for an employer on 5 April they must give you a P60.

What is the UK equivalent of a W 2?

In the UK, the P60 form has been issued since 1944 by employers to each of their employees to detail the employees' taxable income and deductions made by PAYE (both for income tax and National Insurance contributions) for that year.

What is a P60 in Canada?

A P60, also known as an end-of-year certificate, is a document that employees receive every year. It details in full how much the employee has earned in that financial year, and how much they have paid in income tax, National Insurance contributions, statutory payments made to the employee, and student loan repayments.

What is a P60 in the UK?

Your P60 shows the tax you've paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs every tax year. There's a separate guide to getting P60s if you're an employer. If you're working for an employer on 5 April they must give you a P60.

What is the UK equivalent of a T4?

Great Britain – Form P60. Canada – T4 slip.

How do I get P60?

Ask your employer for a replacement P60. If you cannot get a replacement from them, you can either: use your personal tax account to view or print the information that was on the P60. contact HMRC and ask for the information that was on the P60.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UK HMRC P60Single sheet?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the UK HMRC P60Single sheet in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute UK HMRC P60Single sheet online?

Filling out and eSigning UK HMRC P60Single sheet is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out UK HMRC P60Single sheet on an Android device?

Use the pdfFiller Android app to finish your UK HMRC P60Single sheet and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is UK HMRC P60(Single sheet)?

The UK HMRC P60 (Single sheet) is an annual tax document that summarizes an employee's total earnings and the amount of tax deducted by their employer during the tax year.

Who is required to file UK HMRC P60(Single sheet)?

Employers are required to complete and provide a P60 to all employees who were employed by them at the end of the tax year.

How to fill out UK HMRC P60(Single sheet)?

To fill out a P60, employers must include details such as the employee's name, National Insurance number, their total taxable pay, and the total tax deducted during the tax year.

What is the purpose of UK HMRC P60(Single sheet)?

The purpose of the P60 is to provide employees with a summary of their earnings and tax contributions for the year, which is essential for filing tax returns and verifying tax status.

What information must be reported on UK HMRC P60(Single sheet)?

The P60 must report the employee's personal details, total earnings for the year, total tax paid, National Insurance contributions, and any other relevant deductions.

Fill out your UK HMRC P60Single sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC p60single Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.