University of Iowa N0003101 2015-2025 free printable template

Show details

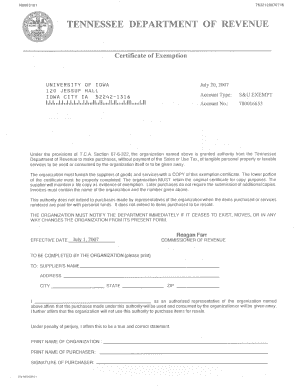

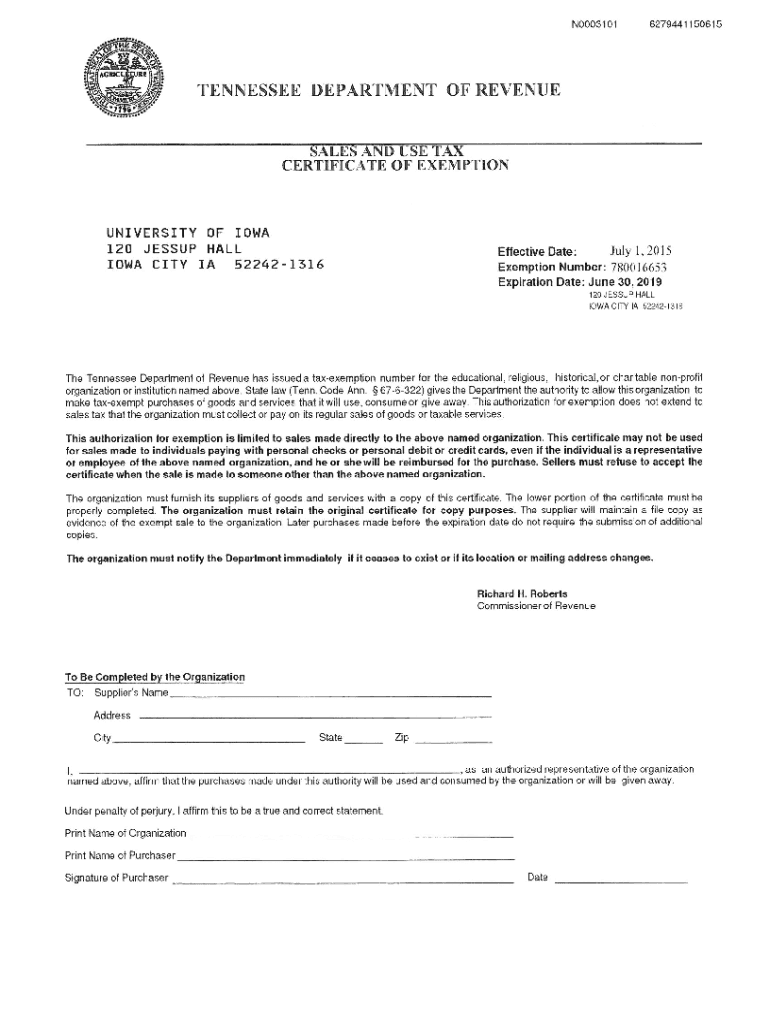

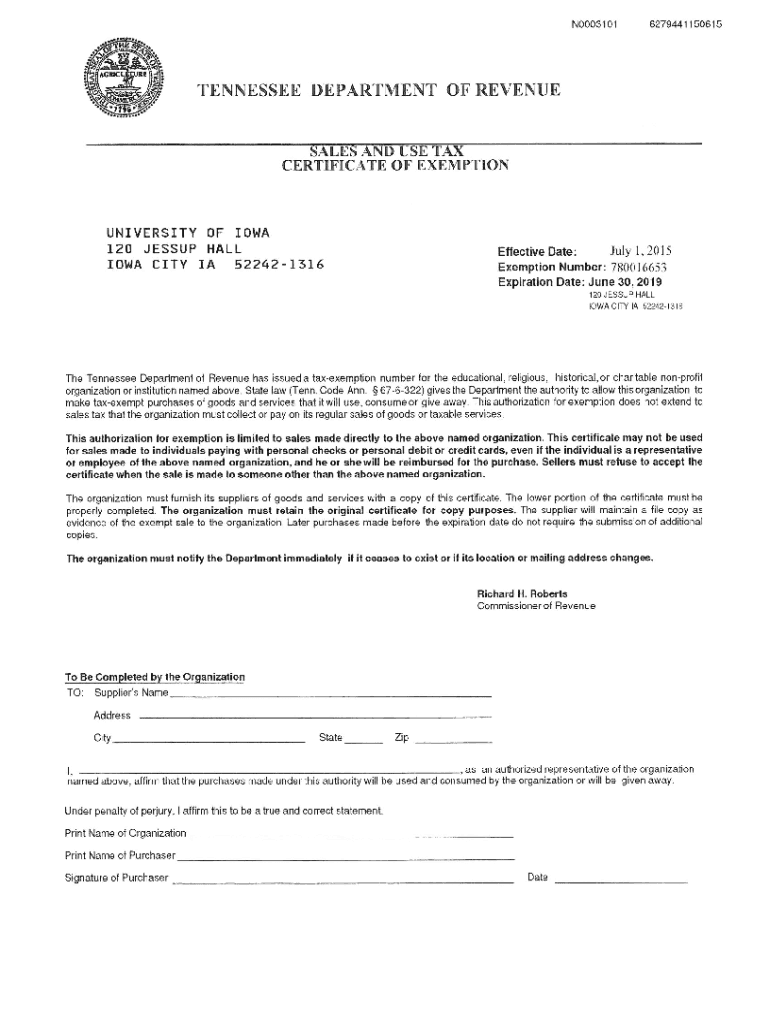

7632128070716 N0003101 TENNESSEE DEPARTMENT OF REVENUE Certificate of Exemption UNIVERSITY JESSUP IOWA CITY OF IOWA HALL IA 1 1 1. CA Section 67-6-322 the organization named above is granted authority from the Tennessee Department of Revenue to make purchases without payment of the Sales or Use Tax of tangible personal property or taxable services to be used or consumed by the organization itself or to be given away. The organization must furnish the suppliers of goods and services with a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tennessee tax exempt form

Edit your tax exempt form tn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utk tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tn tax exempt form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax exempt form tennessee. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

University of Iowa N0003101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax clearance letter tennessee form

How to fill out University of Iowa N0003101

01

Gather all necessary personal and academic information required for the form.

02

Locate the University of Iowa N0003101 form on the official website or through your student portal.

03

Begin filling out the form by providing your name, student ID, and contact information in the designated fields.

04

Complete the section that asks for your academic program and major.

05

Provide any required signatures and dates where indicated on the form.

06

Review the completed form for accuracy and completeness.

07

Submit the form electronically or print it out and submit it in person, as required.

Who needs University of Iowa N0003101?

01

Current students of the University of Iowa who need to apply for or update their enrollment status.

02

Students seeking financial aid or scholarships that involve the use of the N0003101 form.

03

Prospective students applying for special programs or transfer applications.

Fill

tn sales tax exemption

: Try Risk Free

People Also Ask about unt tax exempt form

How do I get tax-exempt in Tennessee?

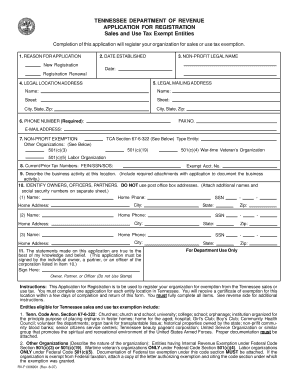

Certain Tennessee non-profits are eligible to be exempt from Tennessee state and local sales tax. You will need to complete an application for non-profit sales and use tax exemption and submit it and all required documentation (copies of articles, bylaws, IRS determination)to the Tennessee Department of Revenue.

How do I apply for farm tax exemption in TN?

You'll also be required to submit the following documentation: Tax returns with income information. 1099s. Proof of land qualification under the Agricultural Forest and Open Space Land Act. Copy of your Schedule F. Copy of either Form 4835 or Schedule E. Detailed statement of why you qualify for an exemption.

How many acres do you need to be considered a farm for taxes in Tennessee?

A parcel must have at least fifteen (15) acres, including woodlands and wastelands which form a contiguous part thereof, constituting a farm unit engaged in the production or growing of crops, plants, animals, nursery, or floral products.

How do I qualify for farm tax exemption in Tennessee?

Agricultural Exemption Tangible personal property used primarily (more than 50%) by a qualified farmer or nursery operator in agriculture operations. Equipment used primarily for harvesting timber. Gasoline or diesel used in agricultural operations. Seeds, seedlings, and plants grown from seed. Fertilizer. Pesticides.

What businesses are tax-exempt in Tennessee?

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in iowa sales tax exemption certificate?

With pdfFiller, it's easy to make changes. Open your state of tennessee tax exempt form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for signing my tennessee sales tax exemption form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tennessee sales and use tax certificate right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete tennessee tax exempt certificate on an Android device?

On Android, use the pdfFiller mobile app to finish your tennessee sales tax exemption certificate. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is University of Iowa N0003101?

University of Iowa N0003101 is a specific form used for reporting certain activities, compliance, or financial information related to the University of Iowa.

Who is required to file University of Iowa N0003101?

Individuals or entities who are involved in activities or transactions that require reporting to the University of Iowa are obligated to file the N0003101 form.

How to fill out University of Iowa N0003101?

To fill out the University of Iowa N0003101, one should follow the provided guidelines, ensuring all required fields are completed accurately and thoroughly before submission.

What is the purpose of University of Iowa N0003101?

The purpose of University of Iowa N0003101 is to collect and report necessary data for compliance, transparency, and regulatory requirements related to university activities.

What information must be reported on University of Iowa N0003101?

The information that must be reported on University of Iowa N0003101 typically includes details about financial transactions, compliance status, and relevant personal or organizational data.

Fill out your University of Iowa N0003101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to tn tax clearance letter

Related to ttu tax exempt form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.